KSE-100 extends rally on investor optimism

Stability in local currency, export growth drive uptrend

The Pakistan Stock Exchange kicked off 2022 with optimism and the bourse recorded an enthusiastic week as clarity on macroeconomic front and stability in the value of local currency encouraged bulls to hold their positions.

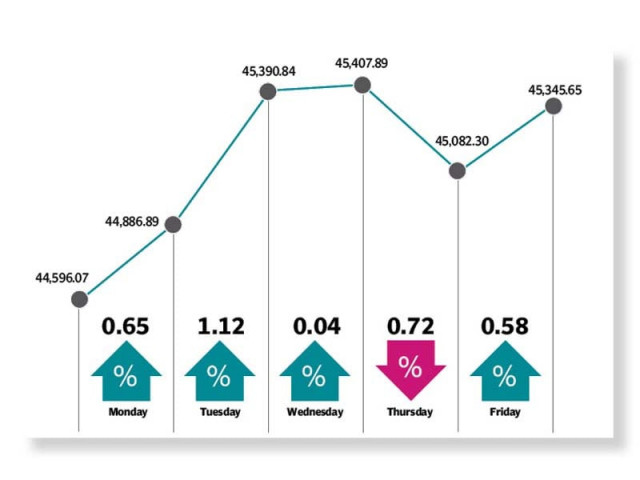

As a result of upbeat economic cues, the KSE-100 index surged 750 points or 1.68% to breach the 45,000 point barrier.

“The KSE-100 index started the new year with renewed optimism, led by heavy foreign buying in technology scrips,” stated a report from Arif Habib Limited.

Trading began on a positive note and the index added over 800 points in the first three sessions as growth in exports fuelled buying activity at the bourse.

Investor sentiments strengthened after data from the Ministry of Commerce showed 16.7% increase in foreign shipments in December 2021, pointing towards contraction in trade deficit.

Moreover, market participants also foresaw resumption of the International Monetary Fund bailout programme this month and expected the economy to take a breather following receipt of next tranche of the loan. Investors assumed fresh positions in hopes of reduction in economic miseries.

Some recovery in rupee against the greenback also drove buying activity and elevated the gains.

The market revered its trend on Thursday on the back of steep increase in Covid-19 Omicron variant cases which sparked fears of imposition of another lockdown. Investors rushed to offload their holdings because another round of lockdown would deal a lethal blow to the economy.

Adding to investor woes, the trade gap widened by over 100% in the first six months of the ongoing fiscal year as reflected from the Pakistan Bureau of Statistics data. The development shattered investor spirits as it pointed towards additional devaluation of the local currency and continuation of inflationary pressure.

Cherry picking in the final session helped the stock market post a rebound as market players bought scrips that had fallen to attractive valuations.

“Going forward, we expect the market to show positivity in the coming week attributable to successful achievement of vaccination targets, constructive meeting with IMF and expectation of healthy corporate profitability during the outgoing quarter,” said Arif Habib Limited report.

During the week under review, average daily traded volumes rose 46% week-on-week to 318 million shares while average daily traded value climbed 32% week-on-week to $57 million.

In terms of sectors, contribution to the upside was led by fertiliser (212 points), power generation (159 points), commercial banks (146 points), oil and gas exploration (111 points) and engineering (41 points).

Scrip-wise major gainers were Hubco (163 points), Systems Limited (94 points), Pakistan Oilfields (85 points), Engro Fertiliser (76 points), and Fauji Fertiliser Company (59 points).

Foreigners bought stocks worth of $24.2 million compared to a net buy of $8.1 million last week. Major buying was witnessed in technology ($22.5 million) and banks ($0.7 million). On the local front, selling was reported by individuals ($15.1 million) followed by mutual funds ($8.4 million).

Among other major news of the week, SBP issued Licencing and Regulatory Framework for Digital Banks, cement sales contracted 4.2% in December and ECC slapped more taxes on car import.

Published in The Express Tribune, January 9th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ