Govt imposes Rs200b worth of additional taxes

Move aimed at achieving Rs4.96 trillion 'aspirational' target

Representational image. PHOTO: REUTERS

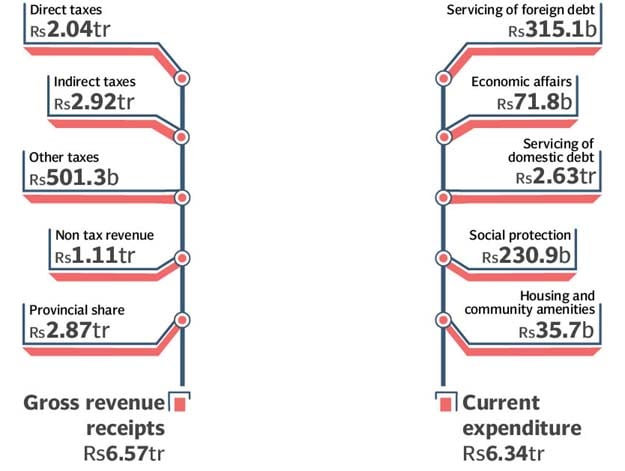

In the midst of recession, the federal government on Friday slapped at least Rs200 billion worth of additional taxes aimed at achieving Rs4.963 trillion 'aspirational' target, which almost everyone believes cannot be achieved.

In the midst of recession, the federal government on Friday slapped at least Rs200 billion worth of additional taxes aimed at achieving Rs4.963 trillion 'aspirational' target, which almost everyone believes cannot be achieved.At least Rs120 billion additional income tax measures have been proposed by the government yet it claims that no tax burden has been put on the people. Similarly, around Rs80 billion sales tax measures have been taken in addition to additional revenues being generated from federal excise duty measures on cigarettes and energy drinks.

Federal Minister for Industries and Production Hammad Azhar claimed in his budget speech that no new tax has been imposed. But according to the Finance Bill 2020, the government has introduced Rs100,000 to Rs200,000 luxury tax on above two Kanal residential homes in Islamabad Capital Territory and also introduced luxury tax on farm houses from Rs25 per square foot to Rs80 per square foot.

But in its technical briefing, the Federal Board of Revenue (FBR) Inland Revenue Policy member said that the government gave net benefit of Rs49.5 billion to the taxpayers. This included Rs24.5 billion negative revenue impact of Inland Revenue measures and Rs25 billion net customs relief, he added.

The government has proposed Rs4.963 trillion tax collection target for the FBR, which is 27% higher than anticipated four-time downward revised collection of Rs3.908 trillion.

The Rs3.9 trillion collections will be equal to 9.4% of GDP while for the next fiscal year the government has set the target at 10.9% of GDP. It has proposed additional revenue measures for achieving this goal. Some punitive measures have been proposed to discourage informal economy and forcing the manufacturers and registered persons to sell their products predominantly to only registered sales tax persons.

The permanent business establishments of foreign companies have been brought under the scope of tax law, which will bring all the Chinese companies in the tax ambit. Both the non-resident and resident companies will be subject to minimum 1.5% income tax, which will directly hit all foreign companies including Chinese.

Three proposed measures against foreign companies having permanent presence in Pakistan will yield additional Rs27.2 billion revenues for the FBR. Besides, foreign companies' expenditures on interest will be treated as their incomes under OECD initiative that will give Rs4 billion additional revenues to the FBR.

The CNIC condition on purchases has been relaxed to Rs100,000. But the government has proposed to amend the 11th schedule to collect 17% GST on supplies to non-registered sales tax persons, which will generate additional tax of Rs35 billion.

It tried to strike a balance between relief and additional measures in a bid to revive the International Monetary Fund (IMF) programme and at the same time provide solace to businesses affected by the novel coronavirus disease.

For expansion of tax base, supplies to non-registered persons has been proposed to limit to encourage them in the tax net. The construction package tax incentives have been extended further that were going to lapse in December. However, it was yet to be seen what will be the reaction of the IMF that had approved time-bound concessions.

The taxation measures have been proposed to revive the stalled IMF programme that has asked Pakistan to achieve Rs4.963 trillion tax collection target in fiscal year 2020-21, lowering its original demand by Rs140 billion due to the impact of the Covid-19 in the first quarter of the next fiscal year.

Furthermore, the government has introduced the non-filer tax regime for the sales tax purposes that are expected to give huge boost to the FBR's revenues due to very low level of registration in Pakistan.

Customs

The government has proposed to exempt additional custom duties on those tariff lines which are now at 0% customs duty in tariff. It has also proposed to reduce customs duty on 40 raw materials of various industries and cut the customs duty on 90 tariff lines from 11% to 3% and 0%.

The lawmakers have reduced regulatory duty from 12.5% and 17.5% to 6% and 11%, respectively on Hot Rolled Coils (HRC) of iron and steel, respectively.

Sales tax

The government has amended eleventh schedule (withholding tax) of the sales tax to charge 17% GST from unregistered person on sales to the government departments. The sales tax on Potassium Chlorate has been increased from Rs70 to Rs80 per kg to discourage illicit manufacturing of match boxes.

It has introduced the concept of active taxpayer in the GST law that will also fetch in billions of rupees worth additional taxes. Similarly, output tax is proposed to be restricted to sales tax on

The scope of section 73 is proposed to be widened to cover all registered persons supplying taxable goods, which may antagonise the business community.

Federal excise duty

The government has increase the rate of FED on cigars, cheroots, and cigarillos and cigarettes from 65% to 100% of retail price and also increased the rate of FED on filter rods from Rs0.75 to Re1 per filter rod; which would significantly enhance its revenue collection.

It has also imposed levy of FED on e-liquids of electric cigarettes at Rs10 per ml. The 25% FED on caffeinated energy drinks has been imposed. Similarly, 7.5% FED at ad valorem has been imposed on locally manufactured double cabin (4x4) pick-up vehicles and at 25% in the case of imported ones. But the government has reduced FED on cement from Rs2 per kg to Rs1.75 per kg.

Income tax

The government has abolished at least nine types of withholding taxes aimed at simplifying the existing withholding regime. These taxes were not generating any significant amount of revenues.

It has abolished advance tax on education related expenses remitted abroad, on steel melters and composite units, withdrawal of balance under pension fund, on local purchase of cooking oil, on functions and gatherings, on cable operators and other electronic media, on dealers, commission agents and arhatis on insurance premium and on tobacco.

It has reduced holding period and tax rates for capital gain on immoveable property that will yield Rs4 billion revenues. Five slabs have been proposed and CGT will be chargeable in case of first four slabs, falling within four years holding period.

It has abolished the bifurcation of plots and constructed property for determining holding period of capital gains. The holding period for taxation of capital gains on disposal of immovable property is being restricted to four years. In addition, rates are also being reduced on capital gains emanating from disposal of immoveable property.

The government has doubled the withholding tax rate on those persons whose children study in expensive schools but are not active taxpayers aimed at generating Rs3.5 billion additional revenue.

In order to provide a level playing field to commercial importers - manufacturers -, it has removed distortions and proposed tax at 1% for capital goods, 2% for raw materials and 5.5% for finished goods irrespective of status of the importer

In one of the biggest budget proposals to raise Rs27 billion revenues, the government has proposed that permanent establishments of non-residents will pay 3% income tax in respect of various services akin to resident taxpayers.

To complement efforts towards broadening of the tax base and documentation of the economy, electricity expense is being allowed as an expense against business income subject to adherence to certain conditions.

The government has aligning withholding tax rates with charging tax rates on dividends to generate additional Rs7 billion revenues.

In another key budget proposal, the government has rationalised depreciation allowances to half year deduction rule that will generate Rs16 billion revenues. It has also rationalised normal depreciation to generate Rs12 billion more taxes.

In an important measure, the government has proposed penalties against power and gas distribution companies for issuing industrial and commercial connections of electricity or natural gas to non-registered taxpayers.

Published in The Express Tribune, June 13th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ