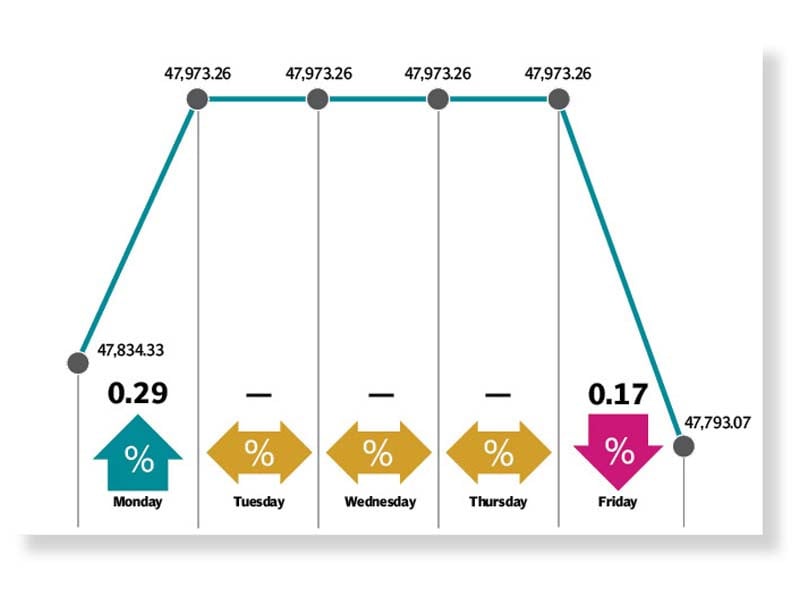

Lack of positive triggers at the Pakistan Stock Exchange (PSX) kept the bulls at bay as the benchmark KSE-100 index witnessed lifeless trading and closed almost flat. The index was down 41 points or 0.1% during the shortened trading week to close at 47,793.07.

The market managed to finish one session out of the two sessions in the green during the week. The stock market remained closed for three days on account of Eidul Azha holidays.

Trading was subdued with volumes remaining low throughout the week as the upcoming results season forced market players to trade cautiously. The week kicked off on a positive note, in line with the performance in the previous week. Trading, however, remained lacklustre as investors avoided taking fresh positions ahead of the three-day-long holidays (Tuesday-Thursday).

During the session, the benchmark KSE-100 index surpassed the 48,000-point mark, but lack of positive news flow erased the gains and the market trend remained flat after mid-day on Monday.

Rising coronavirus cases as a fourth wave swept across Pakistan triggered cautious trading as investors anticipated the government’s response in order to contain the spread of the Delta variant.

Trading then resumed on Friday and failed to carry forward the positive momentum. The approaching rollover week and the monetary policy announcement scheduled for July 27 (Tuesday) played a prominent role in the bearish close of the market.

Unimpressive trade data, with the trade deficit widening to $1.6 billion in June 2021, adversely impacted the positive momentum, pulling the benchmark KSE-100 index down following five consecutive sessions of advance. Moreover, continuous depreciation of Pakistani rupee against the US dollar on the back of a soaring import bill coupled with increase in restrictions to contain the spread of the virus shattered investor confidence.

Nevertheless, Pak-Kuwait Investment Company Head of Research Samiullah Tariq said, “I think with the improvement in economic indicators from next month, the market should resume its rally.”

Financial result season is expected to begin next week, which also held investors from assuming fresh positions at the bourse.

“Going forward, we expect the market to remain range-bound to positive in the upcoming week attributable to beginning of result season which will keep specific companies in limelight,” stated the Arif Habib Limited report. “However, pressure on external account, rising infection ratio of coronavirus in Pakistan and uptick in CPI in the upcoming months are downside risks to the index performance.”

Average daily traded volume contracted 32% week-on-week to 318 million shares while average daily traded value declined 26% week-on-week to settle at $71 million.

In terms of sectors, negative contributions came from cement (49 points), food and personal care (19 points), refineries (14 points), technology and communication (12 points) and textile composite (11 points).

Scrip-wise, major losers were TRG Pakistan (30 points), Engro Corporation (25 points), Pakistan State Oil (14 points), Lucky Cement (21 points) and HBL (11 points). Meanwhile, Sui Northern Gas Pipelines (48 points), Pakistan Services (33 points), Systems Limited (23 points), Fauji Fertiliser (18 points) and Meezan Banl (16 points) were the major gainers.

Foreign selling was witnessed this week, settling at $21.02 million compared to a net buy of $4.6 million last week. Selling was witnessed in all other sectors ($21.95 million), and technology sectors ($0.61 million). On the domestic front, major buying was reported by individuals ($9.02 million) and companies ($5.65 million).

Among other major news of the week; SBP reserves rose $845 million to $18.1 billion, current account ended FY21 in deficit, dollar touched nine-month high at Rs161.48, GDP grew faster than ADB forecast in FY21, Foreign direct investment declined by 29% in FY21 and Lucky Cement plans to set up assembly plant.

Published in The Express Tribune, July 25th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

-(1)1714378140-0/AliAminMaryam-(4)-(1)1714378140-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ