PSX inches up in lacklustre week

Concerns over fourth wave of Covid-19 hinder market from posting exorbitant gains

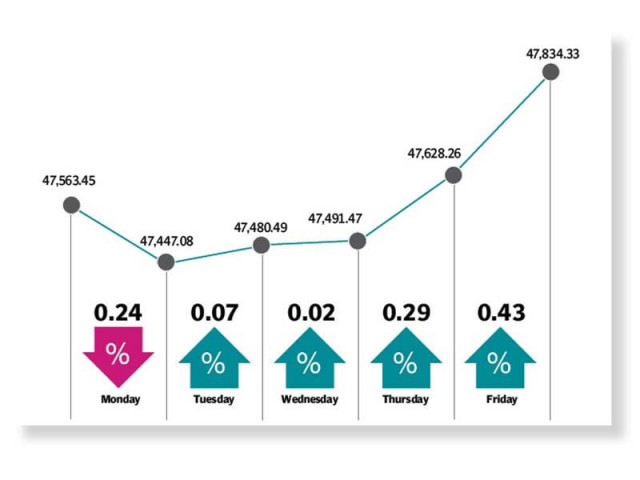

The Pakistan Stock Exchange (PSX) witnessed a tepid week as concerns over the fourth wave of Covid-19 played on investor’s mind and dimmed trading activity. Despite lacklustre trading, the KSE-100 index managed to close the week with a gain of 0.6% or 271 points at 47,834 points.

“The week saw the index gaining some momentum in spite of a continued rise in Covid cases on account of the delta variant,” stated a report from Arif Habib Limited.

Trading on Monday kicked off on a negative note and the market dropped as concerns over rising coronavirus cases coupled with the anticipation of another lockdown shattered investor confidence.

The market bounced back in the next session and remained on an upward trajectory for the rest of the week owing to a handful of positive triggers. Investors took cues from historic rise in remittances to all-time high level of $29.4 billion in fiscal year 2020-21.

The State Bank of Pakistan also received $1 billion in proceeds from Eurobond which helped prop up country’s foreign currency reserves to four-and-a-half-year high and restored investors’ confidence in the economy. Upbeat car sales data, which showed a surge of 90% in the number of vehicles sold in fiscal year 2020-21 compared to the previous year, also helped lift the market upward.

In addition, the forthcoming festival of Eidul Azha and a short trading week motivated investors’ to assume fresh positions.

Power sector stocks attracted the limelight following the release of power production data which reflected highest-ever generation of 130,223 GW in the previous fiscal year.

Despite positive triggers, trading remained sombre as concerns over mounting Covid-19 infections and announcement of measures to curb them took a toll on investor sentiments. Mid-way through the week, Sindh announced fresh restrictions to keep rising virus cases in check.

Downtrend in rupee against the US dollar also derailed investor spirits and fuelled profit taking. On the regional front, the conflict in Afghanistan continued to be a major concern and restrained the market from posting exorbitant gains.

“Next week the market is expected to continue the momentum it gained this week,” stated the Arif Habib Limited report. “We highlight cyclical sectors to be in the limelight due to healthy earnings expected in the upcoming result season.”

Average daily traded volume contracted 4% week-on-week to 467 million shares while average daily traded value declined 10% week-on-week to settle at $96 million.

In terms of sectors, positive contributions came from commercial banks (82 points), technology and communication (75 points), cement (46 points), textile composite (36 points) and investment banks/investment companies/securities companies (36 points).

On the flip side, sectors that contributed negatively included fertiliser (36 points), power generation and distribution (17 points), pharmaceuticals (13 points), oil and gas exploration companies (12 points) and automobile parts and accessories (7 points).

Scrip-wise, positive contributors were Systems Limited (79 points), Lucky Cement (62 points), Pakistan Stock Exchange (36 points), Unity Foods (33 points) and Bank Al Falah (30 points). Meanwhile, Pakistan Oilfields (15 points), Engro Fertiliser (15 points), Kapco (11 points), Cherat Cement (11 points) and Engro (10 points) were among the negative contributors.

Foreign buying was witnessed this week, settling at $4.6 million compared to a net sell of $5.2 million last week. Buying was witnessed in cements ($1.32 million), exploration and production ($1.30 million) and technology and communication ($1.30 million).

On the domestic front, major selling was reported by individuals ($9.98 million) and broker proprietary trading ($6.32 million).

Among other major news of the week; Cherat Cement shared plans to set up plant in DI Khan, government raised Rs551 billion via MTBs’ auction, forex reserves dropped to $24.31 billion and petrol price rose by Rs5.40 per litre.

Published in The Express Tribune, July 18th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ