Pakistan's current account deficit contracts 78%

Deficit hits five-year low at $2.96 billion in previous fiscal year

The current account deficit - difference between the government’s higher foreign expenditure and lower income - narrowed by a massive 78% to $2.96 billion in the previous fiscal year ended June 30.

The current account deficit shrank to 1.1% of gross domestic product (GDP) in FY20 compared to 4.8% ($13.43 billion) in FY19, the State Bank of Pakistan (SBP) reported on Tuesday. The deficit of $2.96 billion is the lowest in five years. The number improved after the government revised upward the previous month’s (May) current account surplus to $344 million compared to the initially reported $13 million.

The much-needed improvement in the current account deficit in FY20, however, was initially achieved by compromising economic growth. Later, the Covid-19 outbreak slowed down the economy further and caused negative growth for the first time in 68 years.

In dollar value, the gross domestic product (GDP) contracted 5.22% to $263.80 billion in FY20 compared to $278.36 billion in FY19, the central bank reported. The value of GDP in terms of dollar, however, does not truly reflect the growth pattern. Pakistan actually measures economic production in rupee terms and converts that into dollar value.

The volatility in the rupee-dollar exchange rate caused a sharp difference between GDP growth in terms of dollar and actual growth in rupee value.

Earlier, the government had provisionally reported an economic contraction of 0.38% for the first time in the past 68 years.

“It (current account deficit) is a good number,” Pakistan Kuwait Investment Company (PKIC) Head of Research and Development Samiullah Tariq said while talking to The Express Tribune.

The number, however, was achieved through curtailing imports rather than increasing exports. “This is worrisome that we have not yet improved exports,” he added.

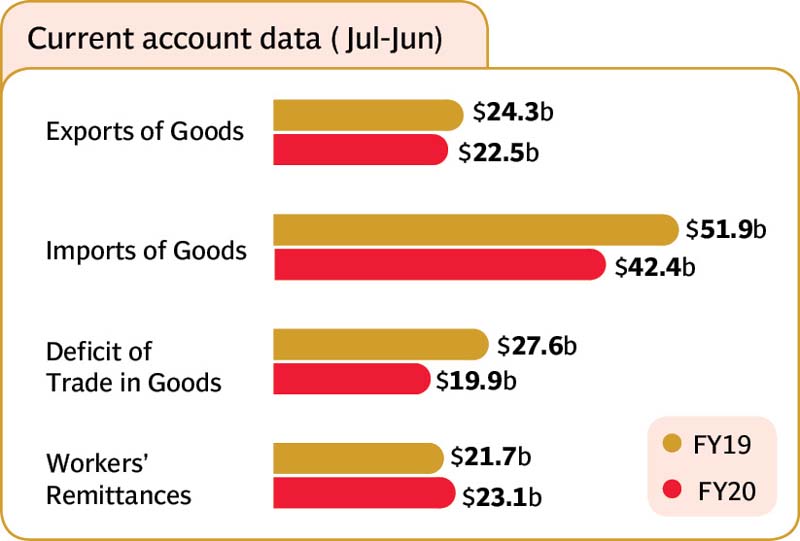

A notable growth in the receipt of workers’ remittances helped a lot in narrowing the current account deficit in FY20. Arif Habib Limited Head of Research Tahir Abbas said “the decline in current account deficit came due to a 30% fall in trade deficit to $22.8 billion in FY20 compared to $32.6 billion in FY19.”

The current account deficit in June stood at $96 million compared with $981 million in the same month of previous year. It was achieved mainly due to a 13% drop in imports and 51% improvement in workers’ remittances. Exports, however, declined 12% in June 2020 compared to June 2019.

“The government is targeting current account deficit of 2.4% of GDP in current fiscal year 2020-21,” Tariq said. “We have to increase exports to improve the balance of payments and reduce the current account deficit to a sustainable level.”

He said economic growth would be better in FY21 than the one recorded in FY20. The International Monetary Fund (IMF) has projected Pakistan’s GDP growth at 1% in FY21.

Imports would continue to increase with reopening of the domestic economy from the lockdown. The workers’ remittances are also anticipated to sustain uptrend during the current year, he said.

He, however, said the government should address issues pending release of the third tranche from the IMF of $450 million under its ongoing loan programme of the total of $6 billion. “The resumption of the IMF programme is a must to streamline the economy and improve confidence of other multilateral and bilateral lenders’ confidence in the domestic economy,” he said.

The resumption of IMF programme is also needed to attract both long-term and short-term foreign investment in the domestic economy. “I am confident the government would address the pending issues to get the IMF programme revived,” he said.

Published in The Express Tribune, July 22nd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ