All-time high: Remittances soar to $23.1b in FY20

Inflows jump 51% to $2.47b in June 2020 from $1.64b in June 2019

Pakistan created history in June 2020 as the receipt of workers’ remittances exceeded expectations by a staggering 51% to a record high of $2.47 billion compared to $1.64 billion in June 2019.

The receipt of much-needed foreign exchange in these testing times when the Covid-19 pandemic had engulfed the entire world pushed total remittances to an all-time high at $23.10 billion in the previous fiscal year ended June 30, the State Bank of Pakistan (SBP) reported on Monday.

“Inflow of workers’ remittances registered an increase of 7.8% in the March-June 2020 pandemic period compared with the corresponding period of 2019,” the central bank said.

Total remittances were even higher than the cumulative export earnings of $21.39 billion in FY20.

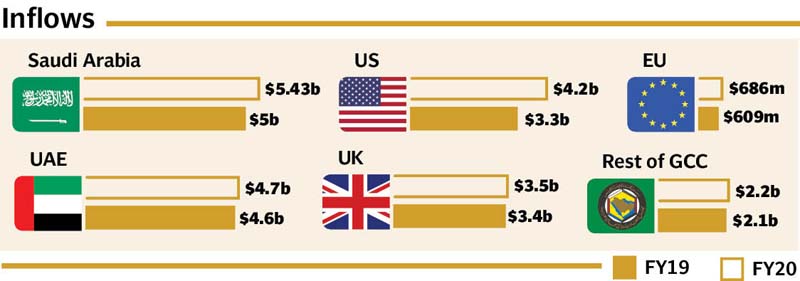

The full-year remittances of $23.10 billion in FY20 were higher by 6.4% compared to $21.74 billion in the prior fiscal year (FY19).

A leading bank’s remittances department head said the inflow of remittances soared as the suspension of international commercial flights due to Covid-19 prompted expatriates to send foreign exchange through proper banking channels instead of the illegal Hawala/Hundi (reference) channels.

“The Hawala/Hundi system ceased to operate as illegal operators failed to settle their accounts in the past three to four months due to restrictions on movement through international travel. Neither currency smugglers arrived in the country nor did they depart since late April when Pakistan suspended international flight operations to contain the coronavirus pandemic,” he added.

“The deadly global health crisis has done what our law enforcement agencies were supposed to do...putting a halt to Hawala/Hundi operations,” he said.

Secondly, the unavailability of flights prevented legal expatriates from visiting their homeland as well. Therefore, they dispatched funds through banking channels which they were supposed to bring in physical form along with them.

“Saudi Arabia, however, allows expatriates to carry 60,000 riyals (around $16,000) while going to Pakistan,” he pointed out. More than half of the total (over 11 million) expatriate Pakistanis are doing jobs in Saudi Arabia.

“The credit for receipt of outstanding workers’ remittances goes to the federal government, the SBP and banks. The government tasked the SBP to act and the central bank strictly directed commercial banks to bring much-needed foreign exchange through legal channels,” he said.

“The deadly virus has killed over a dozen of my colleagues in the journey to bring much-needed remittances to different departments of ... the bank nationwide,” he said. “Bankers also stand as frontline workers like doctors during Covid-19,” he added.

“Remittances are expected to remain high in July as well...ahead of Eidul Azha (falling in the last days of the month),” he said. “Remittances peak ahead of Eidul Fitr and Eidul Azha every year.”

In June 2020, the workers’ remittances from Saudi Arabia increased 42% to $619.4 million compared to the previous month of May 2020. They rose 7.1% to $452 million from the US.

The remittances rose 33.5% to $431.7 million from UAE, while they increased 40.8% to $401 million from UK compared to the previous month of May 2020, SBP said.

The central bank said, “The significant increase in remittances during June 2020 can be attributed to a number of factors. Since many of the countries eased lockdown in June, overseas Pakistanis were able to transfer accumulative funds, which they were unable to send earlier. Further, it is also believed that they sent remittances to support extended families and friends due to Covid-19.”

“Supportive government policies in terms of extension of reimbursement of Telegraphic Transfer charges scheme (free send remittance scheme) to small remitters by reducing threshold from $200 to $100, as well as, broadening the scope of incentive scheme for marketing scheme for financial institutions increased the incentives for sending remittances through regular channels,” it said.

“Further, on-boarding of a large number of technology based money transfer companies by SBP and PRI also helped absorb the shock of lockdowns. Financial institutions were motivated to use effective marketing campaigns with particular focus on digital channels for sending and receiving remittances to promote the use of legal channels,” the central bank said.

Published in The Express Tribune, July 14th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732486769-0/image-(8)1732486769-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ