Overseas Pakistanis: Remittances soar 9.35% to $1.8b in November

Inflows will help improve country’s capacity to make import, debt payments

PHOTO: AFP/FILE

The remittances stood at $1.66 billion in the same month of the previous year, the State Bank of Pakistan (SBP) reported.

“This ($1.81 billion) is an encouraging number,” Arif Habib Limited Head of Research Samiullah Tariq said while talking to The Express Tribune.

He pointed out that the data of the past four to five years indicated that the number never came above $1.7 billion for November.

Remittances slow down to $7.48b

Improved inflows in the month enhanced the overall remittances received in the first five months (Jul-Nov) of the current fiscal year to $9.29 billion, which was slightly better compared to $9.28 billion in the same period of the previous year.

“Remittances were comparatively low in the first few months of the ongoing fiscal year. However, November has covered the gap for the first five months,” Tariq said.

Overseas Pakistani workers remitted $9,298.57 million in the first five months of FY20, compared with $9,281.94 million in the same period of the preceding year.

Remittances for the full fiscal year may end up with 3-4% growth to over $22 billion, he anticipated. This would, however, be lower than the target of 10-11% growth to over $23 billion for the year.

He pointed out that the current account balance had turned into a surplus in October after a gap of four years and a similar trend was expected in November. “Therefore, the dramatic shift to surplus from the deficit seen in previous months suggests the country will not be in difficulty if the remittances remain slightly lower than the target for FY20,” he said.

The International Monetary Fund’s (IMF) projection suggests Pakistan will record a current account deficit of $6.5 billion in FY20.

“If the current account balance comes to zero or goes into surplus in November, the deficit for the first five months will be around $1.1-1.2 billion,” he said. “This trend suggests the deficit for the full fiscal year should be lower than $5 billion against the target of $6.5 billion.”

The expected drop in the current account deficit would make up for any slowdown in the remittances, he said.

Remittances from Saudi Arabia, which remains the largest source of remittances for Pakistan, were comparatively better but may have remained under pressure. “Challenges to the Saudi Arabian economy due to low crude oil prices may impact the flow of remittances to Pakistan,” said Tariq.

However, remittances from the UAE, which was also an important source, were much better as its economy did not entirely depend on oil exports, which was diversified, he said.

Remittances from the US and UK also improved notably. The increase suggests people are fast adopting legal channels, mostly banks, for sending their remittances as Pakistan has launched a crackdown on the illegal Hundi/Hawala system.

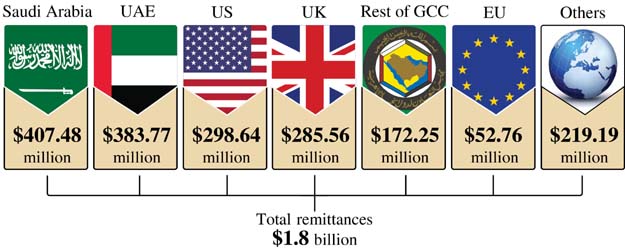

Country-wise inflows

Country-wise details for November 2019 showed that inflows from Saudi Arabia amounted to $407.48 million compared with $395.12 million in November 2018, according to the central bank.

Overseas Pakistani workers sent $383.77 million from the UAE in the month compared to $350.35 million in the same month of last year. Expatriate Pakistanis in the US sent $298.64 million compared to $268.32 million.

Remittances hit six-month high in April, amount to $1.78b

They sent $285.56 million from the UK compared to $246.78 million last year. Remittances from Gulf Cooperation Council (GCC) countries - including Bahrain, Kuwait, Qatar and Oman - came in at $172.25 million compared to $153.51 million in the previous year. People from European Union member countries sent home $52.76 million compared to $42.22 million remitted a year ago.

Remittances received from Malaysia, Norway, Switzerland, Australia, Canada, Japan and other countries in November 2019 amounted to $219.19 million against $207.74 million in November 2018.

Published in The Express Tribune, December 11th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ