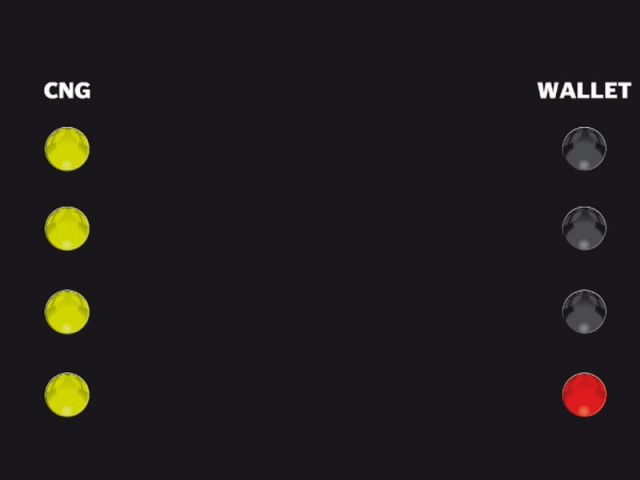

Another hike: Govt considering imposing petroleum levy on CNG

Gas price will not increase as dealer margin will be cut.

The government is mulling over the imposition of Rs5 per kilogramme as petroleum levy on compressed natural gas (CNG) and reducing margins of dealers as it has been found that CNG stations are earning a profit of Rs22 per kg on sales to consumers.

However, the CNG association has rejected the proposal, saying the business has already been hurt by gas outages and imposition of the levy will deal a further blow to the industry.

“The cash-strapped government will generate Rs13 billion per year through the petroleum levy on CNG, but it will do so by cutting the margin of dealers and therefore, it will not cause an increase in CNG prices for consumers,” a source said.

Earlier, the government had planned to impose petroleum levy on liquefied petroleum gas (LPG) equal to the freight charges imposed on the import of LPG.

Petroleum Minister Dr Asim Hussain held a meeting with officials of Oil and Gas Regulatory Authority (Ogra) on Tuesday to work out a mechanism for imposing the petroleum levy on CNG.

Hussain was surprised to know that oil dealers were charging margins of Re1 to Rs1.50 per litre on sale of petroleum products while operating cost was not part of the pricing formula. However, CNG stations were charging Rs13.99 per kg as operating cost on sale of gas. The minister was of the view that no business in the country was enjoying such a high rate of return.

In its defence, the CNG association argues that they have invested their money in setting up filling stations while in case of petrol and diesel outlets the oil marketing companies have invested.

According to a working, CNG stations are making a profit of over Rs22.21 per kg on different counts including 20 per cent return on investment amounting to Rs8.22, compression cost, cost of maintenance (machinery), cost of lubricant, civil works, depreciation (machinery) and cost of labour. It has been noted that these outlets are charging Rs8.09 per kg as compression cost.

Gas distribution and transmission companies are providing gas to CNG outlets at Rs32.89 per kg in Khyber-Pakhtunkhwa, Balochistan and Potohar region (Rawalpindi and Islamabad) and at Rs29.43 per kg in Sindh and Punjab, excluding Potohar region.

However, consumers are getting CNG at Rs66.42 per kg in region-1 and Rs63.11 per kg in region-2 and the price also includes 16 per cent general sales tax amounting to around Rs7 per kg. Consumers are being charged Rs2.92 per kg as rental/OMC margin and Rs1.05 per kg in various fees and taxes.

Published in The Express Tribune, August 10th, 2011.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ