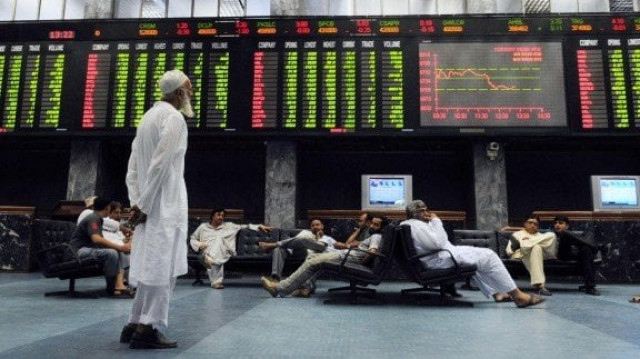

Market watch: KSE-100 slips on profit-taking, pandemic worries

Benchmark index sheds 100.92 points to settle at 47,169.84

The stock market remained in consolidation phase and shares fell on Friday as investors trimmed their positions after a brief rebound witnessed earlier this week. Anticipation regarding multiple economic headwinds also fuelled concerns about domestic growth.

Primarily the market was down due to profit-taking but uncertainties ahead are also making investors cautious.

Investors remained sceptical about pace of recovery as the economic outlook remains unclear because the country is struggling to contain the fourth wave of infections.

Initial support came on the back of assurance of Finance Minister Shaukat Tarin, who vowed to protect both the International Monetary Fund (IMF) deal and the Kamyab Jawan Programme.

However, rupee plunged to a 10-month low on Thursday and closed at 164 in the inter-bank market, which further activity at the bourse.

At close, the benchmark KSE-100 index recorded a decrease of 100.92 points, or 0.21%, to settle at 47,169.84.

A report from Arif Habib Limited stated that the market traded in a narrow range between +50 points and -147 points.

“Index traded directionless as it has been the case for the past two weeks, where the market is looking for a significant driver and has discounted IMF transferring $2.8 billion in new funding to Pakistan,” the report said.

Foreign investors have been increasing positions in technology stocks, where local corporates and individuals have been disposing off positions. Steel, cement, chemical, refinery, exploration and production and oil and gas marketing companies saw selling pressure.

Sectors contributing to the performance included cement (-46 points), exploration and production (-23 points), technology (-23 points), oil and gas marketing company (-18 points) and miscellaneous (+33 points).

Individually, stocks that contributed positively to the index included Pakistan Services (+33 points), TRG Pakistan (+9 points), Ghani Glass (+8 points), FrieslandCampina Engro Pakistan (+8 points) and Millat Tractors (+7 points).

Stocks that contributed negatively were Systems Limited (-32 points), Maple Leaf Cement Factory (-19 points), Lucky Cement (-18 points), Oil and Gas Development Company (-12 points) and MCB (-10 points).

JS Global analyst Neelum Naz said, “The market is consolidating in a narrow range and can further correct in coming days amid lack of volume and buyer interest.”

Maple Leaf Cement Factory (-3.6%) announced its financial result and reported a consolidated earnings per share of Rs3.49 for the year ended June 30, 2021 with no cash payout.

Naz added, “Investors are advised to cherry-pick blue-chip stocks available at deep discounts across all sectors.”

Overall trading volumes fell to 213.4 million shares compared with Thursday's tally of 230.2 million. The value of shares traded during the day was Rs9.3 billion.

Shares of 452 companies were traded. At the end of the day, 168 stocks closed higher, 257 declined and 27 remained unchanged.

TRG Properties was the volume leader with 24.5 million shares, gaining Rs2.94 to close at Rs42.16. It was followed by Ghani Global Holdings with 23.9 million shares, gaining Rs0.97 to close at Rs44.39 and WorldCall Telecom with 11.4 million shares, losing Rs0.03 to close at Rs3.34.

Foreign institutional investors were net buyers of Rs142 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ