The company had reported a profit of Rs5.14 billion in the same period of previous year, according to a notice sent to the Pakistan Stock Exchange (PSX) on Tuesday.

Meanwhile, earnings per share of the company jumped to Rs55.94 in the Jul-Sept 2019 quarter from Rs38.55 in the same quarter of previous year.

Net sales were up 24.5% to Rs17.85 billion in the three-month period from Rs14.34 billion in the corresponding period of previous year.

“Net sales of the company increased primarily on the back of a hike in Mari field gas prices by 44% year-on-year to Rs273 per mmbtu owing to currency devaluation,” said Topline Securities’ analyst Shankar Talreja.

“However, overall production declined around 2%,” he added, which was in line with the drop in oil prices.

Operating expenses recorded an increase of 18% to Rs3.25 billion while exploration cost went up 31.2% to Rs2.04 billion in the period under review.

The uptick in exploration cost was due to higher seismic data acquisition by the company in block 28, Bannu west, Sukkur and Ghauri blocks, the analyst added.

Mari’s share price improved 1.44%, or Rs14.75, to close at Rs1,036.60 with trading in 75,040 shares at the PSX.

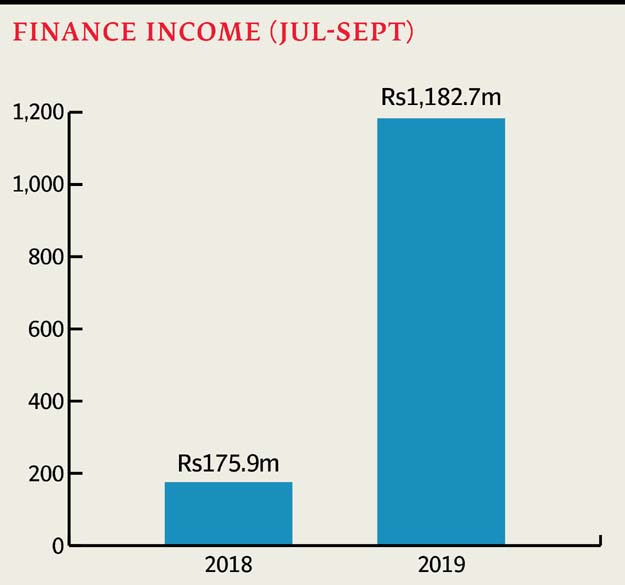

The company reported a significant rise in finance income, which increased 572.3% to Rs1.18 billion from Rs175.9 million in the previous year. Similarly, other income rose 141% to Rs289 million in the Jul-Sept 2019 quarter.

The Topline Securities’ analyst attributed the jump in finance income to a “cash rich balance sheet of the company, which is invested in high-yielding government papers”.

Talreja said inability to meet a set benchmark of incremental production to avail higher pricing, slowdown in demand from customers and lower-than-anticipated international oil prices were key risks for the company’s earnings and valuation.

Published in The Express Tribune, October 23rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1726117332-0/Megan-Thee-Stallion-(1)1726117332-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ