FDI plunges to nine-month low at $73.4m

Fall comes due to hefty rupee depreciation, economic slowdown

PHOTO: REUTERS

This was reflected in statistics of foreign direct investment (FDI) which plunged to a nine-month low at $73.4 million in July 2019, the first month of the current fiscal year 2019-20, according to the State Bank of Pakistan (SBP).

The FDI was 59% lower than the $178.9 million received by different sectors of the economy, particularly construction and power, in the same month of previous fiscal year. The FDI had dropoped to half at $1.66 billion in the last fiscal year compared to investment of $3.47 billion in FY18.

“Pakistan has remained a potential market for foreign investors. They still have plans to make fresh investment in the country, but they have continued to wait for the return of economic stability,” said Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General Abdul Aleem while talking to The Express Tribune.

He highlighted uncertainty in the rupee-dollar parity as one of the major concerns of foreign investors. “Now, it seems that the rupee has become stable,” he said.

The central bank let the local currency depreciate 32% to Rs160 against the US dollar in the fiscal year ended June 30, 2019. Since then, it has remained stable at around the same level.

An industry source, who spoke on condition of anonymity, said a slowdown in the economy had badly impacted business confidence.

“It is a must for the authorities concerned to first create an enabling environment for the local businessmen desiring to make new investment. Foreign investors may follow suit,” he pointed out.

“There is a great need to hold investment conferences in foreign countries to highlight the opportunities of investment in Pakistan.”

He cited the plunge in car sales, losses or a drop in profit faced by petroleum oil refineries, oil marketing firms and fast moving consumer goods manufacturers as some of the reasons why foreign investors held back new investment plans for Pakistan.

“Most of such companies listed at the Pakistan Stock Exchange have either suffered losses or recorded a significant drop in profits due to economic uncertainty,” the source said.

The government’s demand to print retail prices on imported goods and the condition of collecting computerised national identity card (CNIC) copy at wholesale and retail levels had further dented the business confidence, he said.

He was of the view that completion of the first phase of multibillion-dollar investment in Pakistan by China under the China-Pakistan Economic Corridor (CPEC) was another major reason for the plunge in FDI in recent months.

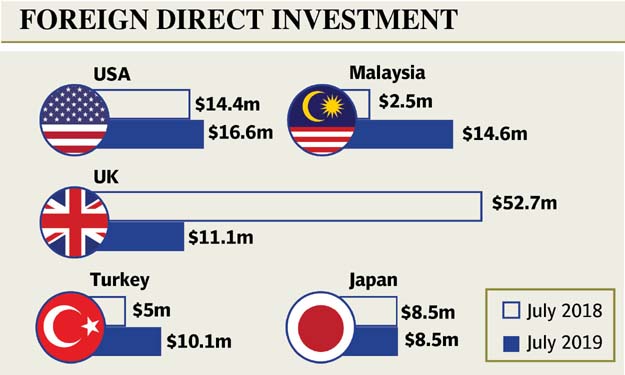

Country-wise FDI

The United States invested a net $16.6 million in Pakistan in July 2019 compared to investment of $14.4 million in the same month of last year. Malaysia injected a net $14.6 million last month compared to $2.5 million in July last year.

The United Kingdom poured FDI worth $11.1 million into Pakistan in July 2019 compared to $52.7 million in the same month of last year. China divested a net $4.5 million in July compared to investment of $90 million in the same month of last year, according to the central bank.

Published in The Express Tribune, August 23rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ