World Bank increases Dasu project financing by $700m

Additional funds will be used to complete first phase of 2,160MW capacity

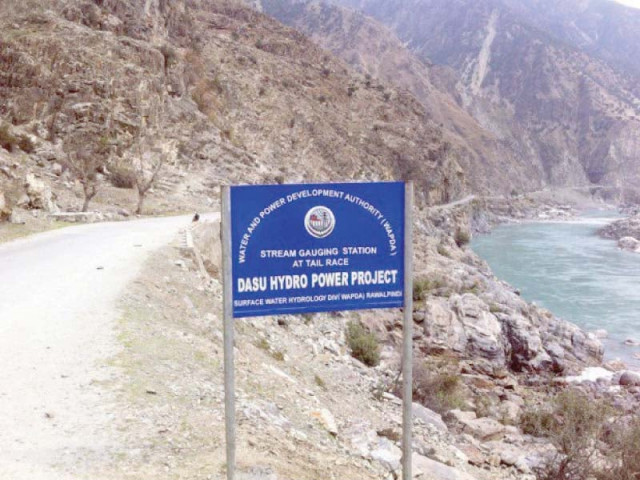

The Dasu project will help lower the overall cost of energy generation, which will benefit millions of energy users by making electricity more affordable. PHOTO: FILE

The World Bank on Wednesday approved $700 million in additional financing for the Dasu project, according to a statement issued by the lender’s local office.

The additional financing will be used to complete the first phase of 2,160MW production capacity and cover the cost of construction of a 255-kilometre-long power transmission line from the project site to Islamabad.

The total project cost is $4.1 billion and the World Bank had earlier given $588.4 million for its construction, which has now been increased to $1.3 billion.

The World Bank has also extended guarantees for acquiring another loan of $460 million from commercial banks, which has increased its direct and indirect exposure to the project to $1.75 billion.

The project, launched in 2014, has faced significant delay due to a dispute over land-acquisition cost and is falling behind its completion deadline.

The land acquisition deadlock was resolved as late as November 2019. It will still take one and half year to take possession of land and make payments, suggesting how badly megaprojects are handled.

“Pakistan’s energy sector is aiming to move away from the high-cost and inefficient fossil fuels towards low-cost, renewable energy to power the national grid,” said Illango Patchamuthu, World Bank Country Director for Pakistan.

He said along with reforms in the tariff structure, the Dasu hydropower project would result in fewer imports of fossil fuels and alleviating the stress on the country’s current account balance.

The project will help lower the overall cost of energy generation in the country, which will benefit millions of energy users by making electricity more affordable for households, as well as the manufacturing and agriculture sectors.

The power plant will provide electricity, particularly in summer, to reduce blackouts when the demand is higher. The Dasu plant will produce electricity at $0.03 per kilowatt-hour (kWh) compared to Pakistan’s current cost of electricity generation of $0.08 per kWh.

In a report the lender prepared for its executive board to pave the way for approval of the $700-million new loan, the World Bank underlined that although Pakistan had increased its installed capacity to 35,870MW for the national grid system, in June 2019, the firm generation capability was only estimated at 26,877MW.

The lender has referred to a report of the National Electric Power Regulatory Authority (Nepra) to substantiate its claim.

The World Bank stated that “peak generation demand in July 2019 was 28,800MW, considering losses in transmission and distribution, showing that the supply-demand gap remains”.

The previous Pakistan Muslim League-Nawaz (PML-N) government had added 11,000MW of electricity to the national grid under the China-Pakistan Economic Corridor and because of some hydroelectric power projects.

The World Bank said demand projections were suppressed and at 500 kWh per capita Pakistan’s electricity consumption was about one-fourth of that of the middle-income and one-seventh of the upper middle-income countries.

If Pakistan is to reach the middle-income country status, its electricity supply not only needs to be increased by about 10%, it also needs to be reliable and cost-effective, it added.

The government plans to add about 18,000MW by 2028. However, it needs about twice as much to meet the 10% growth in demand while in parallel retiring the high-cost old and inefficient thermal plants.

The bank has also raised questions about growing reliance on imported fuels to generate power.

Pakistan’s estimated cost of generation in the current fiscal year is over $8.5 cents per kWh and 21% from imported liquefied natural gas (LNG)-based plants at 13 cents per kWh and 22% from imported coal plants at 11 cents per kWh.

Annually, the power sector incurs substantial losses due to heavy reliance on costly imported fossil fuels, unbudgeted subsidies, lack of timely determination and implementation of tariffs and the poor performance of electricity distribution companies, it added.

Pakistan’s electricity mix has become more reliant on imported fossil fuels, thus rendering the sector more vulnerable to price volatility and foreign exchange risks.

More than 70% of the additional capacity added in recent years is based on imported fuels, mainly coal and LNG, while use of cost-effective indigenous renewable energy sources like hydroelectric power, wind and solar remains limited.

In FY19, 40% of the electricity power generated was through imported fuel, requiring $4 billion in foreign currency in fuel payments for power generation.

Published in The Express Tribune, April 2nd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ