Rupee likely to stay stable, gold may fall

Currency may lose 2-4% over the year; with availability of vaccines gold unlikely to hit new highs

Pakistan’s currency is expected to gradually depreciate in the range of 2-4% to around Rs164-66 to a dollar over the next one year as the gap between demand and supply of foreign currency will remain narrow during the year of economic revival, ie 2021.

The expected receipt of International Monetary Fund (IMF) loan tranches, launch of Eurobond and Sukuk to raise financing in international markets, new financing from other global financial institutions, improvement in workers’ remittances and a nominal deficit in the current account balance altogether will support the rupee to stay firm during 2021.

However, the projected uptick in demand for dollar to pay for increasing imports and repay huge foreign debt may pile pressure on the rupee on and off in the new year.

“The rupee may, at most, depreciate 2-4% to around Rs165-166 to a dollar by December 2021,” Tangent Capital Advisers CEO Muzammil Aslam said while talking to The Express Tribune.

The favourable balance of payments would keep the rupee largely stable. Nominal strengthening of the currency would, however, be seen due to likely “very minor deficit of around 1% of GDP or in the range of $2.5-4 billion in the current account balance (which records major sources of foreign currency inflows and outflows),” he said.

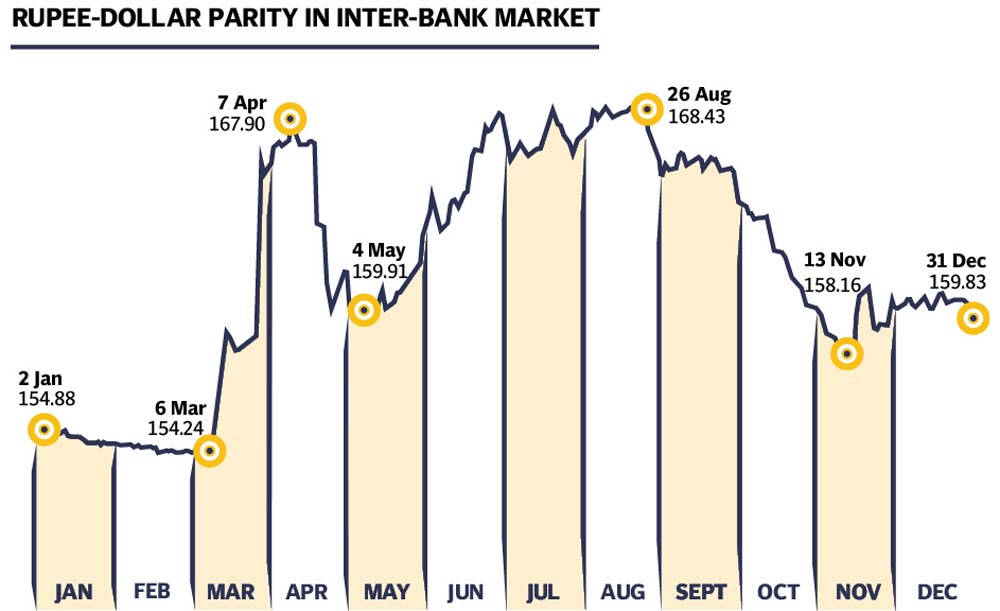

Pak-Kuwait Investment Company Head of Research Samiullah Tariq said, “The rupee may depreciate 3% to around Rs165 to a dollar by December 2021 … to adjust inflation in the national economy.” The rupee depreciated 3.2% or Rs5 during 2020 to Rs159.83 to a dollar on Thursday (December 31) compared to Rs154.84 on December 31, 2019, according to the State Bank of Pakistan (SBP). Aslam said the balance of payments - mainly the current account balance - was the most effective tool to gauge future value of the local currency.

He elaborated that the expectation for the rupee was purely based on economic fundamentals and did not take into account unforeseen shocks like spike in tensions on Pakistan-India border, Islamabad’s diplomatic relations turning unfriendly with other nations including the US and worsening of Covid-19 situation. Foreign countries have rescheduled Pakistan’s debt obligations and Islamabad will resume debt repayments next year. In the first year of repayments, the country will make routine repayments only.

“So, the resumption of foreign debt repayments (in 2022) will not impact the rupee-dollar parity,” he said.

“If the IMF programme is revived (chances for which are high), then other avenues of foreign currency inflows like the launch of Eurobond in international markets will also open up. Pakistan’s economy is expected to be very comfortable on the external front. This will support the rupee to stay stable in 2021,” he said. Tariq added that imports had started rising gradually ahead of a boom in the national economy in current fiscal year 2020-21. “The increase in imports will be offset by improvement in export earnings and inflow of workers’ remittances.”

DESIGN: IBRAHIM YAHYA

Brent crude prices in the international market have recovered to $50 a barrel compared to $40 a couple of months ago. The rupee may depreciate abnormally in case oil spikes to $70. “However, chances for this remain on the lower side,” he said. During 2020, the rupee hit a high of Rs154.24 to the dollar on March 6 with foreign investors investing $3.5 billion in government debt securities like treasury bills and Pakistan Investment Bonds (PIBs) from July 2019 to February 2020.

It hit an all-time low at Rs168.43 on August 26 when foreign investors pulled out $3 billion from T-bills and PIBs to keep cash in hand during the Covid-19 pandemic.

Later, the rupee again recovered to Rs158.16 in mid-November 2020 following receipt of impressive workers’ remittances of over $2 billion a month for the past six consecutive months (Jun-Nov 2020) and a surplus current account balance for the last five consecutive months (Jul-Nov 2020). The rupee also strengthened in the previous year after release of an IMF loan of $1.4 billion to help Pakistan fight the pandemic. Other international financial institutions like the World Bank and Asian Development Bank also extended soft loans during the year.

Gold hits peak

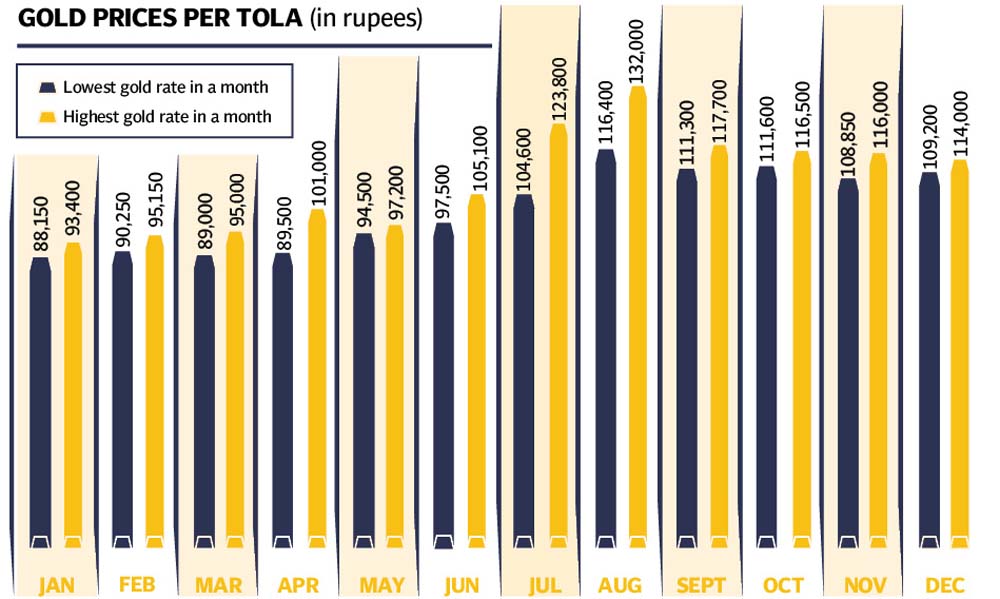

Year 2020 was particularly glamorous for gold as the precious metal hit a record high of Rs132,000 per tola (11.66 grams) in August in line with the uptrend in world market due to the Covid-19 outbreak.

DESIGN: IBRAHIM YAHYA

In the international market, the precious metal hit a new peak of $2,070 per ounce (31.10 grams) on August 6.

“Gold is more likely to lose shine in 2021 following introduction of effective Covid-19 vaccines … rather than hitting new highs in the world market,” said AA Gold Commodities Director Adnan Agar. The introduction of around half a dozen effective vaccines will help global economies to reopen on a big scale from June-July 2021. This will make share prices attractive and encourage investors to relocate their investment from gold to the global stock markets. The precious metal rose a net 29% or Rs25,600 to Rs114,000 per tola at the end of 2020 on Thursday compared to Rs88,400 on December 31, 2019.

Technology-driven revolution like the emergence of online sales and a change in US government following elections would also support fast economic and stock markets’ recovery globally, Agar added.

“Gold may move in a range of $1,600-1,950 per ounce,” he said. “Weakening of the US dollar against other major world currencies like the euro and pound will not let gold slip below $1,600 in 2021.”

All Sindh Saraf Jewellers Association President Haji Haroon Rasheed Chand, however, anticipated an uptrend in gold in 2021. “It will hit new highs in the new year due to ongoing Covid-19 cases.”

Published in The Express Tribune, January 1st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ