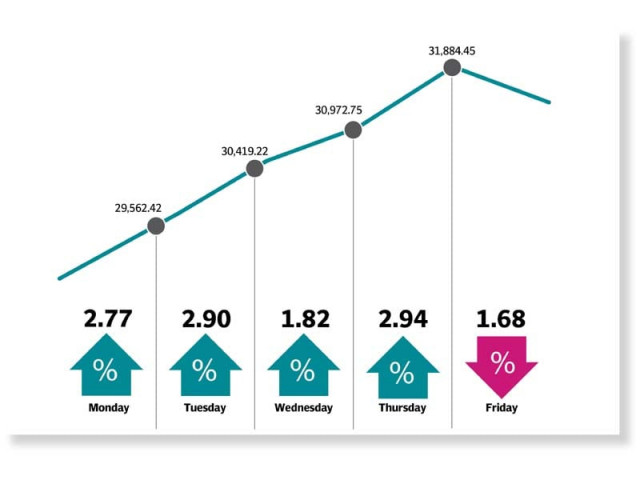

KSE-100 jumps 9% in stellar performance

Benchmark index gains on back of renewed buying, improvement in current account gap

The quantum jump was the highest weekly gain ever in terms of points, according to a report of AHL Research.

After hitting a near five-year low, trading kicked off with a bang on Monday as the index advanced nearly 800 points on the back of renewed buying. Investors shed worries of the preceding week and came out of the shadows to buy shares, many of which were at historically low levels.

Previously, the market was in the grip of bears as gloomy news on economic and political fronts had been dominating investor sentiment. The remarkable performance was long overdue as analysts were of the view that the market had bottomed out since the index had plunged beyond technical levels.

On the other hand, the massive improvement in the current account deficit also helped create excitement at the bourse with investors heaving a sigh of relief over the improving trend of the external account balance. The auction of Pakistan Investment Bonds (PIBs), held during the week, also revived the mood with the result indicating that there would most likely not be any more interest rate hike. The market recovery was also based on expectations that the Securities and Exchange Commission of Pakistan (SECP) may change rules to support the bourse.

Moreover, efforts to de-escalate tensions between India and Pakistan also soothed market participants, pushing the index to post gains in four sessions of the week. Unfortunately, the trend reversed on Friday and the index succumbed to profit-taking, closing with a dip of 534 points. Rumours regarding the Financial Action Task Force (FATF) putting Pakistan on the blacklist dented sentiments, taking some shine off the spectacular week.

Investor participation picked up sharply with average daily trading volumes surging 135% week-on-week to 174 million shares, while the average daily traded value rose 83% to $38 million.

The sector-wise positive contribution was led by commercial banks (744 points), oil and gas exploration companies (469 points), fertiliser firms (319 points), cement plants (235 points), and power generation and distribution companies (216 points). Stock-wise, positive contribution came from Engro (256 points), Oil and Gas Development Company (205 points), HBL (188 points), Hubco (160 points) and MCB Bank (147 points).

Foreign selling was witnessed during the week, which came in at $4.97 million compared to net buying of $1.7 million last week. Selling was witnessed in the exploration and production sector ($6 million) and fertiliser sector ($0.8 million). On the domestic front, major buying was reported by individuals ($6.5 million) and broker proprietary trading ($3.8 million). However, mutual funds remained sellers of $3.55 million during the week.

Among major highlights of the week were current account gap narrowing in July on improved trade balance, World Bank president planning to visit Pakistan in first week of November, country crossing another hurdle as FATF meeting loomed, commissioning of the 1,320MW coal-fired Hub power plant and foreign exchange reserves dipping $26 million to $8.2 billion.

Published in The Express Tribune, August 25th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ