NA clears budget with majority vote

New revenue measures introduced to achieve Rs5.8tr tax target

The National Assembly on Tuesday passed the budget with a majority vote, giving effect to new revenue measures in an ambitious bid to achieve a tax target of Rs5.8 trillion and at the same time providing some relief to big businesses and wealthy individuals.

On back of 172 treasury members, the lower house of parliament approved the amended Finance Bill 2021 to bring changes in four tax laws.

In the amended bill, the government withdrew the proposal to exempt the income of the political parties from tax and also rolled back its plan to impose Rs10 billion in taxes on the salaried class.

However, the government has retained the powers to arrest a filer if they defaulted on Rs100 million tax obligation and a non-filer of tax returns on a default of Rs25 million, subject to approval by a finance minister-led committee.

It has also amended the definition of a “resident person” by again declaring that an individual who will stay in Pakistan for 183 days in a tax year would be treated as Pakistani for tax purposes, withdrawing the two-year-old definition of 120 days.

The government’s efforts to give the National Accountability Bureau (NAB) access to tax records of politicians and bureaucrats also did not succeed after a story appeared in The Express Tribune and opposition to the move by the PPP and the PML-N.

The income tax exemption for the Army Welfare Trust was also not part of the amended bill that the assembly approved.

Similarly, the government has also withdrawn the proposed increase in sales tax rate on machinery, plant, chicken and dairy products after opposition from various segments of the society.

Prime Minister Imran Khan attended the budget session, while former president Asif Ali Zardari and his son, PPP Chairman Bilawal Bhutto Zardari, were also present in the House.

The Finance Bill 2021-22 was discussed clause by clause in the House. Amendments proposed by treasury members were accepted while those proposed by opposition members were rejected.

After the clause by clause reading was completed, a voice vote was conducted by the NA speaker and the budget was passed.

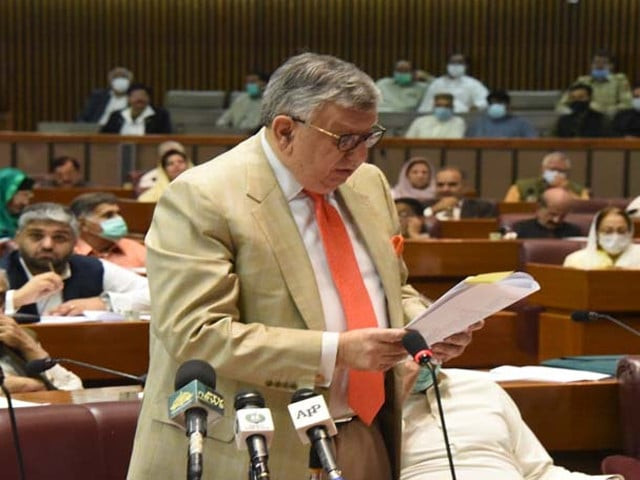

The National Assembly on Wednesday (today) will approve supplementary grants for the outgoing fiscal year. Finance Minister Shaukat Tarin will also lay out the schedule of the authorised grants for fiscal year 2021-22 starting from Thursday.

Sources said after the approval of the final bill, there is gap of about Rs350 billion between the Rs5.8 trillion tax target and the measures taken to achieve it.

Because of this gap, Pakistan and the International Monetary Fund (IMF) could not conclude talks for the 6th review of the programme.

Despite resistance from various quarters, the finance minister has managed to retain powers to arrest people on their failure to pay taxes.

“Provided that where the offence of concealment of income which has resulted in non-payment of tax of Rs100 million and above in case of a filer and Rs25 million or above in case of non-filer, the procedure provided in section 203 B shall be applicable,” read the bill passed by the House.

“Where on the basis of material evidence brought on record, as a result of audit conducted by the auditors, an assessment is made or amended, and the assessing officer records a finding that the taxpayer has committed the office of concealment of income, which has resulted in non-payment of tax, the taxpayer may be arrested after obtaining written approval of the committee. “

The committee shall comprise the finance minister, the Federal Board of Revenue (FBR) chairman and the senior-most member of the board. During a post-budget news conference, Tarin had announced including Special Assistant to PM on Revenue Dr Waqar Masood in the committee. However, he is not part of the body.

In a significant amendment that the NA approved, “persons or classes of persons notified by the board with the approval of the minister in-charge” will be required to file compulsory income tax returns.

Also read: ‘PM stood firm despite IMF pressure’

During discussions, there was a proposal that all 25-year-old people or those who have bachelor degree should file returns to give a boost to the low rate of return with only three million individuals filing.

Now, the FBR will define the group of people who will have to file the income tax returns in all circumstances.

The board may sanction rewards to e-intermediaries for filing of returns by new taxpayers like benefits, rebates, tax credits, allowances or any other incentive in cash or otherwise.

A documentation measure to declare the computerised national identity card number as a common identifying number for sales tax purposes has been withdrawn in the final bill.

The House also approved the amendment to seek income returns and wealth statements about the foreign source of income without any time limit.

The current maximum limit was five years that has been abolished.

It has also been made mandatory that every taxpayer shall declare to the commissioner the bank account utilised by the taxpayer for a business transaction.

The government has again amended the definition of a resident and non-resident person for tax purposes, rectifying a two-year old mistake.

Now only those persons will be treated as resident Pakistani that will stay in Pakistan for 183 days.

The government has withdrawn the budget proposal to charge capital gains tax on sale of business property within four years.

It has also approved 3.5% tax on gain of up to Rs5 million on the sale of property, 7.5% on gain between Rs5 million to Rs10 million, 10% on gain from Rs10 million to Rs15 million and 15% on above Rs15 million gain while striking a compromise with the real estate sector.

The NA did not approve the proposals to tax the income of seafarers and impose a 10% income tax on provident and the pension funds.

The government had proposed to tax these sources of income to generate Rs10 billion.

Similarly, the NA did not approve to tax-free and subsidised food.

The government had proposed withdrawal of income tax exemption on medical expenditures, however, the amended bill has not approved the proposal and the exemption shall be available to salaried individuals.

The House also did not approve to exempt the income of the political parties from tax.

The political parties will remain subjected to file their annual returns. The lower house of parliament approved income tax exemption for Fauji Foundation.

The National Assembly approved reduction of tax on income from contracts.

Currently, the rate of withholding taxes from payments on account of contracts is 7% in case of companies and 7.5% in case of others.

The amended bill has now reduced these rates to 6.5% and 7% in case of companies and others, respectively.

The assembly approved reducing withholding tax rate to 2% from payments on account of Oil Tanker Contractors Services. It also approved 15% income tax rate for persons on profit on debt from investment in federal government debt.

The 15% tax shall be final tax on such profit on debt.

In a major development, the government has revised the income tax rate for the banks.

The assembly approved 5% additional tax, if the bank’s asset-to-deposit ratio (ADR) falls up to 40% on the last day of the tax year. if the ratio exceeds 40%, but does not exceed 50%, the additional tax rate would be 2.5%.

The ADR related taxation has reduced the burden when compared with the existing law.

Under the present law, the total additional income from investment in the government securities is taxable at additional 2.5% rate.

Similarly, relief has also been provided to builders and developers. They were supposed to incorporate profits equal to only 10 time of the taxes paid while excess profits were liable to be taxed at normal tax rates.

However, the amended bill now provides that profits in excess of 10 times of taxes paid shall be taxed at flat rate of 20% and will be allowed to be incorporated in the wealth statements of builders and developers.

The government has reintroduced zero-rating facility for milk and fat-filled milk excluding those sold in retail packing under a brand name. This will allow the milk manufacturers to claim refunds on their inputs. However, it has imposed 17% GST on the import of the milk.

Similarly, the government withdrew the proposal to slap 17% GST on flour and milk at the import stage.

The cereals and products of the milling industry will remain exempted at the import stage.

In a major decision, the National Assembly approved a 16% GST on supplies of foods from tax-exempt areas of erstwhile Fata and Pata to taxable areas.

In the budget, the government had withdrawn the FED imposed on production in tribal areas but it created hue and cry and fear of smuggling of goods from these areas to the settled areas.

Also read: ‘Budget long on promises, short on sustainability’

The government has decided to retain 10% sales tax on plant, machinery, flavoured milk, butter, yogurt, cheese, cream, milk cream, milk, poultry and cattle feed, bio diesel, 5% on harvesters, and reduced sales tax rate on jewellery.

However, rates have been increased on the making of jewellery from 0.5% to 2%.

The National Assembly also gave the nod to reduce GST rate on sales of textile products through integrated POS from 12% to 10%.

The supply, repair and maintenance of any ship are also zero-rated from the next fiscal year.

A major penalty has been introduced for those tier-1 retailers, who do not integrate with the FBR’s system.

In case a tier-1 retailer does not integrate his retail outlet, the adjustable input tax for whole of that tax period shall now be reduced by 60% instead of 15%.

The government has imposed 17% GST on supplies made by manufacturers of marble and granite having annual turnover less than Rs5 million even if their annual utility bill is more than Rs800,000.

The 17% GST has been imposed on supplies of crushed stones.

In the amended bill, the government has imposed 2% sales tax of the gross value of supplies by unregistered persons doing trade through online platforms.

But this amendment will take effect from the date of notification by the FBR.

The government has imposed a 3% custom duty on the import of refrigerant gas.

It has reduced the penalties and punishment for the failure of the importers in fully disclosing the invoices and the packing lists in the containers.

Against the proposal of imposing minimum Rs100,000 penalty on first time violation to Rs1 million on third violation, the government has reduced the fine amount to Rs50,000 to Rs500,000.

It has dropped the proposal to block the importer for one year and confiscate the imported goods on the fourth attempt of concealing documents.

The government has omitted the condition of treating import agent as owner of goods after the importers made hue and cry about misuse of these powers by the taxmen.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ