Tax levied on ride-hailing services, online shopping in Sindh

Sindh sets sales tax collection target at Rs145b for next fiscal year

PHOTO: REUTERS

The provincial government has also imposed sales tax on car tracking and alarm services, according to the Sindh Finance Act 2019 presented on Friday.

The provincial government collects sales tax at different rates in the range of 13-19.5% on different sectors.

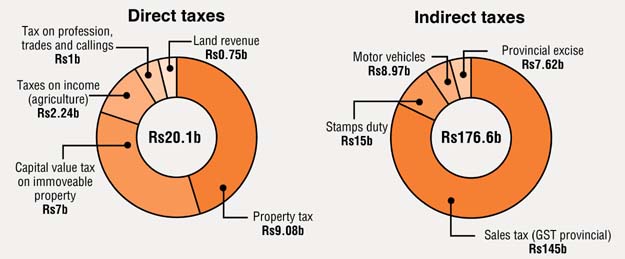

It has set a collection target for the provincial sales tax on services at Rs145 billion for the next year, which is Rs25 billion higher than the target of Rs120 billion in the preceding fiscal year 2018-19.

New taxes will be charged with effect from July 1, 2019.

Besides, the provincial government has revised rates of taxes under the Sindh Motor Vehicles and Stamp Duty Act.

As per details, the provincial government has imposed 13% sales tax on services provided or rendered by cab aggregators and owners or drivers of the motor vehicles using cab aggregator services.

It imposed 13% sales tax on warehouses or depots for storage or cold storage, 13% sales tax on coaching and training services, except for educational coaching centres.

Other services, which attracted 13% sales tax, include actuarial services; services of mining of mineral and allied and ancillary services in relation to; construction site preparation and clearance, excavation and earth moving and demolition services; waste collection transportation, processing and management services; vehicles parking and valet services, electric power transmission services and insurance agents, the finance act said.

The government would charge 19% sales tax on vehicle tracking and other tracking services, tracing and alarm services, telecommunication services not elsewhere specified, audio text services, tele-text services, trunk radio services, paging services, including voice paging services and radio paging services.

The government has imposed fixed tax of Rs20,000 on all limited companies with paid-up capital or paid-up share capital and reserves not exceeding Rs25 million. The companies include modarabas, mutual funds and any other body corporates.

Such companies whose paid-up capital would exceed Rs25 million, but not exceed Rs50 million, will pay Rs40,000; companies with paid-up capital of over Rs50 million but less than Rs75 million, will pay Rs60,000; between over Rs75 million and less than Rs100 million will pay Rs80,000 and companies whose paid-up capital exceeds Rs100 million will pay a fixed tax of Rs100,000.

Holders of import or export licence, owners of industries, factories and commercial establishments; contractors engaged in construction work or supplying goods or providing services or labour; all wholesalers and agents, goods or services for others as owner or on commission basis; medical and legal practitioners, auditors, video shops and any other persons providing professional services and shops assessed to income tax in the proceeding professional services and shops having turnover of different limits ranging from Rs1 million to over Rs50 million will pay fixed taxes in different six slabs starting from Rs1,500 and ending at Rs100,000.

Besides, the Sindh Finance Act 2019 also revised rates of taxes on residential and commercial properties and stamp duties on a number of sectors and services.

The government has set the tax collection target at Rs288.70 billion from different heads including provincial tax receipts (excluding GST on services), provincial sales tax on services and provincial non-tax receipts.

The target is almost Rs48 billion higher than that in the outgoing fiscal year 2019.

Published in The Express Tribune, June 15th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ