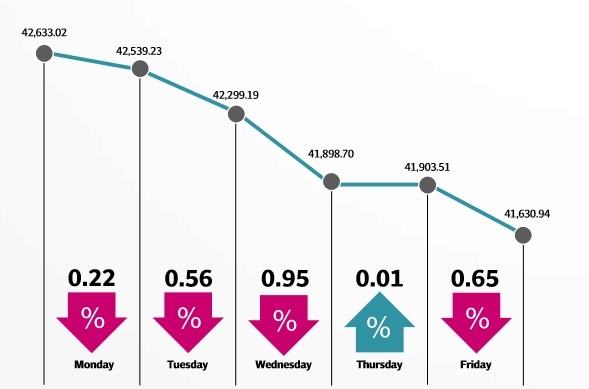

KSE-100 plummets 1,002 points amid global sell-of

Global crude prices, inflation concerns keep stock market under pressure

Apart from fears of the contagion wreaking further havoc, concerns regarding deteriorating macroeconomic indicators also dented investor sentiments. Decline in global crude prices during the week also adversely impacted oil stocks. Though oil prices rose on Friday they were still set for a fourth consecutive weekly loss, as markets attempted to assess the economic damage of the virus that has spread from China to around 20 countries, killing more than 200 people.

The week kicked off on a bearish note as trading remained

lacklustre due to weak interest and an absence of positive triggers. Additionally, investors also awaited the central bank’s decision regarding the monetary policy announcement and adopted a wait-and-see approach.

The index continued to post losses in the following session as the stock market came under pressure amid uncertainty over the monetary policy announcement, due later in the day. The State Bank of Pakistan (SBP) left the benchmark interest rate unchanged at 13.25% for the next two months, which meant bank financing would remain expen sive for the businesses.

On the political front, the situation appeared to be in limbo as friction within members of the ruling Pakistan Tehreek-e-Insaf (PTI) piled on pressure from the opposition and provincial governments.

With no respite in sight, the KSE-100 recorded its third successive session in red on Wednesday as weak investor sentiment, in the wake of pessimism over the status quo in the monetary policy, triggered select cement and steel (leveraged) scrips to tumble.

Moreover, concerns over increasing inflationary readings and political pressure also kept the index dull. The downward trend reversed on Thursday and the index changed gears led by buying activity in banking and cement stock. The recovery was seen as investors weighed strong financial results and reports of Pakistan’s likely exclusion from the Financial Action Task Force’s (FATF) grey list to be reviewed in Paris next month. Additionally, the government’s decision to delay proposed gas tariffs also helped improve investors’ sentiments.

Despite a near flat finish in the positive on Thursday, the market reverted to its losing ways on the last trading day of the week and fell back in red amid decline in global markets. Major stock markets around the world tumbled after the World Health Organisation (WHO) called coronavirus outbreak a global emergency.

Participation remained dull as volumes were down 1% weekon-week to 188 million, while average value traded dipped 7%, clocking-in at $46 million.

In terms of sectors, negative contributions came from commercial banks (down 431 points), oil and gas exploration companies (303 points), power generation and distribution (113 points), cement (66 points), and fertiliser (41 points). Scrip-wise, negative contributions were led by MCB (down 126 points), PLL (108 points), UBL (97 points), HBL (96 points) and HUBC (95 points).

Foreign selling this week clocked-in at $8 million compared to a net buy of $4.8 million last week. Selling was witnessed in cement ($4.2 million) and textile composite ($1.3 million). On the domestic front, major buying was reported by individuals ($9.8 million) and broker proprietary trading ($2 million).

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ