Govt aims to bring parity in tax collections from three sectors

Taxes on industry, services and agriculture sectors to be brought at par with their share in GDP

PHOTO: Express

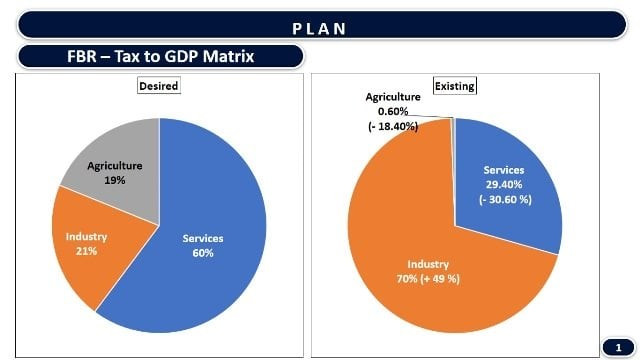

At present, the share of industrial sector in GDP stood at 21%, while it paid almost 70% of the total taxes collected in the fiscal year ended on Sunday, June 30, 2019.

On the contrary, the share of agriculture sector in GDP stood at 19%, but its contribution in the total collected taxes stood at a meagre 0.60% in FY2019.

Govt announces major taxation concessions

Therefore, the industrial sector remained overburdened at the cost of agriculture and services sectors. It paid taxes much more than its due share of 21%, while the agriculture sector continued to mint money and paid almost zero taxes, a source familiar with the development said while talking to The Express Tribune.

Similar is the case with the services sector, whose share in GDP surged to 60%, but its share in the total tax collection remained low at 29.40% in the fiscal year.

“Had the economy not slowed down to nine-year low at 3.3% in fiscal year 2019 compared to 5.2% in the preceding year, the agriculture and services sectors would have paid their due and potential taxes to the national exchequer," he said.

Govt gives Rs20b tax relief to richest class

Low tax collection forced the government to cut development budget. This would directly hit dozens of industries associated with the construction sector like cement, steel, paint, woodwork and many more and would also impact their capacity to create job opportunities in the country.

"The defence allocation stands at Rs1,153 billion for FY2020 that is almost Rs172 billion less than what it was required to meet the expenses in the year," he said.

"Similarly, the government has allocated Rs431 billion for the bureaucracy that is almost Rs49 billion less than what it was required for the year," he said.

"The low tax collection did not let the government revise up the salaries of the government employees of grade 21 and 22."

"The incumbent government has devised a long-term strategy to create balance between incomes and tax contributions by the three sectors."

The current actions being taken by the government like going after the people who were using Benami accounts (fictitious bank accounts) to having transferred billions of dollars aboard to build up their illegal assets are part of the long-term strategy to document the economy, he said.

K-P increases tax on people earning over Rs20,000

"Only one per cent people out of total 200 million is paying taxes, while others remain out of the taxpayer net," he said and added, "Low tax-to-GDP ratio remained the single biggest issue in Pakistan."

He said the government is all set to go after big fish in the system. It would not pardon the people who were minting money but not paying due taxes. "The government has resolved to launch a crackdown against those who would still try to hide undeclared assets once the amnesty scheme (Asset Declaration Scheme 2019) comes to an end on July 3," he said.

He said the government has presented a "strategic budget" for FY20. One may call it a budget aimed at introducing structural reforms at the Federal Board of Revenue and the Ministry of Finance to fix the faltering economy.

"The reforms are set to be completed over the next two years (by end of June 30, 2021). Their implementation would pay divided to the nation," he said.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ