9th NFC award: What do the provinces want?

This piece is part of our educative web series 'Explanare' to understand complex economic &...

ILLUSTRATION: AUROBA TARIQ. Inspired by a miniature at https://blogs.harvard.edu/sulaymanibnqiddees/2015/03/

ILLUSTRATION: AUROBA TARIQ. Inspired by a miniature at https://blogs.harvard.edu/sulaymanibnqiddees/2015/03/

ILLUSTRATION: AUROBA TARIQ. Inspired by a miniature at https://blogs.harvard.edu/sulaymanibnqiddees/2015/03/The National Finance Commission, which met in Lahore on March 29, concluded deliberations without reaching a consensus.

In this second part of the web series 'Explanare', we continue our conversation with economist Asim Bashir Khan, discussing the demands and grievances of smaller provinces, and how to come up with an award that could be acceptable to all federating units.

Express Tribune: Khyber-Pakhtunkhwa's demand for additional funds to finance the merger of erstwhile Fata has been rejected. Was the request justified? If not, how else can the development of tribal districts be funded?

A B Khan: K-P already receives one per cent from the gross divisible pool for bearing an extra burden imposed by the war on terror.

We have to come up with a consensus, calculate the share of the tribal belt on the basis of three indicators i.e. poverty, area and population, and add to the K-P's cumulative share, which will then increase.

However, this is when a formula-based arrangement will be in place. The erstwhile Fata is still in an interim phase, and till then the federal government has to fund the tribal districts.

ET: Moving on to Sindh…Chief Minister Murad Ali Shah did not attend the March 29 meeting. What are Sindh's demands?

A B Khan: Sindh wants an additional share from the divisible pool.

The Octroi and Zila Tax (OZT) was abolished in June 1999. As compensation, provinces received a grant in lieu of OZT till 2010. Sindh still receives 0.66% in provincial receipts, and wants it to be increased to 2%.

Sindh can also be better accommodated if the weightage of revenue collection and generation (5%) is increased because increasing the share of revenue effort by and large benefits both Sindh and Punjab.

Meanwhile, there is another important issue which can't be dealt with at the forum of NFC: Sindh distributes the share of OZT among districts and local councils on ad hoc and political basis.

As a matter of agreed principle, the share is to be distributed based on the OZT collection in 1999, in which Karachi's collection was 71% - Rs4.8 billion out of total collection of Rs6.8 billion. Karachi's share, however, has been reduced from 71% in 2000 to 32% in 2018.

Over the years, Karachi's funds have been delayed and diverted, impacting the city's development.

The Provincial Finance Commission, which determines the division of funds with the consensus of the opposition and the government, has also been defunct since 2011.

ET: Speaking of Balochistan, the poverty-stricken province claims that the "theatre of terror" has now shifted from K-P to Balochistan, hence their share in the divisible pool should be raised. It wants a treatment similar to that of K-P, which is receiving one per cent additional funds from the gross divisible pool. Is this feasible?

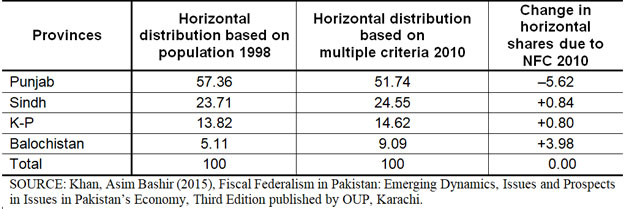

A B Khan: Remember this is a zero-sum game and adds up to 100 per cent: gain in one's share is at the cost of reduction in others’.

What can be done is that if everything is settled and peace has returned to K-P, either the one per cent share it receives for war on terror can be transferred to Balochistan or this one per cent can be divided equally among both the provinces.

ET: We discussed in the last segment that Balochistan was compensated for not receiving its due share in the royalty of natural resources. The province is calling for further compensation. Was it not paid?

A B Khan: It was not compensated fully.

Gas in Balochistan was discovered in 1954 but it got its first gas connection in 1984. Rather than introducing public services there, the natural resource was utilised by other provinces: replacing the imported fuel to save foreign exchange, produce low-cost electricity and supplement rapid industrialisation in Sindh and Punjab. Balochistan has implicitly backed Pakistan's economic growth and development and been deprived of it since long.

Secondly, provision of public goods and services in Balochistan is challenging, and it does not have a level-playing field.

Historically, it hasn't had the infrastructure to provide commodities and services, and hence could not generate enough revenue.

Almost 67% of Pakistan's agricultural land is concentrated in Punjab. Therefore, a large share of agricultural loans is concentrated outside of Balochistan. It is not an agrarian region, and most of the farms are rain-fed and wait for showers for cultivation.

ET: Where is Punjab standing, does it not have any problems?

A B Khan: It's not the case. Punjab's population is over 110 million, and its southern region is marginalised.

The entire debate over resources is with Punjab. It is a bipolar game, a tug of war: on the one hand side it is Punjab and the rest of the provinces on the other.

Objectively speaking, Punjab also needs resources to accommodate its huge population. Draining out Punjab's resources is a loss for Pakistan's economy.

Making changes to the share of provinces without a consensus is not possible. Clause 3 (a) of Article 160 of the Constitution specifies that a province's share cannot be decreased in absolute monetary terms compared to what it received in the preceding award. Considering this constraint, a new arrangement has to be formulated.

ET: So, what options do we have?

A B Khan: The 9th NFC award should be dedicated to two of Pakistan's smaller provinces - K-P and Balochistan - which should be given more resources. The historical injustices done with them should be minimised.

In the new economic arrangement, the richer provinces should start relying more on their own resources i.e. broaden their tax net through taxing the top-landed elite on agriculture, rationalise property tax, improve collection of irrigation charges and ease their complicated taxation, business and investment procedures.

The federal government, on the contrary, which is suggesting to the provinces to broaden their tax base, needs to increase its tax revenues first.

Being a centralised federation, the federal government has a historical backlog of liabilities i.e. foreign loans, with expenditures including the defence budget which exhaust a huge chunk of its budget.

An arrangement should be such that neither the provinces nor the federal government remain at a disadvantage.

The tricky situation in which the federation is in right now can be illustrated with an anecdote of Ameer Khusrau, an Indo-Persian Sufi poet, musician and scholar.

Thirsty while traversing, Khusrau saw a well from where four young women were filling their pots. When he requested them for some water, one of the girls recognised him and told others he was Khusrau, the poet and composer. They refused to give him water unless he composed a new couplet for them. Asked what the couplet should be about, each lady came up with her own option: one said kheer, the second one demanded charkha, the third one asked for dog and the fourth one's choice was dhol.

Four women, four different demands.

Khusrau, catering to all four, came up with the following verse:

کھیر پکائی جتن سے، چرخہ دیا چلا

آیا کتا کھا گیا، تُو بیٹھی ڈھول بجا

Kheer pakaai jatan say, charkha diya chalaa;

Aaya kutta khagaya, tu baithi dhol bajaa

The writer is a member of staff. He tweets @WaleedTariq89

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ