KSE-100 falls due to political turmoil

Persistent rupee devaluation, volatility in global commodity prices keep investors at bay

The Pakistan Stock Exchange endured a lacklustre trading week as jittery investors weighed the impact of rising political turmoil in the country coupled with persistent rupee depreciation and volatile global commodity prices.

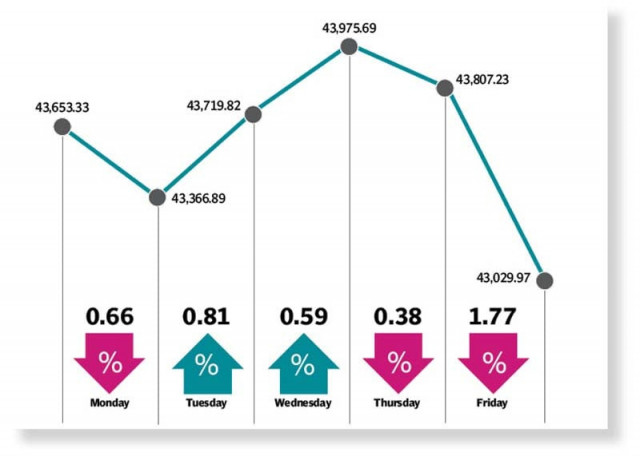

Subsequently, the benchmark KSE-100 index closed the week with a loss of 623.36 points or 1.44% at 43,030 point level.

“The benchmark KSE-100 index declined on the back of increase in political noise and volatility in commodity prices amid Russia-Ukraine conflict,” a report from Topline Securities stated.

The week started on a negative note as skeptical investors rushed to offload their holdings owing to pessimism arising from domestic political unrest and swelling global commodity prices.

However, the market took a breather on Tuesday and gained over 600 points in a two-day bull run as market players cheered the drop in global crude oil prices, which plummeted below $100 per barrel. The reduction wiped off market’s fears of rapid increase in the current account deficit on the back of surge in import bill.

The market, however, reversed its momentum once again and declined in the last two sessions mainly due to deteriorating political situation in the country as the nation inched closer to a vote on the no-confidence.

Moreover, persistent slide in the rupee’s value against the US dollar, which touched a new record low at Rs180.57 in the inter-bank market, also hampered investors’ interest to make fresh purchases of scrips.

Consequently, the index lost around 946 points in the last two days of the trading week.

“Domestic political unrest together with opposition’s planned long-march against the government, is likely to keep the bourse under pressure,” stated a report from Arif Habib Limited. “A key event to look out for is the OIC (Organisation of Islamic Cooperation) meeting.”

During the week under review, average daily traded volume declined 19% week-on-week to 174 million shares, while average daily value traded decreased 32% week-on-week to $26 million.

In terms of sectors, positive contributions came from fertiliser (96 points), food and personal care products (15 points) and leather and tanneries (14 points).

On the flipside, sectors which contributed negatively included oil and gas exploration companies (310 points), banks (127 points), technology and communication (79 points), oil and gas marketing (42 points), and cement (39 points).

Meanwhile, scrip-wise positive contributors were Fauji Fertilizer Company (91 points), Engro Fertilisers Limited (58 points) and Bank AL Habib Limited (32 points).

However, negative contributions came from Pakistan Petroleum Limited (140 points), Oil and Gas Development Company (103 points), TRG Pakistan (84 points), Habib Bank Limited (63 points) and MCB Bank (43 points).

Foreign selling continued this week, clocking-in at $4.9 million as compared to a net sell of $3.13 million the previous week. Major selling was witnessed in banks ($6 million) and oil marketing companies ($0.7 million).

On the local front, buying was reported by banks/ DFIs ($4.4 million) followed by companies ($2.9 million).

Other major news of the week included cut-off yields of long-term government securities soared to 115 basis points, PM lauded ADB’s (Asian Development Bank) role in socio-economic development, petroleum prices remained unchanged, drug-makers threatened to close 600 factories next week, finance ministry sought update on $21 billion support request from Pakistan envoy in Beijing, wheat support price raised and fertiliser subsidy approved.

Published in The Express Tribune, March 20th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ