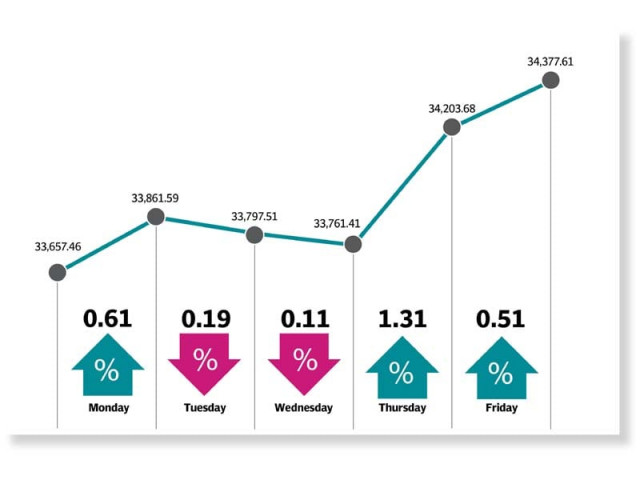

Weekly review: KSE-100 gains 720 points amid political mayhem

Buoyed by positive developments, investor participation increases 34%

Tensions mounted on the political front, as the Jamiat Ulema-e-Islam Fazl’s (JUI-F) Azadi March reached the federal capital and demanded the prime minister to resign. Regardless, investors participated actively at the bourse helping the index climb higher.

Trading began on a positive note following the government’s move to defer the axle load policy for a year. This, coupled with the meager increase in cement prices in the northern region, acted as a catalyst for the market as increased interest was seen in cement and steel stocks.

On the opposite side of the Azadi March, traders observed a two-day countrywide strike demanding the withdrawal of the CNIC condition imposed in the budget 2019-20. Although the strike was called off after two days following an agreement with the government, the impact was felt by the stock market.

Govt efforts to tackle 'Azadi March' gain pace

Bears returned and the index dropped in the following two sessions on the back of slim participation and weak sentiments. The rally en route to paralyse Islamabad did not help matters either.

Fortunately, the negative trend did not last as a breakthrough in talks between the businessmen and government, with the latter agreeing to delay implementation of the CNIC condition, prompted buying activity at the stock market.

Moreover, a decrease in Pakistan Investment Bond (PIB) yield during the outgoing week also signalled a recovery in the economy. This news was particularly celebrated as investors anticipated a decrease in the interest rate by the State Bank of Pakistan during the monetary policy due to be unveiled later during the month.

Investor participation at the stock market was rejuvenated as average daily traded volumes jumped 34% week-on-week to 166 million shares while average daily traded value rose 41% to $166 million.

In terms of sectors, the positive contribution was led by the financial sector (up 189 points), cement sector (187 points), oil and gas marketing companies (96 points), fertiliser (88 points) and power (61 points).

Scrip-wise, major gainers were Dawood Hercules (up 83 points), MCB (81 points), PSO (78 points), Lucky Cement (51 points) and DG Khan Cement (46 points).

Excluded and invisible: Women at the Azadi March

On the other hand, Fauji Fertiliser (down 42 points), Oil and Gas Development Company (20 points), and Nestle (17 points) emerged as the major losers of the week.

Foreign investors turned net sellers of $3.13 million during the week compared to net selling of $2.8 million last week. Selling was witnessed in the exploration and production sector ($2.06 million) and textile ($1.34 million).

On the local front, buying was reported by companies ($5 million) followed by mutual funds ($2.79 million).

Among other highlights of the week were; Pakistan made progress for removal from the Financial Action Task Force (FATF) grey list, IMF stated government was moving in the right direction, petrol price was hiked by Re1 for November 2019 and Prime Minister Imran Khan demanded a comprehensive plan to control price hike and ensure availability of essential food items in the markets.

Published in The Express Tribune, November 3rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ