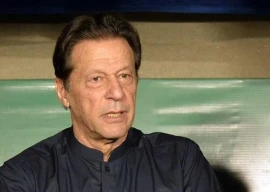

The Pakistan Stock Exchange staged a modest recovery in the outgoing week as Prime Minister Imran Khan’s relief package for the economy rejuvenated investors’ interest at the bourse and propelled the KSE-100 upward.

However, uncertain geopolitical conditions and sharp surge in global crude oil and commodity prices capped gains.

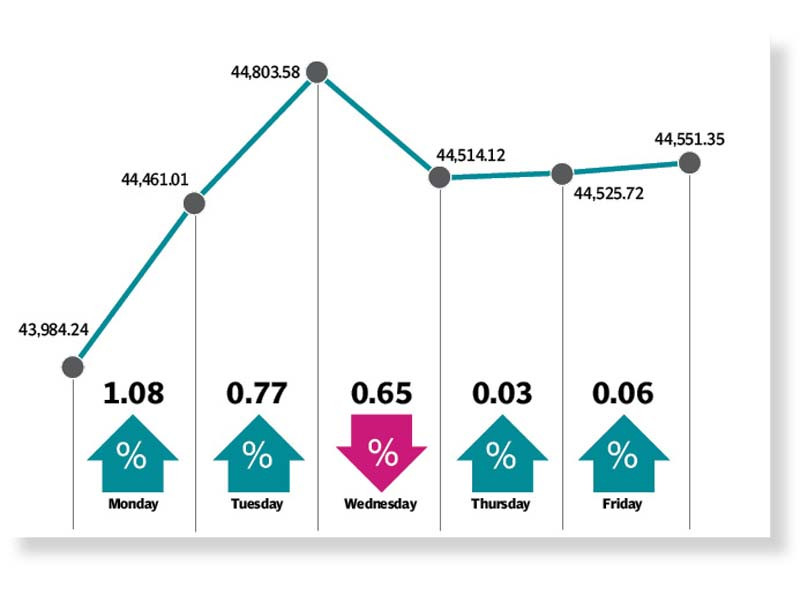

Owing to the mixture of upside and downside pressures, the KSE-100 index closed the week with a gain of 567 points or 1.2% at 44,551 point level.

“After posting a sharp decline last week owing to the Russia-Ukraine crisis, the market exhibited a recovery trend throughout the outgoing week,” said JS Global analyst Wasil Zaman.

The week kicked off on a positive note and the market climbed in the first two sessions aided by value hunting of stocks from the market participants.

The reduction in petroleum and electricity prices by the government, coupled with announcement of tax concessions for industries, bolstered investors’ confidence and they resorted to make fresh buying.

Historic jump in international energy prices reversed the rising momentum at the stock market owing to fears of widening of current account deficit and further depreciation of rupee against the US dollar.

The surge in international oil price past $119 per barrel mark and spike in coal price dampened the trading ecosystem.

Things turned for the worse in the global market as multiple rounds of negotiations between Ukraine and Russia ended at a stalemate and the local stock market remained range bound for the last two sessions of the week.

Moreover, the market players adopted a cautious stance ahead of the monetary policy announcement due on Tuesday.

“We believe that the market will remain jittery in the short term on account of geopolitical tensions and rising commodity prices,” stated a report from Arif Habib Limited. “Key events to look out for include monetary policy meeting, Financial Action Task Force (FATF) decision and the ongoing International Monetary Fund (IMF) review which will have an impact on the market.”

During the week under review, average daily traded volume declined 5% week-on-week to 215 million shares, while average daily value traded rose 12% week-on-week to $43 million.

In terms of sectors, positive contributions came from oil and gas exploration companies (402 points), technology and communication (129 points), fertiliser (95 points), chemical (24 points) and power generation and distribution (19 points).

On the flipside, sectors which contributed negatively included cement (67 points), oil and gas marketing companies (12 points), insurance (12 points), automobile assembler (11 points), leather and tanneries (8 points).

Meanwhile, scrip-wise positive contributors were Pakistan Petroleum Limited (169 points), Oil and Gas Development Company (136 points), TRG Pakistan (117 points), Pakistan Oilfields Limited (74 points) and Engro Fertilisers (37 points).

However, negative contributions came from Lucky Cement (39 points), MCB Bank (34 points), Pakistan State Oil (18 points), DG Khan Cement (17 points) and Dawood Hercules Corporation (16 points).

Foreign selling continued this week, clocking-in at $0.97 million as compared to a net sell of $3.24 million the previous week. Major selling was witnessed in exploration and production ($1.5 million) and banks ($1.4 million).

On the local front, buying was reported by banks ($2.4 million), followed by brokers ($2.1 million).

Other major news of the week included hike in gas prices by Ogra, trade deficit widening by 82.2% to $31.96 billion during July-February 2021-22, first cargo under Saudi oil facility due late in March, oil marketing companies sales increase by 10% year-on-year in February.

Published in The Express Tribune, March 6th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ