PTI’s debt management improves in second year

Early restoration of IMF programme may help Pakistan consolidate gains

ISLAMABAD:After a poor show in its first year in power, the Pakistan Tehreek-e-Insaf (PTI) government has managed to bring some improvement in public debt management in its second year by reducing the cost of borrowing besides slowing the pace of debt accumulation.

Although the public debt skyrocketed to unsustainable levels in the first two years of PTI government, the debt build-up was 50% less in the second year as compared to the first year, according to officials of the Ministry of Finance.

Two key factors for the higher public debt in the first year were addition of Rs3.1 trillion due to a steep currency devaluation and build-up of Rs1.2 trillion cash buffer.

By excluding these two factors, the increase in public debt in the first year was almost equal to that in the second year, according to a government functionary who had remained part of the economic decision-making process in the first year.

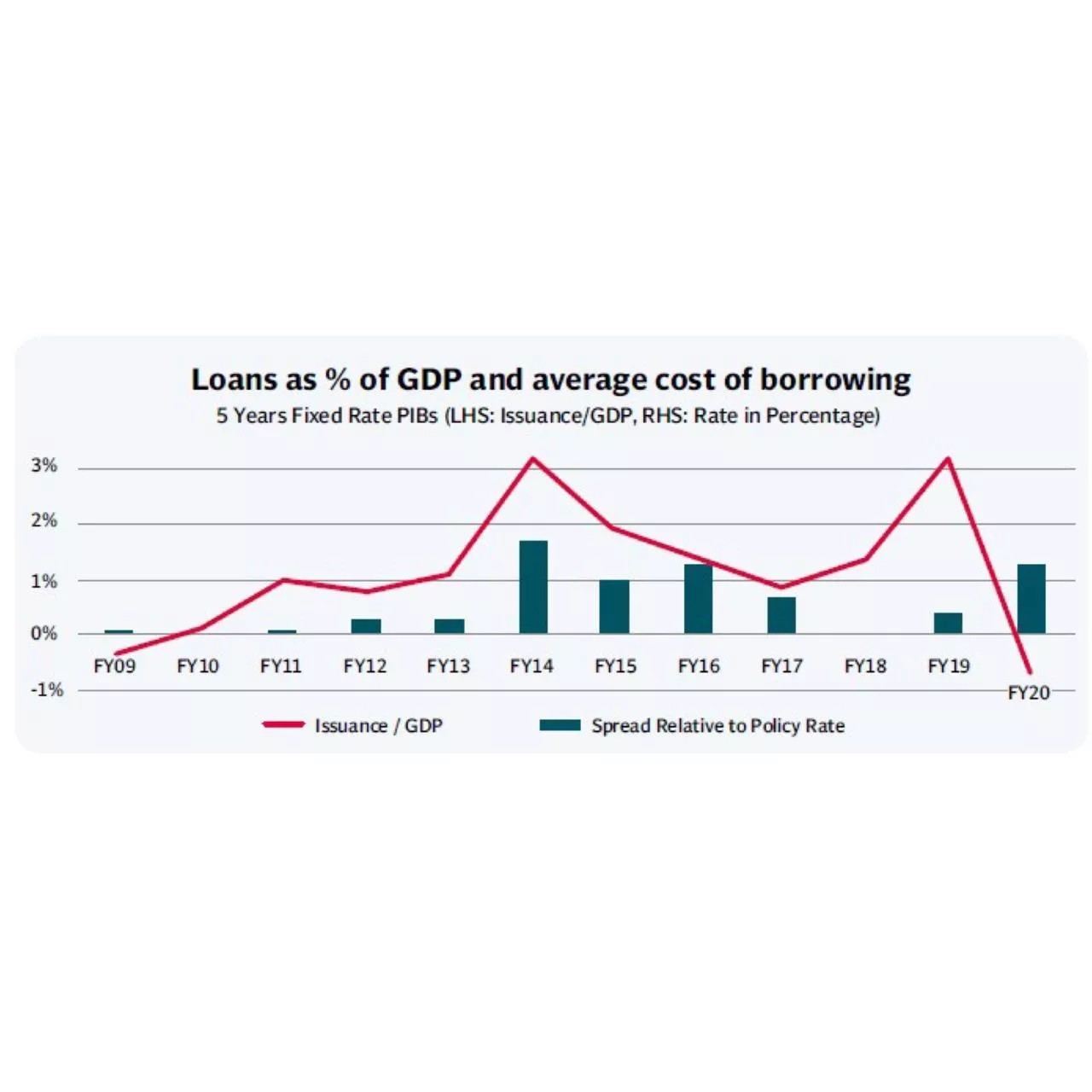

Similarly, the cost of borrowing of three-year, five-year and 10-year Pakistan Investment Bonds (PIBs) was lower compared with the first year but the gains were lost due to the unrealistically high-interest rate of 13.25% set by the central bank.

The cost of borrowing remained above the policy rate due to increasing inflation in the first year. The cost fell in the second year because the inflation rate came down but the State Bank did not cut the policy rate, said the government functionary.

The debt management gains could also be lost if the government did not move swiftly to revive the stalled International Monetary Fund (IMF) loan programme. A well-negotiated IMF programme, which is also based on ground realities, has usually strengthened the hands of the Ministry of Finance in enforcing fiscal discipline.

Technical teams of Pakistan and the IMF are currently reviewing various sectors of the economy and are expected to finish work this month, according to officials. Both sides also discussed Pakistan’s gross financing needs on Tuesday, which was critical to bringing predictability in debt management.

In case the technical teams endorse the government’s roadmap, which is not very visible, an IMF mission could arrive to finalise programme details, said the officials.

During fiscal year 2018-19, which was the first year of the PTI government, the finance ministry contracted long-term debt at fixed rates that were 2.9% to 3.9% above the central bank’s policy rate, according to the finance ministry officials.

But in the fiscal year 2019-20, the cost of long-term debt was either slightly above the policy rate or was lower than the policy rate, according to statistics compiled by the Ministry of Finance.

During the first nine and a half months of the last fiscal year, the SBP kept the interest rate at 13.25%, which not only increased the cost of borrowing for the federal government but also stifled economic growth.

However, banks offered long-term debt to the federal government at rates that were either 0.2% above the policy rate in case of three-year bonds or below the policy rate, according to the statistics.

The SBP’s advice in case of bond auction was also not strictly followed by the Ministry of Finance and the Debt Management Office was given more say in these matters, said the finance ministry officials.

The PTI government came to power in August 2018 and it took about 10 months to finalise a deal with the IMF – a phase of uncertainty that caused damage to the economy.

The power struggle within the ruling party also weakened the then economic team, causing more confusion and uncertainty in economic policymaking.

The PTI government had been shaken in its first year in power, irrespective of whether it was deliberate or because of inexperience, said Dr Ashfaq Hasan Khan, former director general debt of the Ministry of Finance.

In two years, the PTI government added 45% to the debt stock, exposing it to severe criticism. The gross public debt, which was the direct responsibility of the government, stood at Rs36.4 trillion as of the end of June this year.

Finance ministry statistics showed that Rs7.7 trillion was added to the total public debt in the first year and the accumulation in the second year was Rs3.7 trillion. As compared to the first year, the accumulation was lower by 52%.

In terms of size of the economy, the gross public debt shot up to 86.1% of GDP in fiscal year 2018-19, up from 72.1% a year ago. However, in the second year, the ratio deteriorated further but by only 1.1% of GDP to 87.2%, according to the finance ministry officials.

The government’s domestic debt surged to Rs23.2 trillion with the addition of Rs6.8 trillion in the last two fiscal years. Out of this, Rs4.3 trillion was added in the first year and Rs2.6 trillion during the second year.

The PTI’s fiscal performance was also marred by high interest rates and steep currency devaluation of about 39% in two years – the two factors that were not in the control of the federal government. But the devaluation was less in the second year that helped slow the debt build-up.

During the first year, the currency devaluation added Rs3.1 trillion to the public debt – 40% of the total build-up. In the second year, the contribution of currency devaluation was Rs400 billion or 11% of the additional debt.

In the first year, interest expenses stood at Rs2.1 trillion, which contributed 27% to the debt accumulation. In the second year, the interest expenses shot up to Rs2.6 trillion and had a whopping 71% share in the additional debt.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ