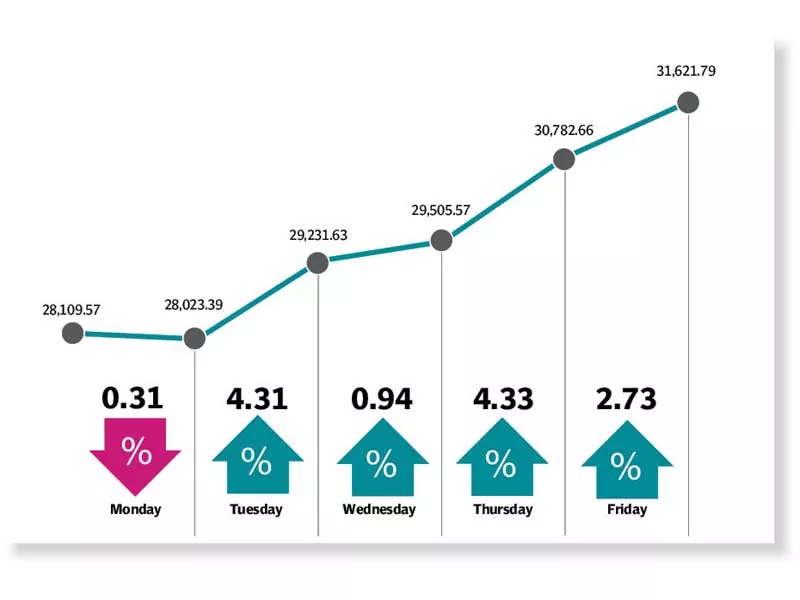

Weekly review: KSE-100 posts highest weekly gain of 12.5%

Investors cheer measures announced by government to mitigate risk to economy from COVID-19

KARACHI: Bulls made an energetic comeback at the Pakistan Stock Exchange (PSX) following three weeks of bearish trade as the KSE-100 index rebounded with a 12.5% jump - the highest weekly return. The KSE-100 index posted gains of 3,512 points to settle at 31,622 points.Investors cheered measures announced by the government to soften the blow to the economy from the coronavirus pandemic, which fuelled a rally at the bourse.

“Till last week, the KSE-100 index had lost 37% of its market capitalisation from its peak (43,219 on January 13, 2020). There was always a chance that, sooner rather than later, some value buying would be witnessed and so it happened,” said a JS Research report.

Although Monday witnessed a marginally bearish session following a rout in global markets as worldwide fatalities from the coronavirus pandemic rose swiftly, turnaround was quick. The Economic Coordination Committee (ECC) approved a Rs1.2-trillion economic relief package to shield the economy from adverse effects of the coronavirus pandemic. Buoyed by the announcement, investors made fresh investment in the PSX as it climbed over 1,000 points.

Meanwhile, recovery in global and regional stock markets, which staged modest rallies to end the quarter on a bullish note also lent support to the domestic market. Further positive measures by the government and a lower inflation reading for March 2020 continued to bolster investor sentiments.

With the few positive developments on the horizon, the stock market staged a handsome rally on Thursday and soared close to 1,300 points as investors cherry-picked stocks that had dropped to attractive valuations following multiple rounds of hammering in the past month owing to the spread of COVID-19 in Pakistan.

Banks and E&P stocks had rallied as valuations had reached dirt cheap levels. Towards the end of the week President Trump’s announcement of a possible agreement between Saudi Arabia and Russia to cut production also sent oil prices soaring (WTI up 18% week-on-week) and thereby E&P stocks. Bulls maintained control on the last trading of the week as index-heavy stocks pushed the benchmark well above 31,000 points.

The rally marked the fourth successive session in the green despite growing COVID-19 cases in the country and overseas.

The euphoria was seen on back of prime minister’s assurance to the construction sector for an economic relief package coupled with Moody’s rating agency’s upbeat statement about measures taken by the State Bank of Pakistan to cut the key policy rate and cushion banks’ asset quality and lending business, which sparked institutional interest. Participation picked up as average volumes jumped 52% week-on-week to 228 million, while average value surged 66% week-on-week to $46 million.

In terms of sectors, contributions came from commercial banks (up 764 points), oil and gas exploration companies (550 points), and cement (537 points). Scrip-wise, positive contribution was led by HUBC (up 290 points), LUCK (227 points), and UBL (186 points).

Foreign selling continued this week clocking-in at $36.1 million compared to a net sell of $13.7 million last week. Selling was witnessed in E&Ps ($13.5 million) and commercial banks ($8 million). On the domestic front, major buying was reported by individuals ($13 million) and funds ($10.3 million).

Other major news of the week; inflation rate dropped to 10.2% in March, Moody’s sees Pakistan growth rates sliding to 2%, demand for electricity, gas, oil drops dramatically, and ECC approved Rs1.2 trillion relief package.

Published in The Express Tribune, April 5th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ