Current account ends FY21 in deficit

Country registers $1.85b deficit due to spike in oil prices, vaccine imports

Pakistan’s current account recorded a deficit of $1.85 billion in fiscal year 2020-21 owing to a jump in imports on account of rise in crude oil prices and vaccine arrivals.

The deficit came despite the fact that the current account remained in surplus in the first 11 months (July 2020 to May 2021) of the previous fiscal year.

According to data of the State Bank of Pakistan (SBP), the current account deficit - gap between foreign payments and income - had stood at $4.45 billion in fiscal year 2019-20.

“Pakistan’s external position is at its strongest in many years,” remarked the SBP in a tweet on Monday. “In line with SBP’s projections, the current account deficit in FY21 fell to only 0.6% of GDP, which is the lowest in 10 years, with exports and remittances at all-time highs.”

It said that foreign exchange reserves rose by $5.2 billion in FY21 to over $17 billion - a 4.5-year high.

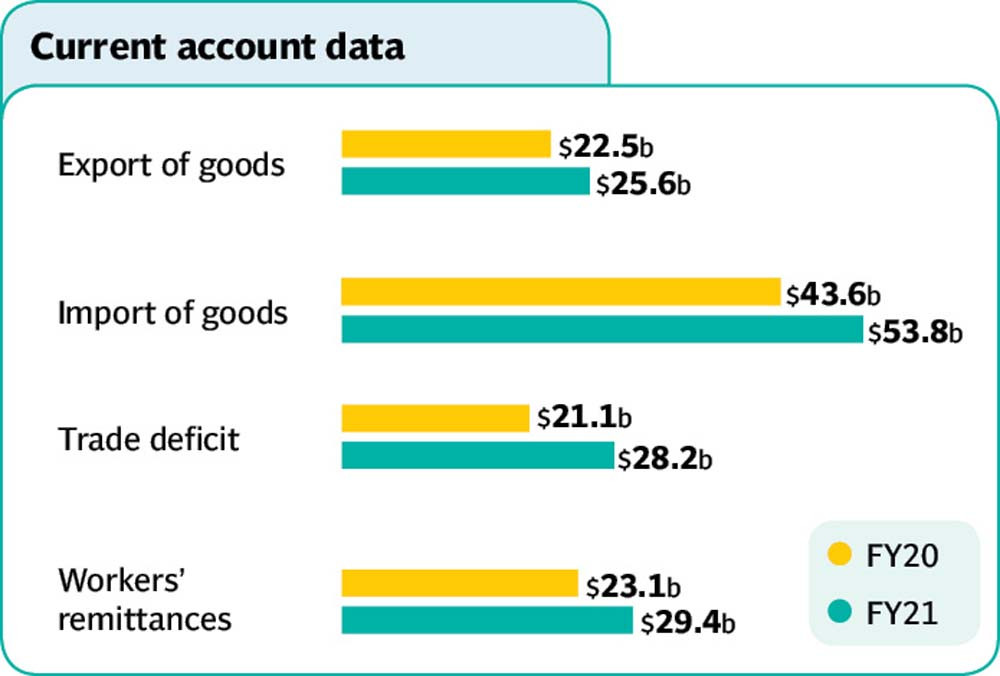

Exports of goods from the country increased 13.73% from $22.5 billion in fiscal year 2019-20 to $25.3 billion in fiscal year 2020-21.

On the other hand, imports of goods spiked 23% to $53.8 billion in the previous fiscal year. The country had imported goods worth $43.6 billion in FY20.

Speaking to The Express Tribune, Arif Habib Limited analyst Sana Tawfiq said that the main reason behind the current account deficit was the growth in the negative balance of trade.

“The balance of trade of Pakistan expanded by 33% in fiscal year 2020-21,” she said. “Imports jumped 23% while the pace of increase in exports remained sluggish.”

In addition, the primary income of the country fell 14% during the previous fiscal year, which widened the deficit.

Giving the outlook, Tawfiq predicted that the current account deficit would rise in FY22 because import pressure was building up.

She added that oil was becoming costlier, hence the country should brace itself for a lofty import bill.

On the other hand, she said that many businesses had secured loans under SBP’s Temporary Economic Refinance Facility (TERF) and they would be importing machinery and equipment to upgrade their units in the ongoing fiscal year, which would enhance the volume of imports.

Deficit in June

According to the SBP, the current account deficit widened to $1.6 billion in June 2021 compared to $650 million in May 2021.

“Exports of goods and remittances increased by $368 million and $197 million respectively,” it said. “Meanwhile, imports of goods rose by $1.4 billion.”

It added that some of the rise in imports was seasonal and it was associated with the bunching of year-end payments.

Import bill was also larger than May due to higher oil imports and Covid vaccines.

Encouragingly, the import of capital goods like machinery continued to rise, reflecting improvement in the investment outlook, it said.

Topline Securities Director Research Atif Zafar expressed concern that the current account deficit in June was extraordinarily high and it dragged the balance from surplus to deficit.

“Imports have registered a drastic jump while exports remained sluggish,” he said.

According to him, the rapid increase in imports was a concern for the whole country.

He projected that the current account deficit would shrink on a monthly basis, however, for the ongoing fiscal year, the deficit would be far above the FY21 number.

Endorsing his views, AA Gold Commodities Director Adnan Agar said that the outlook was gloomy because the rupee had depreciated past 160 against the US dollar, which would make imports expensive.

He said that the government attempted to improve the current account balance, however, due to unforeseen reasons, its efforts went in vain.

He pointed out that the high deficit came in June on the back of mammoth imports coupled with a rise in global oil prices.

Alpha Beta Core CEO Khurram Shehzad voiced fear that if the external account remained weak, then the current account deficit for FY22 might end up well beyond $10 billion.

Published in The Express Tribune, July 20th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ