CNG price hike to generate Rs7.3b annually

Hike probably not enough to cover raise in wellhead prices.

The proposed 13% increase in compressed natural gas (CNG) prices is likely to generate Rs7.3 billion additional revenues for the government annually, however, this might not be enough to cover the upcoming expenses of wellhead gas prices.

Wellhead gas prices are expected to increase 15%, which will increase the government’s expense by Rs52 billion. In order to maintain fiscal discipline, a price hike in the industrial, commercial and domestic sectors seems inevitable along with a reduction in subsidy for the fertiliser sector during the current financial year, according to a BMA Capital research note.

Recent reports suggest that the petroleum ministry has convinced All Pakistan CNG Association to jack up prices by 13%.

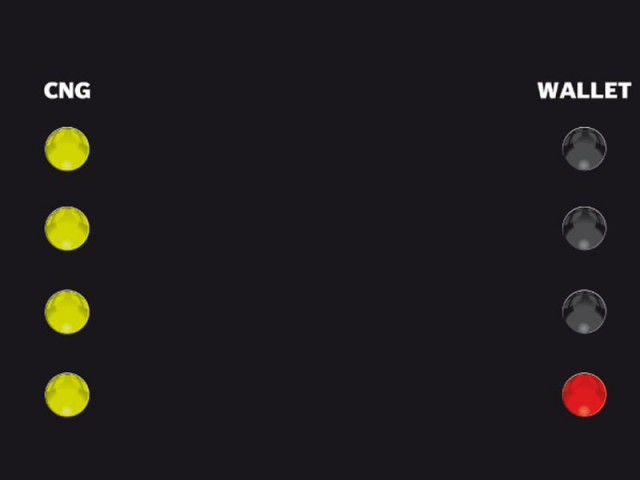

Currently the price of CNG stands at Rs56.8/kg, and a proposed Rs7 to Rs8 per kg hike will take CNG price to 55 per cent of petrol prices.

The domestic transport sector consumes 7.7 per cent of natural gas produced in the country while CNG consumption has grown at a phenomenal annual growth of 32% in the last six financial years.

Price of natural gas in case of CNG is already higher than that charged to the industrial, commercial and domestic sector, says the note. Currently Rs533 per Million British Thermal Unit (mmbtu) is the price being charged to CNG consumers against Rs380 per mmbtu charged to the industrial and commercial sector

OMCs to benefit from narrowing differential

Narrowing differential between CNG and petrol coupled with rising inconvenience due to frequent gas outages and long queues at CNG stations will likely encourage transport sector to revert its reliance on petrol, says the note. Despite substantial price discount in CNG, any further price hikes will enhance demand for petrol and benefit the oil marketing companies (OMCs).

In addition, margin revision for oil marketing companies remains a likelihood which will provide further upside to their profitability, adds the note.

Moreover, high speed diesel and asphalt sales are expected to rebound in fiscal 2012 on the back of increased infrastructure rebuilding activity following last year floods, says the note. Attock Petroleum Limited’s sales and gross profit are highly correlated with both of these products, which will benefit the company significantly during fiscal 2012.

Published in The Express Tribune, July 16th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ