Current account remains in deficit

Balance stands at negative $773 million in July 2021 in wake of spike in imports

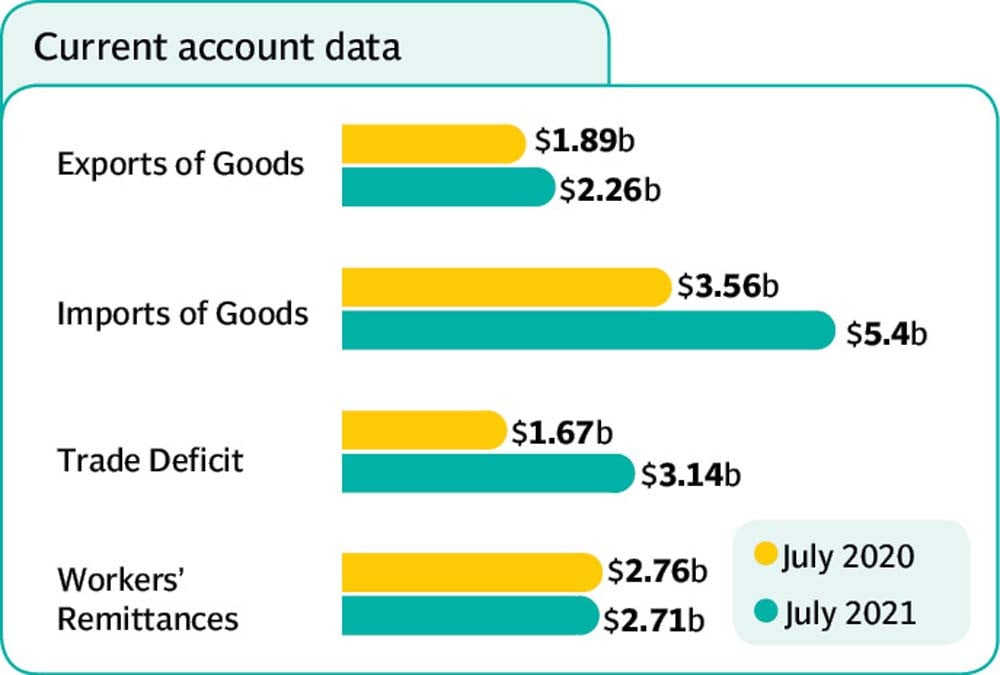

Pakistan’s current account deficit – country’s higher foreign expenditures compared to income – remained elevated at $773 million in July 2021 in the wake of a spike in imports, which were partly necessary to achieve higher economic growth of 4.8% in current fiscal year 2021-22.

Besides, a decline in workers’ remittances and sluggish growth in export earnings (in dollar terms) compared to import payments also widened the current account deficit and sparked concern.

According to experts, a steady and robust inflow of remittances and receipts under the Roshan Digital Account (RDA) coupled with a spike in IT export earnings are vital to contain the current account deficit.

Any slowdown in inflows amid higher import payments and foreign debt repayments will place Pakistan’s external sector at a high risk during FY22.

“The current account deficit in July was in line with the central bank’s projection of 2-3% of GDP (gross domestic product) for full fiscal year 2022. This is no negative news,” BMA Capital Executive Director Saad Hashmey said while talking to The Express Tribune.

State Bank of Pakistan (SBP) Governor Reza Baqir projected the current account deficit at 2-3% of GDP for FY22 and termed it sustainable. The increase in the current account deficit would support the uptick in GDP growth to 4-5% in FY22.

“Downward trend in international commodity prices including iron ore, copper, palm oil and crude oil is expected to keep the current account deficit sustainable, subject to inflows through remittances and IT exports,” added Pak-Kuwait Investment Company Head of Research Samiullah Tariq.

The current account turned in a deficit of $773 million in July 2021 compared to a surplus of $583 million in the same month of last year, according to data reported by the central bank on Friday.

The July deficit, however, was less than half the deficit of $1.62 billion in June 2021.

“This deficit ($773 million in July compared to $1.6 billion in June) is in line with SBP’s expectations of 2-3% of GDP ($6.5-9.5 billion) as economic activity continued to progress,” the SBP said on its official Twitter handle.

“Despite the recent increase in the current account deficit, the position of SBP’s foreign reserves continued to strengthen on a monthly basis,” it added. “This is in contrast to past trends and it is supported by country’s market-based exchange rate system.”

Hashmey said that there was realisation at the government level that imports were growing beyond sustainable levels and Prime Minister Imran Khan had taken notice of that.

“It is for the first time that any government is taking interest in fixing faults in the external economy,” he said.

Besides, the government and the central bank have played a pivotal role in attracting higher foreign currency inflows through workers’ remittances and the RDA, he said.

“We should acknowledge their role in fixing the internal and external economy. The increased inflows over the past two years allowed the economy to grow in FY21 despite the challenges posed by the Covid-19 pandemic,” he said.

Tariq also found the current account deficit to be in line with SBP’s projection. “However, any slowdown in inflows of foreign currency on account of workers’ remittances will put the economy in hot waters.”

He hoped that the downward trend in international commodity prices would keep the balance of payments favourable and current account deficit sustainable. “However, the downturn in commodity prices in world markets may carry the potential to harm our export earnings as well,” he feared.

He recalled that the government had recently announced incentives to ramp up the inflow of remittances and IT export earnings. “The schemes and packages will help make the current account deficit sustainable in FY22.”

“Our import payments and trade deficit (higher import payments compared to export earnings) are surging on the back of local consumption,” Pakistan Business Council CEO Ehsan Malik said the other day.

“Growth in the economy should have largely come from export-oriented sectors instead of import-dependent ones...so that our current account and balance of payments remain favourable,” he added.

Published in The Express Tribune, August 21st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ