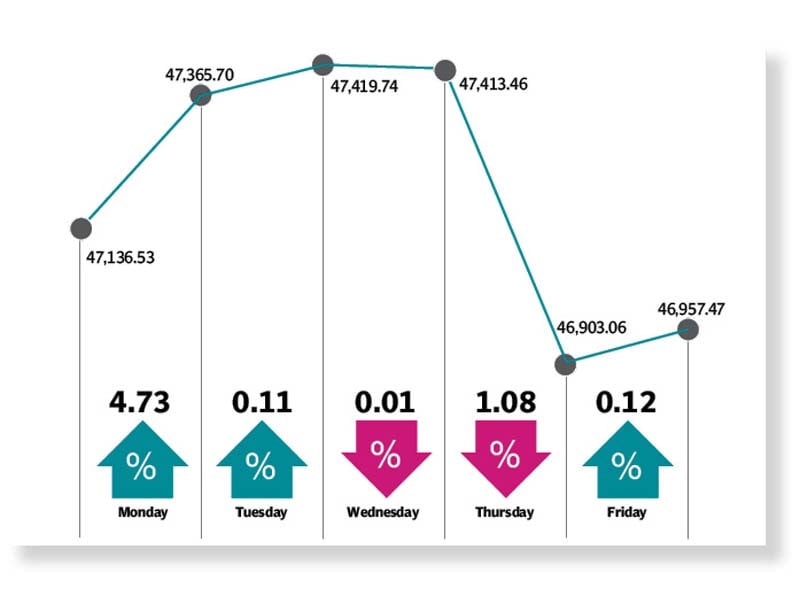

The Pakistan Stock Exchange (PSX) witnessed a roller coaster trading week as a combination of buying interest and selling pressure made the index swing on both sides of the spectrum.

Resultantly, the KSE-100 index dived 179 points or 0.4% to close the week at 47,957.47 points.

“The KSE-100 index declined as investor confidence was shaken up by the mounting import bill of August 2021,” said JS Global analyst Amreen Soorani.

The week began positively and the market jumped in the first two sessions as stability in regional markets coupled with uptick in global oil prices fuelled bullish trading.

Hike in global crude prices, on the back of supply disruptions caused by Hurricane Ida in US, triggered cherry picking in local oil sectors and propelled the market upward.

In addition, the reaffirmation of Pakistan’s sovereign credit rating of “B-/B” by S&P with a stable outlook revived investors’ confidence in local equities and drove buying activity.

Moreover, encouraging corporate financial results lent further support to the rally. The oversubscription in Air Link Communication’s book building process, by 1.6 times, also aided sentiment and accelerated the uptrend.

However, the market reversed its direction mid-week and plunged over 500 points in a two-day bear run as depreciation in rupee against the US dollar shattered investor spirits and sparked uncertainty at the bourse. The market participants panicked over the anticipated worsening of current account balance due to ballooning import bill and costlier dollar.

Moreover, inflation reading for August depicted steep rise in prices of daily use items, which dimmed investors’ mood.

The market staged a rebound in the final trading session of the week aided by clarity over Afghanistan situation.

“We may see the market experience range bound behaviour next week, however, concerns persist over how manageable the deficit of the current account might be,” stated a report from Arif Habib Limited.

Average daily traded volume increased 20% week-on-week to 462 million shares while average daily traded value rose 5% week-on-week to settle at $83 million.

In terms of sectors, negative contributions came from commercial banks (301 points), cement (100 points), automobile assembler (77 points), textile composite (20 points) and oil and gas marketing companies (19 points).

On the flip side, sector-wise positive contribution was led by technology and communication (176 points), power generation and distribution (77 points) and refinery (51 points).

Scrip-wise, negative contributors were HBL (105 points), Meezan Bank (80 points), UBL (63 points), MCB (48 points) and Maple Leaf Cement (24 points).

Meanwhile, positive contribution came from Systems Limited (141 points), Hubco (82 points) and TRG Pakistan (33 points).

Foreign selling continued this week, settling at $5.9 million against a net sell of $5.4 million last week. Selling was witnessed in commercial banks ($4.3 million), cement ($1.3 million) and exploration and production ($0.8 million). On the domestic front, major buying was reported by individuals ($5.1 million) and insurance companies ($4 million).

Among other major news of the week; PPL-led consortium awarded offshore block 5 in Abu Dhabi, forex reserves hit all-time high of $27 billion, and Engro Fertilisers, Bank of Punjab joined hands to support farmers.

Published in The Express Tribune, September 5th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1714370039-0/ojwilson-(1)1714370039-0-270x192.webp)

-(1)1714458896-0/ASP-(2)-(1)1714458896-0-270x192.webp)

-(1)1714463604-0/Untitled-design-(4)-(1)1714463604-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ