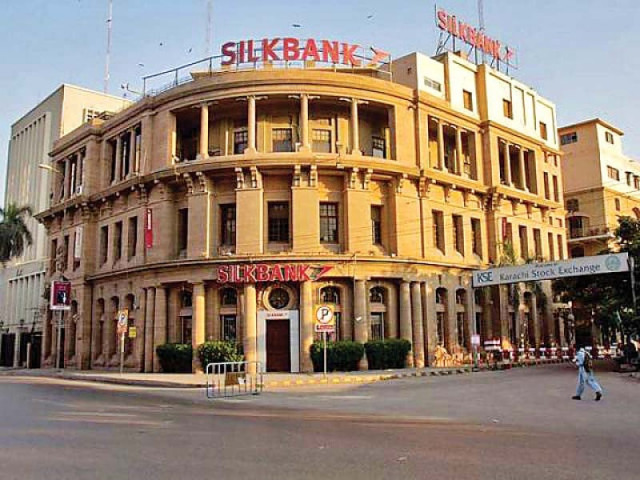

Tarin looks to sell stake in Silkbank

PTI’s Aleem Khan offers to buy shares, deal subject to clearance by SBP

Abdul Aleem Khan, senior minister in the Punjab cabinet, has offered to buy Finance Minister Shaukat Tarin and his family’s shares in the troubled Silkbank Limited, sources close to Tarin have confirmed to The Express Tribune.

The deal will be subject to clearance by the State Bank of Pakistan (SBP), as Aleem Khan is facing a probe by anti-corruption watchdog, said the sources. They said that Khan has offered to buy a total of about 26% stakes in the Silkbank Limited.

The Tarin family is one of the major shareholders of the bank and controls its shareholding through Sinthos Capital, composed of Shaukat Tarin, Sadeq Sayeed and Azmat Tarin, according to the last publically available financial statement of the bank for January-March 2020 period.

“I want to sell my shares in the bank to focus on public life,” said Tarin while responding to a question about the bid made by Khan. But he neither denied nor confirmed that Khan has offered to buy his and his family’s stakes.

The sources said that two commercial banks were also interested to acquire the shares held by Tarin and his family. However, the billions of rupees hole in the bank’s balance sheet, estimated to be in double digits, was one of the reasons behind the delay in reaching a deal. But people close to the finance minister said that the hole has largely been bridged.

The sources close to Tarin said that Aleem Khan made the offer a few days ago. The materialisation of the offer will solely depend upon whether the central bank gives fit and proper certificate to Khan to acquire the assets, said the sources. The SBP is legally bound to vet sponsors of commercial banks.

READ IMF ‘carefully watching’ Afghanistan, too soon to predict spillover to Pakistan

Aleem Khan’s “case is under probe as per law”, replied Nawazish Ali, spokesman of the National Accountability Bureau (NAB), when asked whether any inquiry, investigation or reference was pending against Khan under the National Accountability Ordinance.

In September last year, NAB approved filing of a corruption reference in the accountability court against Khan for allegedly possessing assets worth Rs1.4 billion beyond his known sources of income, according to a daily Dawn story. Khan had remained in NAB custody and then secured bail in May last year and was subsequently allowed to become part of the provincial cabinet.

Sources said that Khan’s condition was that Silkbank would not segregate its consumer finance business and sell it separately to cover the bank’s losses. They said that this condition was acceptable to Tarin and his family. One leading commercial bank was interested to acquire only the consumer financing business of the bank. Silkbank Limited was incorporated in March 1994 in Pakistan and began its commercial operations in May 1995.

Major shareholders of the bank as on March 31, 2020 are Sinthos Capital (comprising of Shaukat Tarin, Sadeq Sayeed and Azmat Tarin) Arif Habib Corporation Limited, International Finance Corporation, Nomura European Investment Limited, Bank Muscat SAOG and Zulqarnain Nawaz Chattha and Zubair Nawaz Chatta, according to the financial statement of the bank.

As of March 2020, the equity of the bank was Rs9.94 billion excluding surplus on revaluation of assets against the Minimum Capital Requirement (MCR) of Rs10 billion as prescribed by the SBP. The Capital Adequacy Ratio (CAR) of the bank was 5.83% against the minimum requirement of 11.5% for 2020, according to the balance sheet.

“The bank is non-compliant with the MCR and ACR at March 2020 end which can expose the bank to regulatory actions under the banking laws,” according to the statement.

The central had taken a lenient view at that time and allowed “staggering of provision against non-performing loans amounting to Rs2.71 billion” and allowed to threat the general provision held against consumer financing as part of common equity instead of for the purpose of CAR calculation. Had this benefit not been taken by the bank, loss before tax would have been higher by Rs1.76 billion and CAR would have been lower by 2.58%.

Silkbank’s share traded at Rs1.77 at the stock market, the lowest price of any publically listed bank.

The Express Tribune waited for Aleem Khan’s version for four days but the senior PTI provincial leader did not respond to various text messages and telephone calls.

Khan had been requested to comment about his offer to Tarin, whether he approached the SBP for due diligence and seeking fit and proper certificate, value of the transaction, percentage of shares that wants to buy and implication of NAB inquiries on the transaction.

“With reference to your queries, it is informed that no potential investor for purchase of Silkbank’s shares has so far approached SBP; therefore, we are unable to comment on any potential deal or investor,” replied SBP chief spokesman Abid Qamar.

Published in The Express Tribune, August 14th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ