Weekly review: Investors remain sidelined amid violence in Karachi

The fertiliser sector takes centre stage after Engro increases prices.

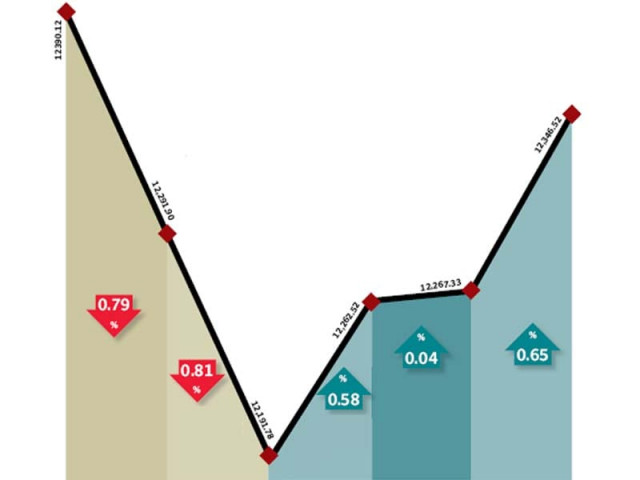

The law and order situation in Karachi failed to improve and kept investors on the sidelines as the benchmark KSE-100 index shed 0.4% (44 points) to close at 12,346 points during the week ended July 15.

Volumes dropped 41.5% and stood at a low level of 34.2 million shares traded per day as investors remained apathetic towards the market following a spate of negative news, which was topped off by the violence witnessed in Karachi on Thursday.

The week began on a negative note, after the United States announced that it would cut $800 million in aid to Pakistan as a result of the recent strain in ties between the two countries. This news dented investor confidence and the KSE-100 index shed 1.6% in the first two trading sessions of the week.

The index managed to recover its losses as the week progressed but volumes stayed thin throughout, hitting a low point on Thursday after the comments made by a senior provincial minister on Wednesday night.

The comments sparked outrage from workers of the Muttahida Qaumi Movement (MQM) which also led to protests throughout Sindh on Wednesday night and brought Karachi to a standstill on Thursday. With almost all markets closed, the bourse recorded volumes of only 25.3 million shares on that day.

The index’s recovery in the latter part of the week was helped by two developments. The first came from the meeting between KSE members and the Securities and Exchange Commission of Pakistan, the regulatory body of stock exchanges of the country.

The meeting focused on improving the recently re-introduced Margin Trading System (MTS), by lowering margin levels and considered increasing MTS eligible securities. The system has so far failed to achieve its target of reigniting activity at the bourses.

The second news came from the fertiliser sector, after Engro Corporation announced a hike of Rs125 per bag in the price of urea. Fauji Fertiliser Company (FFC) and Fauji Fertiliser Bin Qasim (FFBL) followed suit and raised their prices as well, which brought the fertiliser sector to the centre stage during the week.

FFC is the only urea manufacturer which is supplied gas from the Mari gas network, while all others are supplied from the Sui network. Supply outages from the Sui network stand at around 20%, while the outages at Mari amount to only 7%. Hence, FFC was the biggest beneficiary of the news, since it was not really subject to sever gas shortfall, but raised prices nevertheless. The share price rose 6.4% to Rs164 by the end of the week. Similarly, FFBL also rose 7.1% to Rs47. Engro, however, lost out on the news of complete gas outage at its new Enven plant and dropped 5.6% to Rs153.

With volumes dropping 41%, the average traded value also fell by 36% and stood at Rs1.65 billion per day. The index’s market capitalisation declined 0.4% and stood at Rs3.25 trillion by the end of the week.

What to expect?

The developments in the law and order and political situation in Karachi will continue to play a role in the coming weeks. However, a little breather can be expected after the events on Thursday. With the results season right around the corner, a return to higher activity cannot be ruled out in the coming week.

Furthermore, the chief of the country’s intelligence agency also visited the United States during the week, which could result in a resumption of the blocked $800 million in aid, which could provide boost to the market in the coming week.

Monday, July 11

The downward trend continued at the stock market on the back of unrest in the city. Local political developments and news of US withholding $800 million military assistance to Pakistan forced participants to take a cautious stance as future course remains unclear.

Tuesday, July 12

The stock market continued its downward trend to close at a three-week low amid dismal volumes. Fall in regional markets and city’s law and order situation kept sentiment depressed.

Wednesday, July 13

The stock market’s four-day downward trend ended on the back of activity in the fertiliser sector and Nestle. Nestle contributed 37 points in the total index gain with turnover of only 191 shares.

Thursday, July 14

The stock market closed range-bound in thin trade owing to the poor law and order situation in the city. Equities remained gripped with uncertainty after a late night speech by senior PPP minister Zulfiqar Mirza against the Muttahida Qaumi Movement which increased violence in the city.

Friday, July 15

The stock market gained on the last trading session of the week with the fertiliser sector leading the way. Fauji Fertiliser Company jumped 3.9% as analysts expect a Rs2 per share positive impact following the price hikes in 2011.

Published in The Express Tribune, July 17th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ