Political noise, weak results drag index down

KSE 100-share Index dips 213 points to finish at 33,657

The political upheaval was seen amid determination of opposition parties to lead an anti-government protest to Islamabad on October 27. The ‘Azadi March’ announced by the Jamiat Ulema-e-Islam-Fazl (JUI-F), and endorsed by the other opposition parties, demanded the resignation of Prime Minister Imran Khan.

Moreover, a host of weak financial results among other economic developments also influenced the direction of the market with many prominent names posting higher-than-expected losses.

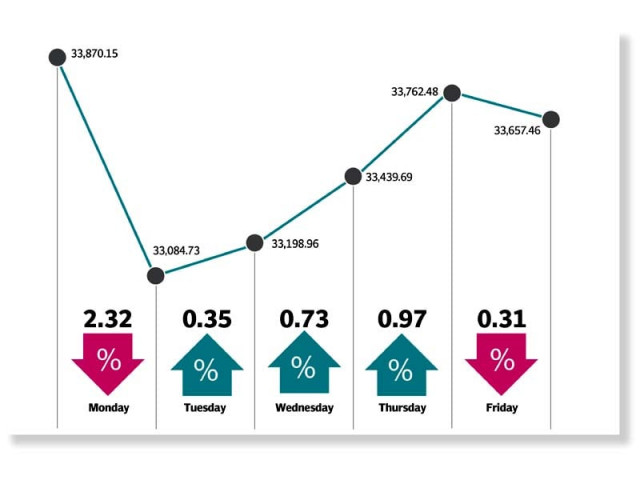

The week began with the KSE-100 index diving nearly 800 points on Monday as investors reacted to the FATF verdict of retaining Pakistan on the grey list till February 2020. Monday marked the first trading session since FATF’s review on October 18.

The trend reversed on Tuesday and the market remained positive for the next three days owing to recovery in global equities and crude oil prices. Additionally, the government’s announcement allowing the JUI-F to hold ‘Azadi March’ if the political party adhered to certain conditions also helped matters. Earlier, there had been a deadlock between the government and the JUI-F regarding the staging of the protest.

The announcement provided much-needed clarity on the political front and boosted sentiments, which reflected at the bourse. The marginally bullish trend was also supported by the release of World Bank’s ‘Ease of Doing Business’ report, which exhibited outstanding performance by Pakistan as the country jumped 28 places to 108th rank. Moreover, Pakistan was also ranked among the top 10 reformers. This news was particularly celebrated by the business community as it was in line with government’s economic objectives.

Furthermore, inversion in the yield of T-bills during the week further enhanced investor sentiment.

Unfortunately, the upward momentum could not be sustained and the index retreated to negative territory on the last trading day of the week.

Activity on the bourse remained weak as average daily traded volumes declined 11% week-on-week to 125 million shares while average daily traded value shrank 17% to $25 million.

In terms of sectors, positive contribution came from oil and gas exploration companies (up 118 points), food and personal care products (47 points) and fertiliser (30 points). Negative contribution was led by commercial banks (down 108 points), cement (104 points), and power generation and distribution (76 points).

Stock-wise, Lucky Cement (down 58 points), Bank AL Habib (44 points), Hubco (42 points), Pakistan Services Limited (35 points) and HBL (35 points) took away from the index.

Foreign investors turned net buyers of $2.8 million during the week compared to net selling of $2.1 million last week. Buying was witnessed in cement ($2 million) and fertiliser ($1.2 million). On the domestic front, major selling was reported by individuals ($3.1 million) and companies ($2.2 million).

Among other highlights of the week; K-Electric awarded $650 million contract to Siemens and Harbin Electric, steel industry demanded ban on import via land route, tax amnesty drove healthy growth in bank deposits, car import fell 83% to $14.7 million in the first quarter and foreign exchange reserves rose to $15.186 billion.

Published in The Express Tribune, October 27th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ