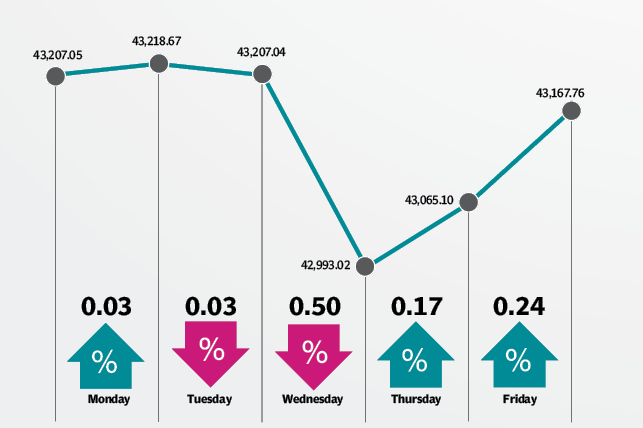

Weekly review: Lacklustre week ends with meagre gain of 39 points

Absence of positive triggers, political uncertainty keeps investors cautious

Absence of positive triggers, political uncertainty keeps investors cautious. PHOTO: AFP

Despite a number of developments, the news flow slowed down, which was evident from the lower volumes, and kept the market lacklustre.

The week kicked off on a positive note although the index remained range-bound. Investors took to offload stocks and book profits as concerns over the surging fiscal deficit, subdued economic growth and high inflation mounted.

Later, an announcement by Fitch Ratings, which maintained Pakistan's rating at 'B-' with a stable outlook, helped the index recover. However, despite this the profit-taking trend continued and the index retreated to the red zone on Tuesday. The dismal auto data released this week also dented sentiments as auto stocks bore the brunt.

By mid-week, bears had control of the KSE-100 and the upheaval on the political front further aggravated matters. Disagreements between the Pakistan Tehreek-e-Insaf (PTI) government and allies were taken as a sign of a brewing political crisis.

"PTI allies are one by one showing disapproval of government policies, which is hinting at a crisis in the making that forced investors to be safe rather than sorry," according to a brokerage house report.

Although, the index made a comeback to the green territory on Thursday, political uncertainty marred the overall trading environment and kept investors' sentiment subdued. The signing of a phase one trade deal between the US and China to ease the ongoing trade war also failed to spark any enthusiasm at the bourse.

This muted sentiment continued till the last trading day of the week that finished around 100 points.

Even though foreign direct investment soared 68% in Jul-Dec FY20, the development failed to provide the impetus to continue momentum from previous weeks.

On the economic front, foreign investment in T-bills recorded the largest single day inflow of $536.1 million taking total net foreign investment in T-bills and PIBs to $2.26 billion in YTD FY20, which bodes well in terms of foreign exchange reserves. This also helped cushion the dip.

With the investors remaining on the sidelines, average volumes dropped 19% week-on-week 246 million, while average value traded declined 38% to $49 million.

In terms of sectors, positive contributions came from commercial banks (109 points), automobile parts and accessories (29 points), automobile assembler (20 points), refinery (20 points), and textile weaving (12 points).

On the other hand, oil and gas exploration companies (96 points) and power generation and distribution (55 points) dragged the index lower.

Scrip-wise, positive contributions were led by MEBL (31 points), HBL (28 points), THALL (25 points), BYCO (21 points) and HMB (18 points).

Foreign buying continued this week clocking-in at $2.8 million compared to a net buy of $7 million last week. Buying was witnessed in E&Ps ($1.4 million) and fertiliser ($1.3 million). On the domestic front, major selling was reported by insurance companies ($2.8 million) and individuals ($2.2 million).

Among other major news were; Hyundai-Nishat began truck production, government approved 121 gas schemes, international tender floated for auction for 18 new blocks, car sales plunged by 43.2% during first half of 2019-20, and foreign reserves with the SBP increased by $82.3 million to $11.58 billion.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ