Foreign investors poured $662.1 million mainly into energy, telecommunication and financial sectors of Pakistan in the first four months of current fiscal year 2021-22.

The foreign direct investment (FDI) of $662.1 million was almost 12% lower compared to the investment of $750.6 million in the same period of last year, Pakistan’s central bank reported on Wednesday.

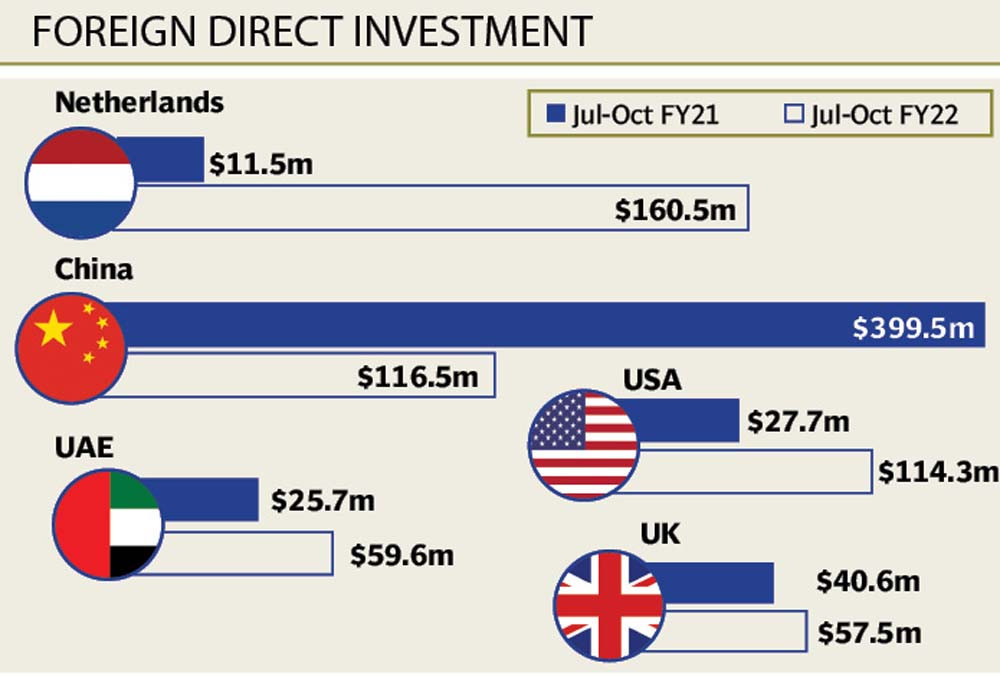

The Netherlands, China and the United States were the three big sources of FDI inflows into Pakistan in the July-October period. They invested a net $160.5 million, $116.5 million and $114.3 million respectively.

In October alone, the FDI inflows amounted to $223 million compared to $293.1 million in the same month of last year, showing a drop of 24%.

Experts noted that the FDI had started to recover across the globe in recent months after plunging in the wake of Covid-19 pandemic.

However, the investment inflows had not yet revived in Pakistan mainly due to volatility in the rupee-dollar parity and economic uncertainty, they said.

Latest economic developments on the domestic front may pave the way for foreign investors to unveil their investment plans for Pakistan.

“Rupee stability in recent days and the central bank’s decision to announce the monetary policy early will remove uncertainty in the market,” said BMA Capital Executive Director Saad Hashmey while talking to The Express Tribune. “It will also motivate global investors to launch new projects in Pakistan.”

Global investors keep a vigilant eye on economic activities and exchange rate in the countries where they invest as economic growth and a stable exchange rate are directly linked with the rate of return on investment, he pointed out.

“The benchmark interest rate remains the main anchor for the exchange rate,” he said. “The anticipated increase in interest rate by 75-100 basis points will support rupee stability. This should encourage foreign investors to make hefty investment in Pakistan in the coming months.”

Pakistan might attract higher FDI in real estate, travel and tourism, and telecommunication sectors, said Arif Habib Limited Head of Research Tahir Abbas.

An expert said that the widening gap between inflation and the real interest rate sparked uncertainty about economic growth and forced foreign investors to wait for the return of stability before initiating new projects.

As a result, the FDI inflows have remained slow since the beginning of current fiscal year on July 1, 2021.

He said that the adjustment in economic indicators including interest rate, inflation rate, stability in rupee-dollar parity and expected reduction in imports may slow down economic activities.

However, fine-tuning of economic indicators would help achieve sustainable economic growth in the long run instead of being stuck in the cycle of overheating and meltdown of economy, he said.

Hashmey said that oil and gas exploration, power, telecommunication and financial sectors would continue to attract FDI.

Global investors are pouring significant investment into fintech and mobile app development sectors.

Since Pakistan’s IT sector and IT exports were growing at a rapid pace, global investors might consider making significant investment in the sector considering the huge size of local population and a remarkable growth in the telecommunication sector, he said.

Abbas said that Pakistan might attract notable FDI when it launched 5G internet. Besides, the government is also focusing on travel and tourism to increase foreign investment.

Accordingly, foreign investors are expected to initiate new projects in the two sectors soon.

He said the power sector witnessed a notable decline in foreign investment in the period under review while the financial sector attracted 8% higher investment.

Published in The Express Tribune, November 18th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732569774-0/Baymax-(2)1732569774-0-165x106.webp)

1732486769-0/image-(8)1732486769-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ