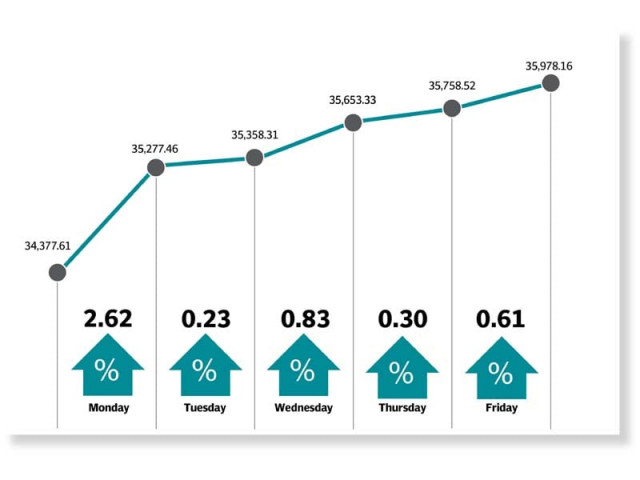

KSE-100 advances 4.7% amid 11-week high returns

Benchmark index rises 1,601 points to close at 35,978

KSE-100 advances 4.7% amid 11-week high returns

The MSCI review also lent support as it did not downgrade the Pakistan Stock Exchange and kept it in the Emerging Market Index.

On the other hand, the political noise, emerging from the Azadi march and sit-in by the opposition parties, eased during the week and many investors heaved a sigh of relief. The benchmark KSE 100-share Index gained 1,601 points or 4.7% to close at 35,978 points in the week ended on November 8, 2019.

“Resurgence of activity continued at the bourse with Friday’s session capping a seven-day positive run,” stated Topline Securities in its report.

At the beginning of the week, trading kicked off on a positive note as the KSE-100 index soared 900 points on Monday, taking cue from positive economic indicators including a stable rupee-dollar parity and market expectations of a positive review by the IMF mission.

The IMF delegation was on a visit to Pakistan to review the country’s quarterly performance under the $6-billion loan programme. The bourse managed to extend gains in the next two sessions amid a decline in profit rates on National Savings Schemes, which bolstered investor confidence.

The Central Directorate of National Savings revised downwards the profit rates on various savings schemes and certificates by up to 2.33%. The development sparked speculation of interest rate cut in the monetary policy announcement later this month, which strengthened investor sentiment.

In the last two sessions, the index moved closer to the 36,000-point mark and a higher-than-expected inflation reading failed to undermine the positive momentum. The Consumer Price Index (CPI) stood at 11% for October, which was above market expectations. October marked the third consecutive month when inflation remained in double digits. On the other hand, the investors cheered the positive MSCI review of Pakistan. The MSCI released its November semi-annual review in which Pakistan kept its place in the Emerging Market Index and averted a downgrade to the Frontier Market.

By Friday, clarity also emerged over the IMF quarterly assessment, helping the bourse end the week in the green zone.

Investor participation improved significantly in the stock market as average daily traded volumes jumped 55% week-on-week to 258 million shares while average daily traded value rose 52% to $54 million.

In terms of sectors, positive contribution was led by the fertiliser sector (up 374 points), commercial banks (357 points), exploration and production companies (211 points), oil and gas marketing companies (115 points) and automobile assemblers (91 points). Negative contribution was led by the textile weaving sector (down five points).

Among individual stocks, major gainers were MCB Bank (up 160 points), Engro (153 points), HBL (125 points), Dawood Hercules (79 points) and Engro Fertilisers (73 points).

Foreign investors turned net buyers of $4.5 million worth of shares during the week under review compared to net selling of $3.1 million last week. Buying was witnessed in fertiliser firms ($6.7 million) and oil and gas marketing companies ($3.2 million). On the domestic front, major selling was reported by banks and development finance institutions ($6 million) and insurance companies ($4.6 million).

Among other highlights of the week were the IMF concluding its review with no waiver, OGDC approving the allotment of 10% bonus shares and the Economic Coordination Committee (ECC) discussing the removal of the condition of 66% compulsory utilisation of liquefied natural gas (LNG) by two mega power projects.

Published in The Express Tribune, November 10th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ