Many would say Sanaullah, at 27 years of age, was in the prime of his life. But a meager livelihood earned from selling old shoes in Karachi’s Saddar area meant survival was a hand to mouth affair despite the energy of youth.

“He was married. He had three children,” Sanaullah’s uncle Ghulam Rasool told The Express Tribune. Life was tough but he was able to make his ends meet – until one fateful day that is. “His shoe stall was removed during an anti-encroachment drive,” Rasool shared. “Left with no other way to earn to meet the needs of his family, my nephew concluded it was better to take his own life than to face his hungry wife and kids empty-handed day after day.”

In Pakistan’s deeply religious society, suicide is one of the most taboo actions a person can resort to. Taken for weakness and lack of faith, the stigma follows not only those who attempt it, successfully or not, but their families as well. Still, one ought to try and see things from the other side. Taking one’s life is never an easy decision – it takes a certain level of desperation to even consider it, let alone follow through with the act.

In just two years, the novel coronavirus pandemic has pushed another massive chunk of our citizenry into poverty. Once secure, many even in Pakistan’s middle-class have suddenly found themselves out of work at a time when inflation seems to do nothing but climb.

Falling through the cracks

To be fair, our country and other developing ones like ours had already been struggling with challenges like inflation, unemployment and an ever-increasing population before Covid-19 hit the world. Pakistan’s market was already in what many economists would describe as shambles and many organisations were being forced to slash staff. Likewise, a large segment of our society perpetually eked out an existence on the brink of survival. In that sense, the pandemic has only further accelerated downsizing and cutbacks, leaving more and more – educated or non-educated alike – without work.

Karachi, Pakistan’s biggest metropolis and financial heart, has seen the human tragedy a floundering economy can lead in a series of shocking back-to-back suicides. In just the last two months, at least two individuals committed suicide after finding themselves unable to find work, feed their families or repay their loans.

Be it someone like Sanaullah, whose sole means to earn the livelihood was removed due to policies he had no way to control or Faheem Mughal, who unable to pay back a Rs60,000 loan, stories of financially motivated suicides have seemingly become all too common.

According to Sanaullah’s uncle Ghulam Rasool, even with the shoe stall his nephew earned no more Rs40,000 to Rs50,000 a month. “He was investing all this money into his three children’s future,” Rasool shared. “All three were studying in English medium schools in the hope that they would have better prospects than Sanaullah ever did.”

According to Rasool, his nephew was not immediately driven to despair. “As soon as his shoe stall was removed, Sanaullah started looking for other options to earn,” he said. “He even tried working as a security guard, but because he was not educated, he could not find any work that could meet his family’s expenses.”

Growing desperate, Sanaullah started taking loans from friends and relatives, Rasool revealed. “By the time he committed suicide, he must have had a debt of Rs400,000 to Rs500,000 that he was unable to pay back. I suppose that is why he though taking his own life was easier.”

It is not always the primary breadwinner who a sudden bout of seemingly unescapable poverty can drive over the edge. Such is the case of Sami Anwar’s daughter, who killed herself because her husband was unable to provide. “My daughter’s husband was unable to buy even milk for their one-year-old son, let alone food for the two of them,” Anwar shared. “Following an argument one day, in which her husband said he couldn’t provide because he had no job, she lit herself,” he said with a shaky voice. “I only wish she had come to me for help. I regret that I never asked if she needed anything. Maybe she would be still alive had I asked.”

Psychology of sudden poverty

According to psychologists and mental health experts, increasing inflation coupled with people losing their jobs is causing severe mental anguish among people who suddenly find themselves unable to meet the most basic of expenses. “This is a very dangerous and emotional state where a person has lost all hope and they cannot fulfill the needs of their children and family,” said clinical psychologist Dr Masooma Zehra.“Taking one’s own life is not easy but the level of pressure on a mind pushes a person to take such decisions,” she said.

Dr Zehra pointed out that in most cases of financially motivated suicide, the victim belonged to the middle-class. “Such individuals are more prone to see themselves as having failed their family if they suddenly find themselves unable to provide the bread and butter,” she explained. “The pressure on males in our society as being the primary bread earners in their families is especially high and it increases the sense of responsibility they feel automatically,” the psychologist pointed out. “At the same time, how is one individual supposed to provide for a family of five or six when the basic wage – which is not even implemented across the board – is set at Rs25,000.”

Before a person concludes that taking their own life is their sole option, they go through a series of events, Dr Zehra explained. “The pressure mounts step by step before one reaches the verge of suicide. When someone loses their job all of a sudden, for instance, a family may be supportive in the initial days. But then the family starts bombarding with questions – what is the next step, what will you do now? Why have you not found work yet, etc.”

“After a few weeks or a month, the family may start asking that person how they will pay the rent or school fees, or manage groceries. All these things build up and the person may start questioning their own abilities,” she said. “Psychologically, the person will become irritable. To avoid such questions, they may become reclusive and stop meeting friends or family,” the psychologist added. “Then, one day, they wake up and see there is no way for them to provide even something as basic as a meal for their family or kids. Their self respect completely shatters because they are unable to come up with a solution. Concern for the family becomes full blown depression.”

According to the psychologist, textbooks state an episode of depression can develop in a timespan as short as four weeks. “If you see these two recent cases of suicide – the man who jumped to his death from the fourth floor of a Karachi mall and the former media worker who hanged himself – both victims had been jobless for a long time,” she pointed out. “You can empathise then how much pressure must have built up in their minds.”

Dr Zehra added that a person’s thoughts and the events that take place in their life also play a vital role. Amid all this pressure, a person’s neurotransmitters can become messed up and their serotonin and dopamine levels fluctuate with this chain of thought. “As such, on a physical level, the stress of things like debt and joblessness can make it easier for a person to attempt a drastic action like jumping off a building or hanging themself,” she said. “This is more difficult for introverts who do not share anything even with close people. Extroverts at least do meet their friends and have their own escape which helps them sometimes,” she added.

When your world comes crashing down

Inflation and increasing cases of downsizing not only push people to the verge of taking their lives but also change their lives in a blink of an eye. For people who have been working on salaries and are the only ones earning bread and butter for their families, being asked to hand in a resignation or to not show up to work the next day can feel like their world has come crashing down on them.

There have been many instances where such individuals have some major thing or expense planned and they lost their job the same month or a few days before. “I was to get married in March next year and had planned everything very smartly keeping in view my salary. But one day in December, my office called and asked me to resign because they thought I have been an extra resource to work,” shared N* who also had his father’s bypass planned the same month.

Switching jobs or finding a new job while already working somewhere is easy and one has the confidence to push his limits in terms of salary offers but when the person has been sacked it is not even difficult to find a better job but more difficult to quote the desired salary. “The moment I bought my new car through financing I lost my job and then when I started searching for new ones, no one was paying me what I was getting earlier,” shared Anas Khan who was forced to accept a lower salary at a new workplace. “There are several reasons for this, especially in sectors that are smaller and have a close-knit professional community. It is easy to get background info on candidates and prey on their desperation.”

Even when you are lucky enough to retain your job, lay offs elsewhere in your field can embolden exploitation from employers. Media worker Shahmir* was among those who were not sacked but forced to accept a lower wage than one he was previously getting due to rising costs. “I got married two months before Covid hit and my wife was expecting when my office thought it was okay to reduce my salary to 40 percent,” he said, “Luckily my wife also works and we both manage our expenses together but what if she wasn’t earning, I can’t even think the problems we could have faced with almost half of the salary slashed off”.

Second earning hand

Second earning hand

With only one person earning for five to six people on average, the burden stays on one person and the weight is very heavy. With covid and associated lay offs, many women have stepped up to help their families and be an earning hand to bear some of the expenses of the house. “I never thought that I could teach but when last year my husband was sacked due to Covid when businesses were closed down, I started teaching tuition at home. As soon as schools opened, I applied in a school where my children study and now from the salary I can at least pay their fees and other study-related expenses while my husband bears the expenses of the house,” shared Saima Asad whose husband was jobless for six months last year. She also told that it was a difficult time because everyone was going through a tough time and it was difficult to ask for money from anyone who already is struggling to make the ends meet.

The industry perspective

While a massive chunk of population blames the current leadership for the price hike, a small proportion claims that rates of commodities are rising owing to global increase in product prices. One thing is certain, every segment has been affected from the price hikes be it agriculture, industries or the services sector. While prices are on an uptrend on one hand, rampant unemployment coupled with lack of job opportunities is posing further challenge to the people of Pakistan, to gain an insight to the two problems, The Express Tribune reached out to few experts from the industry.

Karim Khan, who runs a cottage industry in interior Sindh, agreed that hike in inflation forced him to lay off few of the employees because his business was becoming unsustainable. “I have promised the sacked workers to rehire them once the conditions improve and I am determined to keep my word however the condition is gloomy for now,” he said. “Another concern is that the laid off workers are having a hard time securing employment and few of them have agreed to work on half the pay just to support their families.”

He lamented that the situation was far worse for female workers because during the times of uncertainty, small and medium enterprises preferred to hire male employees because they can work as riders, deliverymen, plumbers, electricians, mechanics and other kinds of trades that are dominated by men. Given the ongoing crunch in his business unit, Khan highlighted that a lot of his employees were becoming depressed and discourage which was causing a decline in productivity of the firm.

“The come to work each day fearing that it could be their last and this factor makes them prone to commit mistakes,” he elaborated. “Running a business in the small and medium enterprise sector of Pakistan is becoming difficult day by day.” The official pointed out those prices of all commodities from raw material to electricity, gas and fuel for vehicles used by his unit have soared.

Just last year, the factory was reporting massive profits as Pakistan began recovering from Covid-19 pandemic and there were plans to double the workforce in the business, he said.

However, all plans went in wait from March 2021 onward when price hikes became a norm. He detailed that a huge chunk of his workers used to commute through motorcycles or vehicles however slowly and gradually, the labour was selling its bikes and commuting through busses and other kinds of public transport.

“If the inflation rises further, I will have to take the difficult decision to completely shut down my business and lay off all the employees,” he said. The official requested the government for support in form a bailout package for the SME sector so business could recover and generate employment.

Khan recalled availing State Bank of Pakistan’s Refinance Scheme for Payment of Wages and Salaries last year and noted that it helped combat layoffs and pay salaries of workers. According to him, a similar scheme was needed again to lower unemployment during the ongoing “disastrous times”.

Dwindling profits, rising expenses

Aleem Niaz, owner of a Kiryana store in Karachi, stated that the volume of his sales had fallen since Pakistan began witnessing price hikes. “At present, people have started cutting on basic food items such as cooking oil, spices, meat and even sugar,” he said. “Few people have shifted from purchasing branded cooking oil to using local ones available at Sunday markets.”

Moreover, he remarked that sales of luxury food items such as sausages, salami and processed frozen food had nosedived. The Kiryana store owner recalled selling one out of three freezers due to decrease in demand of frozen food. He added that demand of ice cream had fallen as well because it is slowly turning into a luxury good.

Niaz shared that he used to have a helper at his shop however he left for a better paying job and the shop was unable to hire his replacement owing to soaring costs. “I was forced to slash jobs to continue operations,” he said.

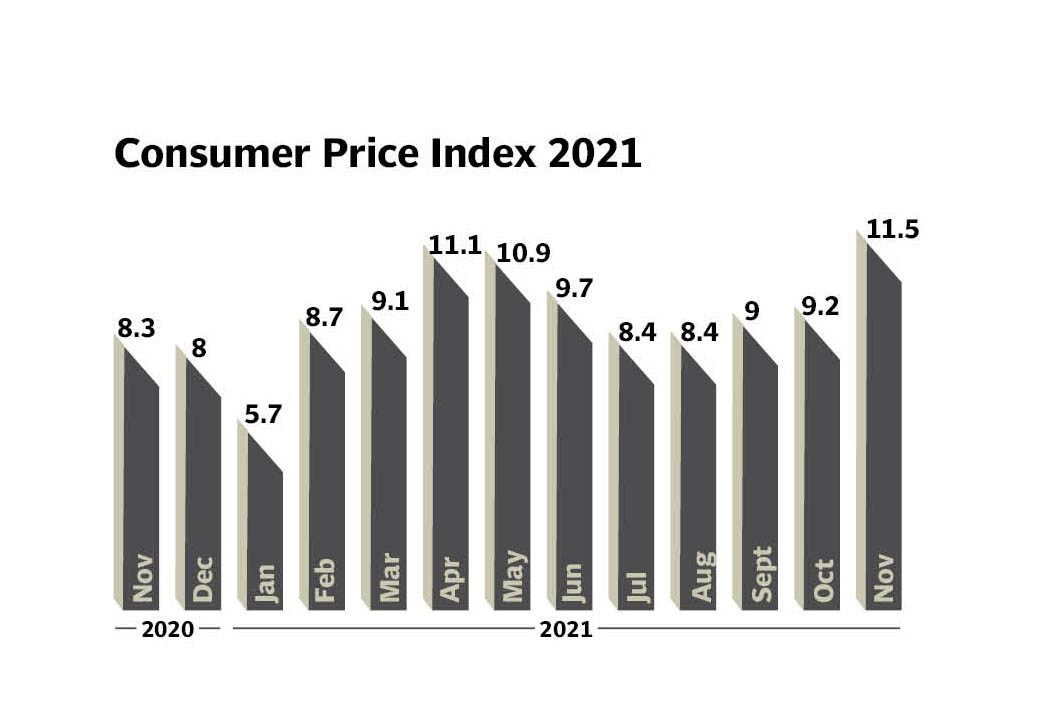

According to the data from the Pakistan Bureau of Statistics, the consumer price index (CPI), the benchmark for inflation, posted double digit growth for the first time this year in April 2021 and it has been rising steeply since then. In November 2021, the CPI grew by a substantial 11.5% adding to the woes of the already deteriorating economy and further suppressing the purchasing power. In addition, the sensitive price index (SPI), a benchmark of weekly inflation, has been showing persistent uptrend as well. The latest Labour Force Survey from the Pakistan Bureau of Statistics (PBS), of year 2018-19, shows unemployment rate at 6.9%. The PBS releases the data with a huge lag due to which it is largely impossible to the current unemployment rate.

Double-digit unemployment

An expert from a research house, on the condition of anonymity, said that according to his estimates, the unemployment rate had entered double digits at present.“In the past few months, Pakistan saw an influx of unemployed people returning home after being laid off in foreign countries particularly in Middle Eastern nations,” he said. “Such people are settling back in Pakistan hence it is increasing the proportion of unemployed people.”

Furthermore, he pointed out that even people from well to do families have started doing second jobs to keep their homes afloat while students have begun doing part time jobs.

While this is a good thing, the reason driving their motivation for a part time job or a second job is saddening, he said. He stated that a large number of unemployed people are entering the ride hailing segment as drivers and online delivery sector as riders.

“It is no secret that the number of drivers in ride hailing companies and delivery applications has soared due to rise in unemployment,” he said. “Even white collar workers are working a blue collar job as a second job to earn an extra buck.” During the times of uncertainty, the anxiety levels of workforce elevates and this causes depression, suicides and even rise in accidents on the roads.

He added that ride hailing firms and delivery companies give a certain timeframe to pick up a customer or to deliver an order and workers have to complete the service within that slim window to gain tips, higher rating and better bonus. This can in turn cause anxiety for people who are performing average or below average and it motivates them to drive recklessly which causes traffic incidents, he said. “I personally put unemployment rate at 12-13% which is high for a country like Pakistan,” he said. “The reason behind my decision is that the pace of creation of new jobs is sluggish.”

Competing for work

While workers are being laid off from one place, other places are not generating enough jobs to absorb them. “For an open position that received 25 CVs on average before Covid-19 struck Pakistan, 100 CVs are being received now hence application rate has grown by four folds.” Whats worse is that at such a time, companies are capitalising on the situation and offering lower pay and people are forced to accept the wages because the situation is largely the same across the board.

If one observes, the number of street hawkers and people selling merchandise on signals and outside crowded markets has soared as well. While it is encouraging to see Pakistan accepting such work and sellers hailing from good families, the overall job satisfaction is nil in such jobs.

Moving on to people doing while collar jobs, he said that pressure is mounting on them day after day to perform better than peers to “seemingly stay safe during rainy weather.”

This has also given rise to workplace politics as everyone is racing to be “boss’ favourite person.” With the rise in competition, the mental health is surely declining. The increase in electricity, gas and petrol prices is adding fuel to the problem, he said.

“Few taxi drivers and those working for ride hailing firms end the day with losses rather than gains,” he said. “They have to keep in mind that purchasing power is already falling and if they quote a high price, the person would conveniently shift to some other application or means of public transport.” All these factors have accelerated suicides happening out of poverty.

Finally, there is a factor of population boom as well, he said adding that the number of dependents of an average person in Pakistan was far higher than someone living in first world country. He partially blamed the government for price hikes and said that rates of items that are produced in Pakistan were climbing as well such as sugar. Amid the fight between the government and different mafia’s it is the common man that is suffering and opting for hard decisions.

No immunity for expatriates

The misery is not limited to resident Pakistanis only because few expatriates have also voiced similar opinions. Abdul Rasheed, a labourer from UAE, stated that till January 2021, he used to send 1,200 dirhams to his family for monthly household expenses and the amount proved to be ample. “Now, I send 1,800 dirhams and still my family back home is unable to pay all bills and this is happening even after steep devaluation of rupee during the year,” he regretted. “On the other hand, my income is stagnant and for bills in November, I had to send 2,000 dirhams home to cover all expenses.”

(*Some names have been changed to protect identities)