Stocks tumble on swelling imports, trade gap

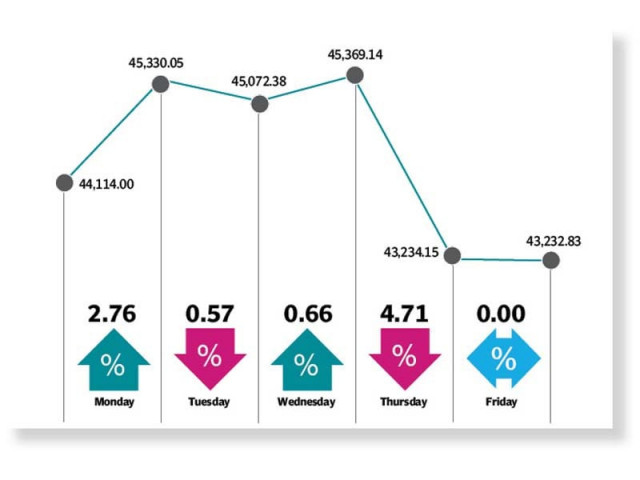

KSE-100 index loses 881 points, or 2% week-on-week, to close at 43,233

Bears held their grip on the Pakistan Stock Exchange in the outgoing week and the benchmark KSE-100 index remained under pressure as the failure of economic team to arrest the runaway import bill and rapidly widening trade deficit unnerved market participants.

The combination of these two factors, along with double-digit growth in inflation, led to a fall of 881 points, or 2% week-on-week, in the KSE-100 index that closed at 43,233.“Market reacted negatively to the news of alarmingly high import bill for November 2021 and a significant increase in cut-off yields in the recent auction of T-bills due to the higher-than-expected Consumer Price Index (CPI) reading,” stated a report of Arif Habib Limited.

On Monday, stock trading kicked off with a sharp rise on the back of expected receipt of $3 billion from Saudi Arabia for depositing in the State Bank of Pakistan before the end of the week. Moreover, investors opted to cherry-pick stocks after the KSE-100 index depicted stability despite a plunge in global markets last weekend owing to the discovery of Covid-19 Omicron variant.

A $10-per-barrel dip in international crude oil prices sparked hopes for a reduction in domestic prices of petroleum products as well, fuelling bullish trading at the bourse.

The surge proved to be short-lived as the market reversed trend on Tuesday amid heavy foreign selling ahead of the reclassification of Pakistan Stock Exchange, which was downgraded to the Frontier Markets Index by Morgan Stanley Capital International (MSCI). However, the reclassification of the stock market attracted investors and the index took a breather and climbed upwards in the middle of the week.

Thursday’s session spelt doom for investors as the market nosedived over 2,100 points in the fourth worst sell-off in the bourse’s history owing to a spike in inflation and an unanticipated surge in imports.

Pakistan reported the historic high import figure of around $8 billion for November, which signaled a further increase in inflation, deterioration of balance of payments and widening of trade deficit.

On the other hand, the inflation reading for November entered into double digits, standing at 11.5%. Moreover, a jump in T-bill yields in the latest auction indicated further monetary tightening by the State Bank of Pakistan in the upcoming monetary policy statement. All these developments battered the stock market and triggered a bloodbath.

There was some respite in the final session on Friday as the market ended on a flat note after investors brushed off the pessimism.

Persistent weakening of the rupee also took a toll on the trading environment, fuelling selling pressure throughout the week. The currency closed the week at a new all-time low of 176.77 against the US dollar.

Average daily traded volumes rose 21% week-on-week to 319 million shares while average daily traded value jumped 51% week-on-week to $90 million.

In terms of sectors, contribution to the downside came from technology and communication (198 points), cement (165 points), oil and gas exploration companies (101 points), textile composite (68 points) and food and personal care products (67 points).

On the other hand, sectors that contributed positively were commercial banks (59 points) and oil and gas marketing companies (20 points).

Foreign selling continued during the week which came in at $62.8 million compared to net selling of $39.2 million in the previous week.

Major selling was witnessed in commercial banks ($27.2 million) and cement firms ($14.8 million). On the domestic front, buying was reported by companies ($25.7 million), followed by individuals ($16 million).

Published in The Express Tribune, December 5th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ