Sony sees software subscription as future for data-analysing image sensors

Sony has developed what it calls the world’s first image sensor with an integrated AI processor

Sony’s image sensor business aims to replicate PlayStation’s success to address its reliance on a handful of manufacturers in the fickle smartphone market: It plans to sell software by subscription for data-analyzing sensors in situ.

Transforming the light-converting chips into a platform for software essentially akin to the PlayStation Plus video games service amounts to a sea change for the $10 billion business, which built its dominance through hardware breakthroughs.

The effort chimes with Sony’s pursuit of recurring revenue after years of loss in the volatile consumer electronics sector. Success, analysts said, could serve as a rejoinder to activist investor Daniel Loeb’s calls for the business to be spun off.

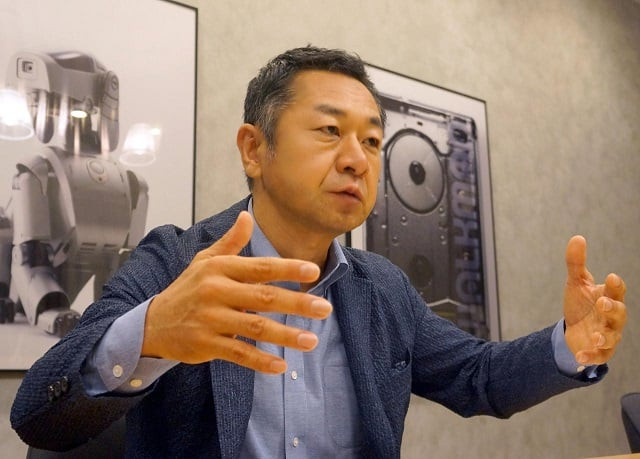

“We have a solid position in the market for image sensors, which serve as a gateway for imaging data,” said Sony’s Hideki Somemiya, who heads a new team developing sensor applications.

Japanese startup creates 'connected' face mask for coronavirus new normal

Analysis of such data with artificial intelligence (AI) “would form a market larger than the growth potential of the sensor market itself in terms of value,” Somemiya said in an interview, pointing to the recurring nature of software-dependent data processing versus a hardware-only business.

Sony has developed what it calls the world’s first image sensor with an integrated AI processor. The sensor can be installed in security cameras where it can single out factory workers not wearing helmets, for instance, or be mounted in vehicles to monitor driver drowsiness. Importantly, the software can be modified or replaced wirelessly without disturbing the camera.

The Japanese conglomerate hopes customers will subscribe to its sensor software service through monthly fees or licensing, much like how gamers buy a PlayStation console and then pay for software or subscribe to online services.

Sony has not disclosed a start date for the service, but at a news conference last month, Somemiya said there was a demand from “retailers, factories - mainly business-to-business”.

MINDSET CHANGE

South Korea’s Samsung and Chinese-owned OmniVision Technologies are also expanding the software capability of image sensors, but analysts said a 52% market share gives Sony a competitive edge in the emerging area.

Still, said Somemiya, a software-centered approach will require a change of mindset at a division accustomed to abiding by specifications of smartphone makers - just five of whom account for the bulk of its revenue.

The new direction comes as US hedge fund Third Point LLC, a minority investor headed by Loeb, continues to push Sony to spin off the image sensor division, saying its value could be higher if it was not masked by the complexity of the company.

Sony Chief Executive Kenichiro Yoshida counters that keeping the division in the house gives it easier access to group resources and has said diversity is the company’s strength.

“CEO Yoshida’s message suggests Sony will focus on profit growth with diversified businesses,” said analyst Junya Ayada at JPMorgan Securities.

Twitter slaps warning on Trump tweet threatening force against protesters

Sony’s portfolio may be growing in complexity, but it still reported two consecutive years of record profit through March 2019, said Ayada.

Having technology with diversified applications can also be advantageous in times of uncertainty, said Atsushi Osanai, professor at Waseda University Business School.

“The next big thing for sensors may be in self-driving technology, but it’s important to explore other applications,” said Osanai.

Still, others said it is hard to factor in the potential of the sensor software subscription service as it could take years for such a business to become a driver of Sony’s overall growth.

“The number of sensors used at factories and retailers will probably be small compared to those for the over one-billion-unit smartphone market,” said analyst Hideki Yasuda at Ace Securities.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ