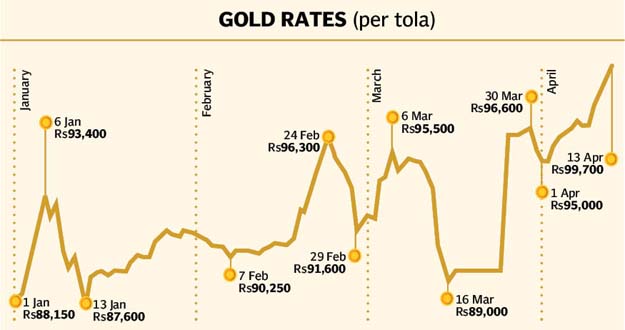

Gold hits historic high at Rs99,700 per tola

Surge led by speculative increase in demand, uptick in prices of imported commodities

KARACHI: Gold price hit an all-time high nearing Rs100,000 per tola (11.66 grams) in Pakistan on Monday mainly due to speculative increase in demand and partly due to uptick in the price of the imported commodity at world markets.The precious yellow metal ballooned Rs1,400 to Rs99,700 per tola in the country. Its price inched up to $3 per ounce (31.10 grams) to over seven-year high at $1,690 at London market just before All Sindh Saraf and Jewellers Association (ASSJA) announced the local price at around 4:30 pm for the next 24 hours.

All the jewellery workshops and outlets are lying closed under the nationwide lockdown these days. However, Pakistan Mercantile Exchange (PMEX) - the commodities futures market in the country that works online - and the Karachi Bullion Exchange - which remains functional through telephonic contacts - continued to operate.

“The latest price for local markets was determined to keep in view the prices at which trades took place among buyers and sellers at the Karachi Bullion Exchange (the major gold market of the country),” Association President Haji Haroon Chand Rasheed told The Express Tribune.

The bullion price is going up worldwide. Besides, the international currency; the US dollar is strengthening globally. And the local currency (versus the US dollar) has continued to depreciate. “The factors took the gold price to a new high at the bullion exchange and local markets,” he said.

Rays Commodities former chief operating officer Adnan Agar said the increase in gold price is mostly based on speculations and seemed unsustainable worldwide.

“The physical demand for gold has dropped next to nil. The growth in gold price is seen on futures contract which is mostly speculative,” he said.

“People prefer to keep cash in hands to cope with the prevailing circumstances amid coronavirus pandemic and lockdowns around the globe. The US dollar has emerged as the most preferred safe haven for investors at these testing times as it remains an acceptable currency at world across…even the Chinese currency (yuan) is largely unacceptable worldwide,” he said.

The US dollar has continued to strengthen against other world major currencies like the British pound, European euro and Chinese yuan. “This trend in currencies has pushed gold prices beyond purchasing power in many countries like Pakistan. The emergence of physical demand for gold is a must for further growth in its prices worldwide,” he said.

“The demand for gold is expected to remain sluggish in response to the prevailing circumstances where the world is fighting a war against the coronavirus pandemic. India and China are the two leading buyers of gold in the world. They, among others, are busy in combating against the COVID-19,” he said.

The recent surge in gold came on the back of a little slowdown in the growth of infection cases in developed countries like Spain and Italy, he said. “The health crisis is yet to be over. If such cases surge again gold would fall,” he said.

The bullion has surged by $225 per ounce since mid of March to around $1,700 at present at world markets. Accordingly, its price soared Rs10,200 per told during a similar period in Pakistan.

Chand stated that the latest price of Rs97,300 is under cost. “The new price is Rs7,000 less than what is its price at Dubai market. If we import gold today it would cost us close to Rs109,000 per tola including taxes on import,” he said.

Meanwhile, Agar said that the gold price may move slightly higher than $1,700 per ounce under the current cycle of an uptrend. “The short-term outlook is negative. It would continue to trade in a band of $1,600-1,750 per ounce in the medium run (one-two months). The long-term outlook depends on developments related to the health crisis whether it worsens or improves,” he said.

“The massive depreciation in rupee (against the dollar) has pushed the gold price to a new record high,” he said.

Published in The Express Tribune, April 14th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ