PTI govt lifts curbs on property purchase

Govt withdraws 3% tax on price differential to close window for legalising black money

Workers are seen on scaffolding at a construction site. PHOTO: REUTERS

“The previous government had imposed a restriction on the registration or transfer of property exceeding Rs5 million to a non-filer. It has been observed that the restriction has not achieved the desired goal of increasing the number of tax return filers, rather such restriction has been legally challenged in courts on the point of jurisdiction,” said Minister of State for Revenue Hammad Azhar while presenting the federal budget for 2019-20 in the National Assembly on Tuesday.

“Therefore, the restriction placed on the purchase of the immovable property may be withdrawn,” he told lawmakers.

He pointed out “if a purchaser of an immovable property pays 3% tax on the difference between DC (old and lower) value and the Federal Board of Revenue’s (FBR, current market) value of property, then he is not required to explain the source of investment of the said differential amount at present”.

“This is a permanent tool for whitening the undeclared money, which is against international tax norms. Therefore, it is proposed to withdraw the tax at the rate of 3% on the differential amount.”

Pakistan Real Estate Investment Forum (PREIF) President Shaban Elahi believes that the closure of the window of legalising black money would significantly impact the government’s revenue collection from the property sector.

“The (federal) government is estimated to have collected Rs60-70 billion in property tax. The closure of the window may slash the tax collection by 30-40%,” he estimated.

In addition to that, overseas Pakistanis have remained one of the biggest sources of investment in the real estate sector of Pakistan. They used to invest $7-8 billion a year. This investment would go down by 25-30%, he said.

Thirdly, the restriction would encourage a capital flight from Pakistan as investors would look for other investment avenues like Dubai, Canada or any other country providing investment opportunities, he said.

Azhar said the FBR had introduced valuation tables for immoveable properties in major cities. The rates notified by the board are still considerably lower than the actual market values. It is, therefore, intended that FBR’s rates of immovable properties would be taken closer to or about 85% of the actual market values.

“As the increase in FBR’s values of immovable property is going to raise the incidence of tax on genuine buyers and sellers, it is proposed that the rate of withholding tax on the purchase of the immoveable property may be reduced from 2% to 1%.”

At present, the withholding tax on the purchase of property is levied only if the value of the property is more than Rs4 million. There is a tendency to avoid this tax by breaking the transaction into amounts of less than Rs4 million whereas the actual value of the property is more than Rs4 million.

“In order to stop the misuse, the withholding tax on purchase is proposed to be collected irrespective of the value of the property,” he said.

Profit to be taxed at a normal rate

Pakistan had introduced capital gains tax (CGT) years ago. Capital gain is the difference between property purchase and sale prices, meaning profit. There were three slabs under the CGT regime, meaning if a buyer sells property within the first year of purchase, he was liable to pay 10% CGT, 7.5% on sale of property after the first year but within two years, 5% CGT on more than two years but less than three years and no CGT on sale of property after three years.

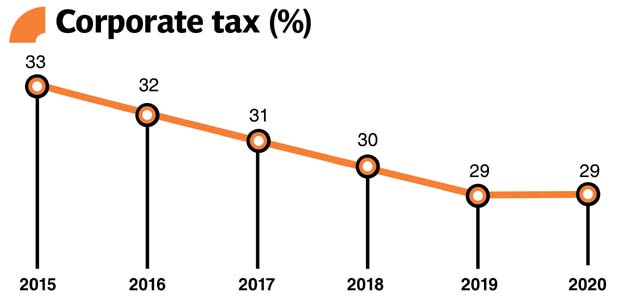

The government has withdrawn the CGT regime and would treat capital gains as part of the total value of the property and the capital gains would be charged at normal tax rates, “which are totaling around 30-35%,” Elahi said.

Azhar said capital gains would be charged 100% at normal tax rate if the property was sold within a year of the purchase. However, three-fourths of capital gains would be charged at normal tax rates if the property is sold in the second year of purchase.

“Income from capital gains on open plots is proposed to be taxed at 100% if the open plot is sold within one year and for a period up to 10 years. Income from capital gains on constructed property is also proposed to be taxed on similar lines when sold within a period of five years,” he said.

“In case a property is sold within one year, it shall be taxed as normal income. The tax shall be charged at three-fourths of the income if the same property is sold after one year,” he said.

At present, there is no withholding tax on the sale of the property if the property is held for a period of more than three years. This is in line with the holding period for taxability of capital gains, which is also three years.

As the capital gain is to be taxed under the normal tax regime even beyond the period of three years, it is proposed that withholding tax on the sale of the property be collected irrespective of the holding period to bring it in line with the proposed treatment of capital gains, he said.

Published in The Express Tribune, June 12th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ