PTI govt to go all out for Rs5.5 trillion tax

Hafeez Shaikh says he is ready to 'offend people' to meet revenue target

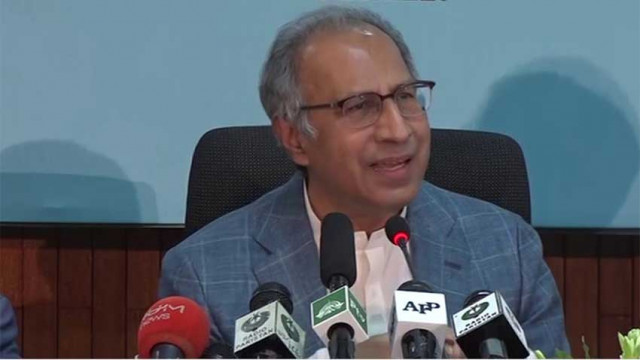

PHOTO: RADIO PAKISTAN

Striking a defiant note, Finance Adviser Dr Abdul Hafeez Shaikh on Wednesday said that he was ready to offend people for the sake of collecting Rs5.550 trillion taxes amid high probability of protests by various business bodies against the budget.

Shaikh also offered himself for accountability for adding nearly Rs8 trillion in public debt during his stint as finance minister from 2010-2013 after Prime Minister Imran Khan announced to form a commission. He was addressing a post budget press conference here on Wednesday.

"If we have to offend some people for this, then we are ready to do it but we will achieve Rs5.550 trillion tax collection target", said Shaikh while laying his government's strategy to deal with the pressure that it will face from those who are adversely affected by heaviest taxation in a single year in Pakistan's history.

The industrialists have already announced to go on strike against the government's decision to withdraw zero sales tax facility that was available to textile, garments, surgical, exports and leather manufacturers.

The Federal Board of Revenue (FBR) needs to increase its tax collection to Rs5.550 trillion at an annual growth rate of 35 per cent - a task that many believe is unrealistic. However, the tax measures that the government has announced in the budget appeared insufficient to achieve the target.

Pakistan has imposed these taxes to qualify for the $6 billion International Monetary Fund (IMF) programme. Dr Shaikh said that the IMF Board was expected to take up Pakistan's request within three to four weeks and it will be up to the Board to approve the programme. Both the sides have already reached a staff-level agreement.

To a question whether the government feels the need to bring a mini budget to add nearly Rs275 billion more taxes, Shaikh said that the tax efforts announced in the new budget were sufficient to achieve this goal.

Shaikh said that the rich people will have to be sincere with the country and will have to pay their due taxes.

He acknowledged that Rs5.550 trillion target was not easy, saying if people were thinking that this target was not achievable, they were not entirely wrong given FBR's performance in the past.

The government has imposed Rs516 billion worth of net taxes in the new budget. In addition, it expects Rs60 billion revenue from telecom sector and another Rs60 billion from the sales of petroleum products.

The benefits in the shape of abolishing fixed income tax regime, ending non-filer tax regime and making property and other assets transactions only through banking instruments mandatory were also huge.

Shaikh insisted that the new taxes would not burden the poor – a stance that is contrary to the reality. Nearly 65% of Rs516 billion new taxes are indirect in nature, which will affect the poor mostly due to their low income levels.

FBR Chairman Shabbar Zaidi, who was also present, said that the government has "moved from traditional system to sectoral analysis [to figure out] which of the industries or sectors are paying less taxes than they should".

Shaikh also spoke about growing cost of debt servicing that would consume 41% of the new budget or Rs2.9 trillion in next fiscal year.

Prime Minister Imran Khan on Tuesday announced to setup a commission to investigate phenomenal increase in public debt from Rs8 trillion to Rs24 trillion during past ten years. However, this also includes PPP tenure when Rs8 trillion were added in the public debt and Shaikh was the finance minister for three years.

If the government is taking loans, it is also ready for accountability, said Shaikh while responding to a question. To a question where he spent Rs8 trillion that he borrowed during his stint as finance minister, Shaikh said that majority of the loans were taken for paying the past loans. But he said that one should wait for the terms of reference of the commission and it should be allowed to do its work.

The PTI government too has added Rs3.6 trillion in public debt in just 10 months at a pace that is double than the Pakistan Muslim League-Nawaz (PML-N) tenure.

The finance adviser said it would be unfair to blame the current government for the debt since the loans were taken by previous governments.

Shaikh said that the government has adopted an austerity policy to reduce expenses with the goal of containing growth in public debt. He said that that the country required money to pay the interest on loans borrowed by past governments, therefore, new taxes had to be imposed.

Shaikh also said that that the distinction between tax filers and non-filers has been eliminated in the budget. "If a person, who has been a non-filer in the past, buys a car or property, he will automatically have to become a filer. If he fails to become a filer within 45 days, he will receive a tax notice within half an hour after the 45-day limit has lapsed,” he said.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ