The Pakistan stock market bounced back from the bearish spell of the past week as optimism over progress in vaccines rejuvenated investors’ interest. The KSE-100 index soared 620 points or 1.5% in the outgoing week as it powered past the 40,000 levels.

The global equity markets advanced as news of progress made by vaccines, spurred hopes for a faster economic recovery. The development also fuelled a rally in international oil prices, thus prompting a buying spree in index-heavy oil stocks. Additionally, the central bank’s decision to maintain interest rate at 7% for the next two months also boosted investors’ confidence, although status quo was largely anticipated by market participants.

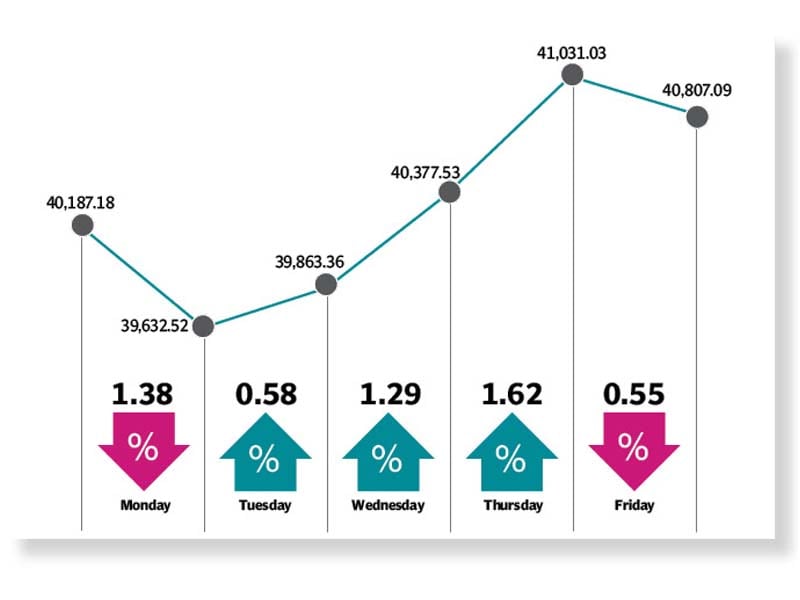

The week kicked-off trading on a negative note as the index witnessed heavy selling due to speculation over the monetary policy announcement, coupled with concern over rising coronavirus cases. Multiple negative triggers including a sell-off in global equity markets, government’s measures to contain the spread of Covid-19 as well as rupee depreciation also sparked hefty selling by investors.

The trend reversed on Tuesday as the index turned bullish following the monetary policy announcement. Additionally, the international oil prices climbed to near pre-Covid levels, which acted as a positive trigger and enticed investors to accumulate oil sector stocks. Consequently, both oil-related sectors at the Pakistan bourse closed the session entirely in the green.

Bulls dominated the bourse for another two sessions as rally in E&P sector and a significant recovery in rupee against the US dollar helped the index finish in green. The oil sector continued to drive the market as bull-run in global markets further encouraged investment in local scrips.

Unfortunately, the momentum could not be sustained and the index succumbed to selling pressure on the last trading day of the week. Market participants were discouraged by the uncertainty in global oil markets as crude prices remained mixed ahead of an OPEC+ meeting early next week.

During the week, the average traded volume in benchmark stood at 172 million shares, while the average value stood at Rs8.32 billion, according to an Aba Ali Habib report.

The heavyweight oil & gas exploration companies was one of the highest gainers this week, closing up 6.9% week-on-week, on account of higher international oil prices and news sources citing recommendations of dividend based formula to be used to clear the outstanding circular debt.

Other sectors that contributed to the rally were technology & communication (+8.0%), vanaspati & allied industries (+7.3%) and automobile parts & accessories (+3.1%).

Among market participants’ foreigners remained net sellers during the week amounting to $9.26 million, primarily contributed by corporates amounting to $9.87 million. On the other hand, local investors remained net buyers amounting to $9.26 million, mainly contributed individuals ($2.61 million), companies ($3.38 million) and insurance ($2.91 million). While the brokers remained net buyers with the amount of $0.65 million.

Other key news during the week were State Bank of Pakistan’s forex reserves increased to $13.4 billion on government official inflows, PM rules out shutdown of factories & businesses and banking sector’s spread jumped 8bps month-on-month in October.

Published in The Express Tribune, November 29th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ