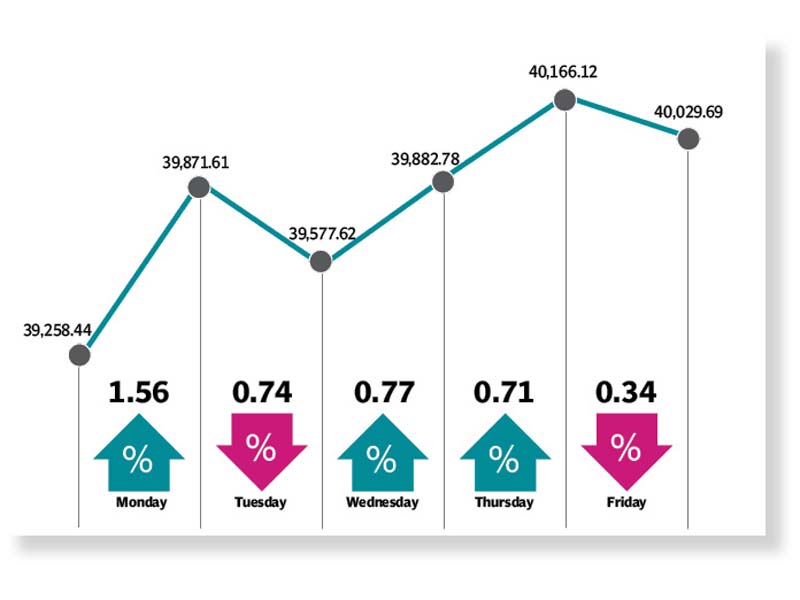

The Pakistan stock market continued to rally as the declining number of coronavirus infections and further easing of restrictions by the government fuelled investor sentiments. Buoyed by the developments of the week, the KSE-100 index jumped 772 points to settle at 40,030 points.

Monday brought good tidings for the market as the index soared over 600 points amid significantly higher trading volumes. Investors cheered the dip in Covid-19 cases in the country, which heralded the end of the lockdown. Additionally, news about projects in the housing sector also spurred the bullish sentiment and invited interest in cement and banking stocks.

Unfortunately, the tide turned in the following session and the six-day winning streak snapped with investors opting to book profits. Encouraging trade data, released by the Ministry of Commerce during the trading session, failed to woo investors to make fresh stock purchases. Market participants resorted to profit-taking and pulled their investments out of index-heavy sectors including automobile, oil, cement and fertiliser, which caused a substantial fall in the index.

The dismal inflation data also kept the temperament subdued and further battered sentiments. The key inflation barometer rose sharply - for the third successive month - to 9.3% in July 2020 over a year ago due to a surge in food and petroleum product prices.

The bearish trend was short-lived as the index bounced back to its winning ways and surged to near 40,000 level. The rebound came on back of activity in cement stocks following positive result of offtake data.

Cement sales soared by a healthy 37.8% to 4.838 million tons in July 2020 from 3.512 million tons in the same month of previous year. Moreover, the exploration and production sector added to the gains on the back of rising international crude oil prices.

The positive momentum continued on Thursday as bullish investor sentiment supported the KSE-100 index in extending the rally from previous session and it powered past 40,000 points. Market anticipation of a hike of Rs5-7 in cement bag prices kept stocks in the cement sector in the limelight, helping them to close with modest gains.

The announcement by the Punjab government of additional exemptions from lockdown coupled with permission to industries and the construction sector to operate round the clock was taken positively by market participants and supported the uptrend. Moreover, approval of key projects (ML-1 Railway by Ecnec along with four projects by CDWP) also kept the momentum strong.

Despite a largely bullish week, the index failed to maintain the momentum and closed the last trading day of the week in red as investors resorted to profit-taking.

Participation picked up significantly as average volumes jumped 64% week-on-week to settle at 638 million shares, while average value traded was up 43% to $145 million.

In terms of sectors, positive contributions came from commercial banks (up 218 points), cement (198 points), insurance (61 points), automobile assembler (59 points), and technology and communication (54 points). On the other hand, negative contributions came from oil and gas exploration companies (35 points) and pharmaceuticals (12 points). Scrip-wise, positive contributions were led by HBL (79 points), TRG (65 points), LUCK (60 points), DAWH (45 points), and PIOC (43 points).

Foreign buying this week clocking-in at $3.7 million compared to a net sell of $9.7 million last week. Buying was witnessed in fertiliser ($2.2 million) and cement ($2 million). On the domestic front, major selling was reported by insurance companies ($29.4 million) and mutual funds ($11.9 million).

Among major highlights of the wee were; foreign exchange reserves held by the central bank increased $567 million to $12.5 billion, Ecnec approved the $6.8-billion worth ML-I project and CDNS raised profit rates on saving certificates.

Published in The Express Tribune, August 9th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ