Dr Abdul Hafeez Sheikh’s budget speech was different. He talked about global giants being wiped out, he elaborated on the global recession, explaining that unemployment in the US was at a high of about 10.5 per cent. He reminded everyone about Greece being bailed out by the International Monetary Fund (IMF) and the European Union.

This time’s budget was realistic in nature, not an expansionary one. The budget was increased by 12.5 per cent to Rs3.259 trillion ($38.34 billion) as compared to last year’s Rs2.897 trillion

Sheikh explained the context of the current environment and how the government had come up with its budget it light of the situation. He explained how the budget had to be made keeping in mind an international framework which requires the government to honour sovereign commitments and protect national credibility, the challenges of the war on terror, energy shortages and Pakistan’s inflation being at an historic high.

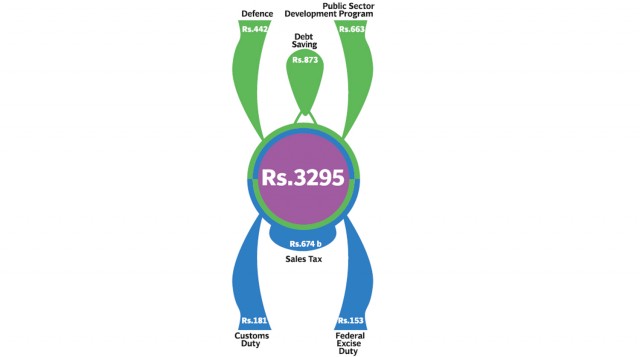

The budget forecast a fiscal deficit of Rs685 billion, 4 per cent of the gross domestic product (GDP). This deficit will be dealt with using external financing worth Rs186 billion, non-bank borrowing of Rs332.6 billion and bank borrowing of Rs166.5 billion.

Another important aspect of the budget is the substantially increased amount of funds disbursed to the provinces by the Federal Government. The provinces will get Rs 1.03 trillion this time, a 57.7 per cent increase from last time’s Rs655 billion.

It was interesting to hear someone say: “however much money Islamabad does not get is the amount of money that will have been saved from being wasted!” (“jitna Islamabad kay paas paisa kam hoga utna zaaya honay say bachay ga!”) This was probably the reason that the government ensured that the National Finance Commission Award was sorted out properly.

Revenue

Realistically, it is unfortunate that the taxes to be collected are heavily skewed towards the indirect modes of taxation. Indirect taxes will be 60.6 per cent of the total collection. Direct taxes collection is targeted at Rs657.7 billion and indirect tax collection is targeted at Rs1.121 trillion.

The government also deferred the Value Added Tax (VAT) till October 1, 2010. This will allow the businesses and the Federal Board of Revenue (FBR) to prepare for the move from the General Sales Tax (GST) to VAT regime and reduce chances of an unnecessary commotion made by people opposed to such a move.

A difficult phase

Pakistan unlike economically mismanaged states in Western Europe, like Greece, is not going to be bailed out by other nations and institutions. The country’s total annual budget is just 3.9 per cent of the stimulus package announced by the European Union to bail out Greece.

What would it be like if Pakistan were given an additional $38 billion in the form of development package managed by the developed economies, they could come in to Pakistan, invest their money and technologies trying to capture a market worth $175 million.

How many dams would $38 billion buy? How many more irrigation canals could be made. Pakistan could fix its energy shortage problems. This is Pakistan’s side of the story, the country’s viewpoint of Greece getting that much bailout money, while it gets nothing.

The world has to realize the difficulty Pakistan is facing and the people of Pakistan have to present these hard facts to the world.

Published in the Express Tribune, June 14th, 2010.

1732274008-0/Ariana-Grande-and-Kristin-Chenoweth-(1)1732274008-0-165x106.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ