Saudi fund seeks tax relief for its projects

Says it cannot pay any type of levy on any project financed by it

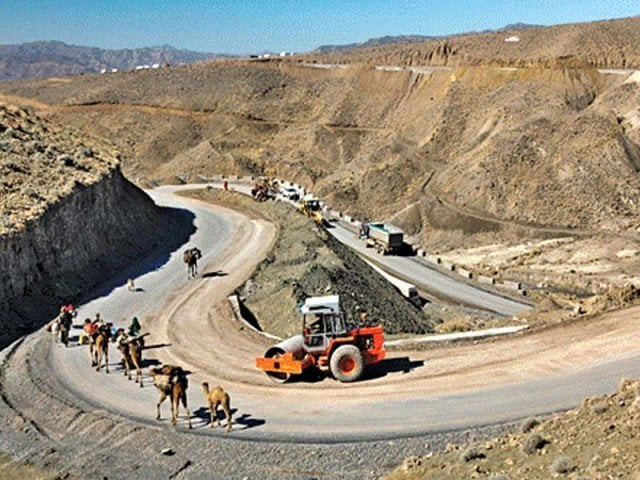

PHOTO: EXPRESS

In this regard, the SFD has pointed to certain hurdles pertaining to local taxes on material, goods and purchases by its contractors for these projects. The SFD has sent a message to the finance minister, contending that as per SFD charter and guidelines, it cannot pay any type of tax on any project financed by the SFD grant. Therefore, the SFD has sought exemption from taxes on all purchases made through the fund or its approved contractors or suppliers, which will be used in the construction of different projects.

The Earthquake Reconstruction and Rehabilitation Authority (Erra) had been advised by the Economic Affairs Division via a letter dated May 3, 2017 that Erra being the implementing agency should seek government’s approval for exemption from the aforementioned duties and taxes.

In this regard, the Federal Board of Revenue (FBR) was approached for the issuance of a no-objection certificate. The FBR conveyed this through a letter dated December 19, 2017 for the submission of a summary to the Economic Coordination Committee (ECC) of the cabinet by ERRA for exemption.

Published in The Express Tribune, May 17th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ