Delta variant fear rattles stock market

Investors remain cautious and continue to weigh impact of fourth wave on economy

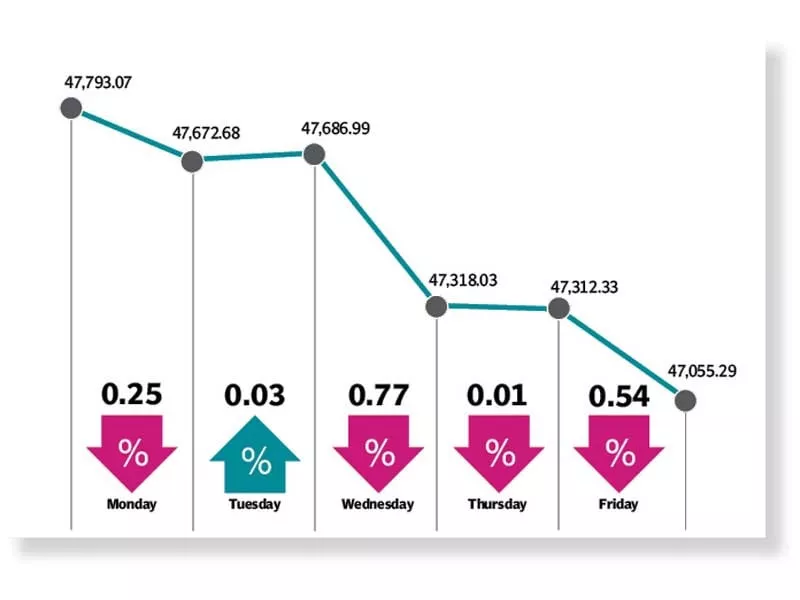

KARACHI:Bears dominated at the Pakistan stock market in the outgoing week with the benchmark KSE-100 index diving 738 points or 1.54% and settling at 47,055.29 points.

Investors were spooked by the increase in Delta variant cases that was feared to lead to strict restrictions, which would cast a blow on the economy. With the upheavals caused by the previous lockdowns fresh in memory, investors decided to trade cautiously and disposed shares during the futures rollover week.

The market started the week on a bearish note due to uncertainty ahead of the monetary policy announcement by the State Bank of Pakistan (SBP). However, on Tuesday the KSE-100 index rose by a marginal 14 points with investors remaining cautious due to the pending monetary policy announcement after the close of trading.

At a press conference later on Tuesday, State Bank of Pakistan Governor Reza Baqir announced that the benchmark interest rate had been left unchanged at 7%. On the international front, Asian stock markets dived as disruptions from China’s latest crackdown on a range of industries worsened. Moreover, international investors’ attention turned to the US Federal Reserve, which kicked off its two-day policy meeting.

The developments spurred selling pressure in the trading session on Wednesday as investors offloaded index-heavy shares, which triggered a plunge of nearly 400 points in the KSE-100 index. In addition to that, the surging coronavirus cases in Pakistan amid the fourth wave rattled investors and pushed the benchmark KSE-100 index deep into the red.

The central bank’s decision to hold the policy rate at 7% and a host of financial results announced during the trading session, mostly in the food sector, failed to entice market participants. The following two sessions also remained gloomy, as investor spirits continued to be hammered by the rising number of Covid-19 infections across the country. In addition, a provincial coronavirus task force meeting was held on Friday, which decided to impose lockdown in Sindh from Saturday (July 31) till August 8.

The news wreaked further havoc and dragged the market down in the second half of the session as the re-introduction of curbs would deal a significant blow to the recovering economy. “Karachi is set to observe a more stringent lockdown in place next week to contain the highly contagious delta variant of the novel coronavirus, and it appears the market may remain upwards sticky in the short term,” stated the Arif Habib Limited report. “However, with result season commencing, and cyclicals expected to post a robust jump in earnings on a year-on-year basis (given a nation-wise lockdown was enforced in 2Q last year), certain stocks may come under limelight.”

Average daily traded volume surged 28% week-on-week to 405 million shares while average daily traded value inched up 14% week-on-week to settle at $81 million.

In terms of sectors, negative contributions came from cement (212 points), commercial banks (178 points), oil and gas exploration companies (58 points), pharmaceutical (53 points) and oil and gas marketing companies (51 points). Scrip-wise, major losers were Lucky Cement (118 points), TRG Pakistan (62 points), MCB (60 points), Pakistan State Oil (45 points) and Habib Bank Limited (44 points). Meanwhile, Systems Limited (67 points), FrieslandCampina Pakistan Holdings BV (43 points), Hubco (38 points), Azgard Nine (34 points) and Millat Tractors (21 points) were the major gainers. Foreigners offloaded stocks worth $5.4 million compared to a net sell of $21.02 million last week. Selling was witnessed in commercial banks ($2.94 million), and all other sectors ($2.56 million). On the domestic front, major buying was reported by banks ($6.3 million) and mutual funds ($2.43 million).

Among other major news of the week; efforts to retain IMF programme were underway, car loans touched a record high of Rs308 billion in FY21.

Published in The Express Tribune, August 1st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ