Govt borrowing to rise 84% to record Rs43.5tr in FY20

The money will be spent on repaying maturing public debt and bearing interest cost

Prime Minister Imran Khan. PHOTO: INSTAGRAM/@imrankhan.pti

The Ministry of Finance on Tuesday sought approval of the National Assembly for the highest-ever borrowing of Rs43.5 trillion in a single year to repay domestic and foreign debt and pay interest on these loans.

Govt borrows a whopping Rs2.24tr in just five months

The Rs43.5 trillion is more than the total size of federal budget for 2019-20 at Rs7 trillion. The difference is because the government does not book loans taken for repayment of domestic and foreign loans in the budget. These transactions are settled outside the budget. The central bank borrows the money on behalf of the federal government from commercial banks.

The Rs43.5-trillion borrowing is the charged expenditure under the constitution and the National Assembly does not have the right to veto this expenditure.

The lower house of parliament can only discuss the expenditure which includes budgets for presidency, Supreme Court of Pakistan, Islamabad High Court, Auditor General of Pakistan, National Assembly, Senate, Pakistan Railways, pensions, Foreign Office other expenditure, Election Commission of Pakistan, Wafaqi Mohtasib and Federal Tax Ombudsman.

Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh placed the Rs43.5 trillion worth of demand before the National Assembly for fiscal year 2019-20, starting July 1.

The demand was placed under Article 82 (I) of the constitution as charged expenditure. In case of “charged expenditure”, the National Assembly can only debate but cannot veto the proposed spending bill.

The borrowing plan underscores Pakistan’s growing dependence on domestic and foreign lenders at a time when the country also faces challenges to meet its external financing requirements.

For the outgoing fiscal year, the National Assembly had approved Rs23.5 trillion for obligatory expenditure and the new demand is Rs19.8-trillion or 83.6% higher than the outgoing fiscal year. This includes Rs43.3 trillion worth of debt servicing-related spending bill, which is higher by Rs19.74 trillion or 84% than the expenses approved by the National Assembly in May last year.

Except for Rs2.9 trillion that will be part of the federal budget, the rest of the amount will not be booked in the budget and will be directly borrowed from domestic and foreign markets to repay the loans obtained in the past. Interest payments on domestic and foreign loans will consume roughly 41% or Rs2.9 trillion of the proposed Rs7-trillion budget for the next fiscal year.

As against Rs21.9-trillion borrowing in the outgoing fiscal year, the government sought the National Assembly’s approval for a whopping Rs39.1-trillion borrowing for repayment of domestic debt in the next fiscal year. The amount is 78% or Rs17.2-trillion higher than the outgoing fiscal year.

The Rs39-trillion maturing domestic public debt is equal to 88% of the size of Pakistan’s economy. This will expose the government to exploitation by commercial banks, which have been dictating their terms due to the mounting financing needs.

The government has also placed another demand of Rs2.53 trillion for debt servicing, which is 80.7% or Rs1.13-trillion higher than the outgoing fiscal year. The debt servicing requirement may further increase due to the anticipated increase in interest rate by the State Bank of Pakistan (SBP) under the IMF deal.

For the next fiscal year, the federal government has projected its budget deficit at Rs3.5 trillion, which is equivalent to 8.1% of gross domestic product (GDP).

To repay foreign loans, the government has sought a whopping Rs1.1 trillion in the new fiscal year, which will be obtained from foreign lenders. The requirement for foreign loan repayment is up by 82% or Rs493.4 billion within a year.

The government has sought another Rs359.8 billion to pay interest on foreign loans, which is higher by Rs130.6 billion or 57% in a single year. Devaluation of the local currency contributed to the increase in cost of external public debt servicing.

Govt to keep details of $3.7b loan under wraps

The government has placed Rs108.3-billion demand before the National Assembly to repay short-term foreign loans, which is down by 38% or Rs66 billion.

By the end of next fiscal year, the public debt-to-GDP ratio is estimated to jump to 77.6%. The government is legally bound to limit the debt to below 60% of GDP but every successive government has breached this statutory limit.

Other charged expenditures

For staff, household and allowances of the president, the government has placed Rs992-million demand before the National Assembly, which is down by Rs44 million or 4.2% over the outgoing fiscal year. But both the National Assembly and Senate will get an increase in their allocations.

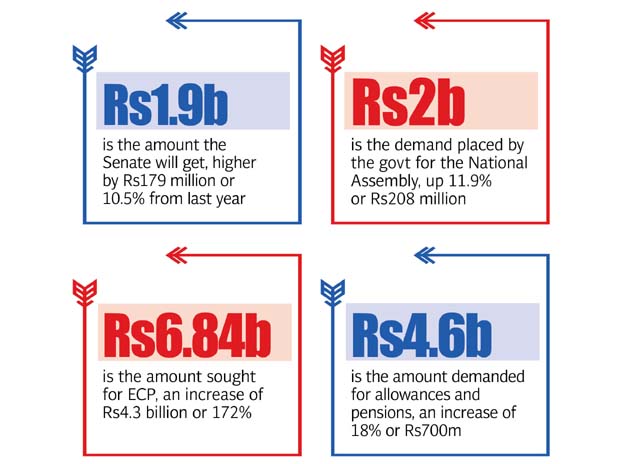

The government has placed a demand of Rs2 billion for the National Assembly, up by Rs208 million or 11.9%. The Senate will get Rs1.9 billion, also higher by Rs179 million or 10.5%.

The government has sought Rs2.1 billion for charged expenditures of the Supreme Court of Pakistan, which is higher by Rs131 million or 6.6%. For charged expenditures of the Islamabad High Court, a Rs579-million demand has been placed before the National Assembly, higher by Rs52 million or nearly 10%. The Election Commission of Pakistan will get Rs6.84 billion, an increase of Rs4.3 billion or 172% over last year.

The government has cut other expenditures of the Foreign Office by 50% to Rs75 million for the next fiscal year, but the Ministry of Law and Justice will get Rs255.3 million for charged expenditures, up by 8%. For superannuation allowances and pensions, the government has placed Rs4.6 billion worth of demand, an increase of 18% or Rs700 million.

Published in The Express Tribune, June 26th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ