DG Khan Cement reports 35% fall in profit for Q3

Sluggish cement prices, rupee depreciation cause decline in earnings

Sluggish cement prices, rupee depreciation cause decline in earnings.

PHOTO: FILE

Despite a higher turnover, the cement manufacturer’s earnings fell 35% in the Jan-Mar 2019 quarter, according to its financial results sent to the Pakistan Stock Exchange (PSX) on Wednesday.

“The company recorded higher sales due to increase in its volumes as it started exporting the stock from its Hub plant. However, sluggish prices of cement cost the company its profit,” said Arsalan Ahmed, an analyst at JS Research.

Another reason for the lower profit was the rupee depreciation due to which the company faced a higher input cost, which it could not pass on to customers, he said.

Turnover of the company came in at Rs11 billion in the Jan-Mar 2019 quarter compared to Rs8 billion in the same quarter of previous year whereas gross profit stood at Rs1.8 billion against Rs1.9 billion.

In the Jan-Mar 2019 quarter, the company posted earnings per share (EPS) of Rs1.89 against Rs2.91 in the same period of previous year.

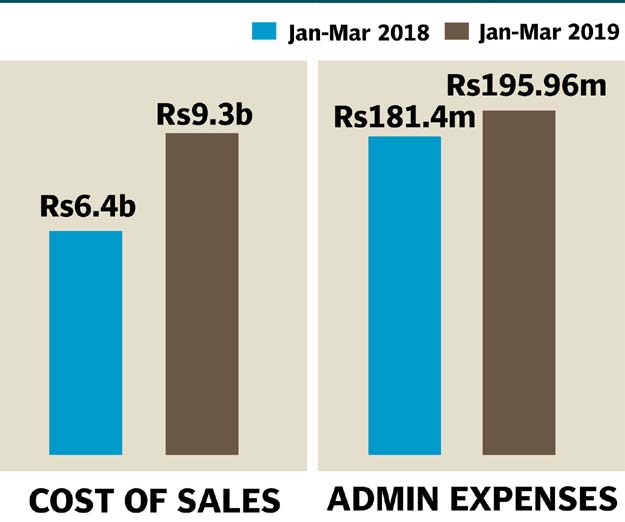

Cost of sales increased to Rs9 billion in the Jan-Mar 2019 quarter against Rs6 billion in the same quarter of 2018. Finance cost swelled from Rs126 million to Rs1 billion.

DG Khan Cement’s profit skyrockets 81.5% to Rs1.3b

The company booked tax expenses of only Rs43 million in the quarter under review compared to Rs439 million in the same period of 2018.

On a nine-month basis, DG Khan Cement posted a net profit of Rs2.5 billion for the period ended March 31, 2019, down 47% compared to Rs4.7 billion in the corresponding period of FY18.

EPS came in at Rs5.71 in the nine-month period of FY19 against Rs10.82 in the same period of last year.

Revenues of the cement manufacturer came in at Rs32.6 billion in the nine-month period of FY19 against Rs25.4 billion in the same period of FY18.

The company’s stock closed at Rs70.29, down Rs0.41, with trading in 3.08 million shares. The KSE-100 index closed at 36,504.25 points, up 100.22 points on Wednesday.

Published in The Express Tribune, April 25th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ