The Pakistan Stock Exchange (PSX) received a hammering in the outgoing week as delay in the resumption of International Monetary Fund (IMF) loan programme dented investor enthusiasm and kept them on the sidelines.

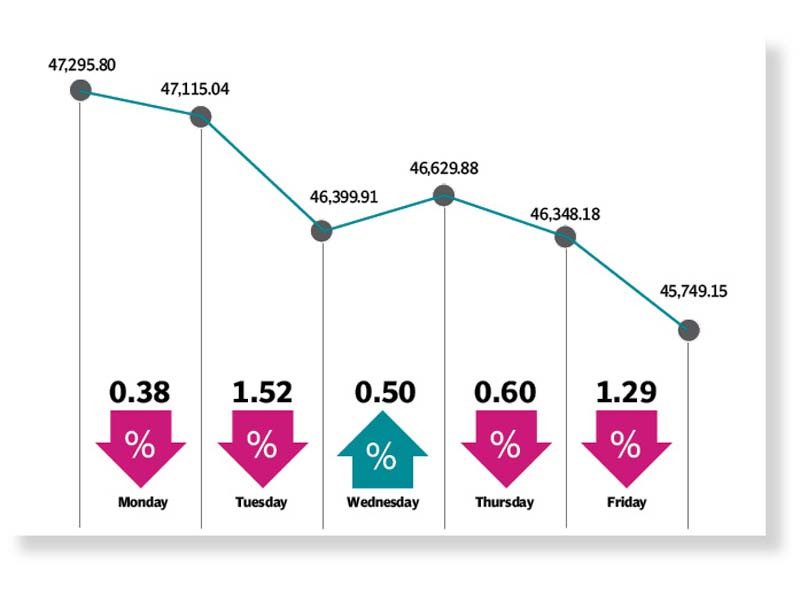

A host of additional negative triggers like the drop in rupee’s value against the US dollar and uncertainty about the receipt of $3 billion in cash deposit from Saudi Arabia dragged the benchmark KSE-100 index down by 1,574 points, or 3.3%, at 45,749 points at the end of the week on November 12.

“Stocks during the week showed weakness as market participants appeared frantic amid delay in positive outcome from the IMF talks regarding resumption of $6 billion Extended Fund Facility for Pakistan,” stated a report of Arif Habib Limited.

The KSE-100 index began the week with a slide and recorded losses in the first two sessions as investors waited in vain for the $3 billion cash deposit in the State Bank of Pakistan (SBP) by Riyadh.

Panic over anticipation of further increase in petroleum product prices and hike in interest rate by the State Bank in the upcoming monetary policy, to be announced later this month, further dampened market spirits.

Midway during the week, the market took a breather and staged a partial rebound due to revival of investor interest following upbeat statements from Adviser to Prime Minister on Finance Shaukat Tarin related to talks between Pakistan and the IMF.

However, the appearance of Prime Minister Imran Khan in the Supreme Court of Pakistan during the hearing of a case capped gains.

The KSE-100 index resumed its downward march in the final two sessions after the jump in US inflation to a 30-year high shook international markets and triggered equity sell-off. Its spillover effect was felt at the Pakistan Stock Exchange as well.

Besides, the lack of developments in talks with the IMF kept investors on the sidelines.

Morgan Stanley Capital International (MSCI) sprang a surprise on Friday when it allotted lower weightage to the PSX in the Frontier Markets index compared to market expectations. This news, in particular, accelerated the sell-off and led to an extension in the bear-run.

Moreover, the rupee plunged to an all-time low at Rs175.73 in the final session, denting the confidence of market participants in the economy. Investors expected a jump in imported inflation as the local currency continued to falter against the US dollar.

“We believe that the market sentiment is hinged upon announcement of the IMF package, which is currently being stalled by two departments of the fund,” stated the Arif Habib Limited report. “Once through, the market is likely to post a rebound.”

Average daily traded volumes dived 26% week-on-week to 316 million shares while average daily traded value dipped 63% week-on-week to $63 million.

In terms of sectors, the negative contribution was led by banks (-277 points), cement (-255 points), technology (-226 points), exploration and production (-140 points) and engineering (-90 points).

On the other hand, the sectors which contributed positively were fertiliser (37 points) and glass and ceramics (3 points).

Stock-wise negative contributors were TRG Pakistan (-140 points), Pakistan Petroleum (-73 points), Oil and Gas Development Company (-70 points), Lucky Cement (-65 points) and UBL (-65 points).

Meanwhile, the positive contribution came from Fauji Fertiliser (48 points), Engro Fertilisers (17 points) and Allied Bank (9 points).

Foreign selling continued during the week, which came in at $5.3 million compared to net selling of $11.2 million in the previous week.

Major selling was witnessed in commercial banks ($7.6 million) and cement firms ($3 million). On the local front, buying was reported by different companies ($6.5 million) followed by insurance companies ($5.7 million).

Other major news of the week included foreign exchange reserves exceeding $24 billion on official inflows, reduction in sales tax on petrol, 105% spike in November RLNG prices and first quarter ending with a budget deficit of 0.8% of GDP.

Published in The Express Tribune, November 14th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719660634-1/BeFunky-collage-nicole-(1)1719660634-1-405x300.webp)

1732276540-0/kim-(10)1732276540-0-165x106.webp)

1732274008-0/Ariana-Grande-and-Kristin-Chenoweth-(1)1732274008-0-165x106.webp)

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ