Weekly review: Bulls dominate as PSX shoots past 42,000

Participation picks up as average volumes surge to levels last seen in 2005

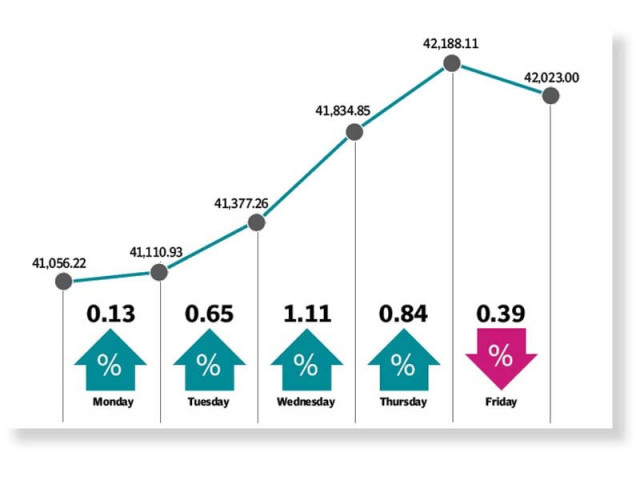

Bulls charged at Asia’s best stock market as the KSE-100 powered past the 42,000 level in the outgoing week to finish with a gain of 967 points or 2.4%.

Interest in cyclical and side board sectors kept the market buoyant as investor participation remained strong. The index maintained a healthy momentum on back of declining yearly and monthly inflation and strengthening rupee against the US dollar. Additionally, sector-specific developments also spurred buying interest in select stocks, which further fuelled the rally. The market finished four out of the five sessions in green to settle at 42,023 points.

Monday witnessed volatile trading as investors awaited inflation data, anticipating further reduction in the policy rate in September if the inflation dipped. Additionally, the upward revision of profit rates on saving schemes also drove sentiments amid some uncertainty.

The bullish rally continued to grip the stock market on Tuesday as the inflation rate eased to 8.2% in August - the lowest in three months - and helped the index surpass the 41,300-mark.

The rally became stronger as the Pakistan Stock Exchange (PSX) once again won the title of being the best Asian stock market and became the fourth best-performing market across the world in 2020.

“Pakistan’s stock market (has become) the best performer in Asia and the fourth best-performing stock market in the world,” marketcurrentswealthnet.com, the New York-based global financial markets research firm had reported on Tuesday.

Investors reacted to the development with euphoria and continued buying activity, helping the index advance for three successive sessions.

Sentiments remained bullish on Thursday that helped the KSE-100 index extend the rally from the previous day to an eight-month high level. Stock market participants made fresh investments on back of news that the PSX had emerged as the best Asian market.

Market players also expected positive developments from Prime Minister Imran Khan’s scheduled visit to Karachi, anticipating announcement of an economic package for the rain-wrecked city.

Unfortunately, the four-day buying spree ended as investors booked profit in line with global market trends. The reversal was attributed to world equity markets as participants continued to fret about the increasingly uncertain economic outlook.

“Average weekly volume skyrocketed to levels last seen in 2005 as liquidity continued flushing into the equity market, making it the best stock market in the world on weekly basis,” according to an AHL Research report.

Average volumes shot up by a massive 70% to settle at 745 million shares, while average value traded jumped 37% to clock-in at $139 million. In terms of sectors, positive contributions came from cement (up 194 points), oil and gas marketing companies (114 points), fertiliser (103 points), chemical (83 points) and textile composite (82 points).

“Sectors such as power (up 3%week-on-week), refinery (8.2%) and chemicals (8.6%) also outperformed the benchmark index,” stated a JS Research report.

On the other hand, negative contributions came from automobile assembler (down 23 points) and power generation & distribution (13 points).

Scrip-wise, positive contributions were led by SYS (65 points), HASCOL (65 points), COLG (55 points), MLCF (53 points) and MARI (53 points).

Foreign selling continued this week clocking-in at $10 million compared to a net sell of $0.8 million last week. Selling was witnessed in commercial banks ($5.2 million) and cement ($2.6 million). On the domestic front, major buying was reported by individuals ($15.4 million) and mutual funds ($8.6 million).

Among major news of the week was; ECC approved hike in K-Electric tariff, prices of petroleum products remained unchanged, finalisation of Pakistan Steel Mill privatisation plan, allowing hiring of financial advisers for Pakistan Petroleum’s divestment and forex reserves held by the central bank stood at $12.7 billion.

Published in The Express Tribune, September 6th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ