Pakistan borrows record $16b in just one year

Foreign loans aimed at avoiding default on debt obligations, import payments

PHOTO: FILE

The $16 billion worth of foreign loans have been obtained during fiscal year 2018-19, which included 11 months of the Pakistan Tehreek-e-Insaf (PTI) government, showed official documents of the federal government.

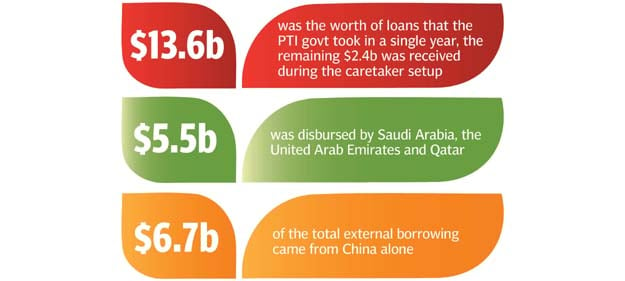

Out of the $16 billion, the PTI government took $13.6 billion worth of loans - the highest ever by any government in a single year. The remaining $2.4 billion had been received in July 2018 during tenure of the caretaker setup.

Pakistan will get $38 billion to meet financing needs: IMF

The $16-billion loans in the just-ended fiscal year included disbursement of $5.5 billion by Saudi Arabia, the United Arab Emirates and Qatar. However, the data that the economic affairs ministry will publish this week will not show $5.5 billion as part of federal government loans, according to sources.

The government would officially disclose loan disbursements for fiscal year 2018-19 at $10.5 billion, the sources said. The remaining $5.5 billion has been booked on balance sheet of the State Bank of Pakistan (SBP).

Sources said rupee cover had also not been generated against the $5.5 billion worth of borrowing.

Initially, $2 billion in Chinese SAFE deposit was also not part of the external public debt. However, Chinese loans have now been made part of the federal public debt due to the International Monetary Fund’s (IMF) pressure.

“Deposits from the UAE and Saudi Arabia are held with the SBP. These deposits were not available for financing the government’s budgetary operations. However, these are part of the SBP reserves,” said Dr Khaqan Najeeb, spokesman for the finance ministry, while commenting on the development. He said these inflows were contracted by the SBP and were accordingly categorised as “deposits with the SBP”.

In the preceding fiscal year 2017-18, Pakistan had obtained $11.4 billion in foreign loans. Loans of $16 billion in FY19 were the highest ever external borrowing in any fiscal year since Pakistan’s creation. About 42% or $6.7 billion of the total external borrowing came from China alone. It included $2.54 billion in commercial loans, $1.6 billion under the China-Pakistan Economic Corridor (CPEC), $2 billion in China SAFE deposit and $628.4 million for Karachi nuclear power plants.

In fiscal year 2017-18, China had given $4.5 billion to Pakistan.

The government’s decision to let the rupee depreciate by over 26% against the US dollar would adversely impact the country’s ability to repay debt. Total external debt and liabilities’ data for the full last fiscal year was not yet available.

As of the end of third quarter of the previous fiscal year, the country’s external debt and liabilities amounted to $105.8 billion.

About three weeks ago, the newly appointed economic affairs minister stated that the government returned $9.5 billion in foreign loans in the last fiscal year. This means that the government has added at least $6.5 billion to the public debt in its first year in power.

Pakistan takes $5.6b in foreign loans in nine months

This is the third time in Pakistan’s history that any government has taken over $10 billion in fresh foreign loans in a single year. The $16 billion in loans were 71% or $6.7 billion higher than the government’s own estimates.

The government had to heavily rely on foreign loans due to a steep decline in foreign direct investment, negative growth in exports, although contained but a still higher import bill and above all repayment of maturing debt.

PM Imran had claimed that foreign investors had promised to make big investments. However, the central bank data showed a steep fall in foreign direct investment, which stood at only $1.7 billion, down over 50%.

Like the Pakistan Muslim League-Nawaz (PML-N), the PTI government also relied on short-term foreign commercial loans. Against the budgetary estimate of $2 billion, the PTI government took $4.1 billion in foreign commercial loans.

Of this, $2.6 billion came from Chinese financial institutions. The government took $2.2 billion from China Development Bank and $300 million from Industrial and Commercial Bank of China.

The government also obtained $242.5 million from Noor Bank of the UAE, $495 million from a consortium led by Credit Suisse, $554.3 million from Dubai Bank and $271.6 million from Ajman Bank, according to official documents.

Bilateral economic assistance that the government showed in its books stood at only 10.8% or $1.7 billion of the total fresh borrowing. Of this, $1.6 billion was disbursed by China, mainly for CPEC. The $5.5 billion from Gulf countries has not been shown as part of bilateral economic assistance.

Loans from multilateral lenders were recorded at just $2 billion or 12.5% of the total assistance as against the target of $3.4 billion. The Asian Development Bank gave a mere $497.5 million in fresh loans, far lower than the $1.4-billion target.

World Bank lending stood at $616 million against the target of $812 million. The Islamic Development Bank disbursed $825 million against the target of slightly over $1 billion.

For the new fiscal year 2019-20, the IMF has projected Pakistan’s gross external financing requirement at $25.6 billion. This includes $6.6 billion in current account deficit financing and $18.2 billion in external debt repayment by both public and private sectors.

Public sector debt repayment has been estimated at $14.5 billion for this fiscal year.

Published in The Express Tribune, July 23rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ